Where Does the Budget Stand Compared to Historical Averages?

Recently, there has been a lot of discussion over whether the country has a revenue problem or a spending problem. While there is no way to definitively answer that question – by definition, our fiscal problems are due to the disconnect between spending and revenue – one way to evaluate our situation would be to put spending and revenue in a historical context as a share of economic output. From that perspective, it is clear the answer is "both."

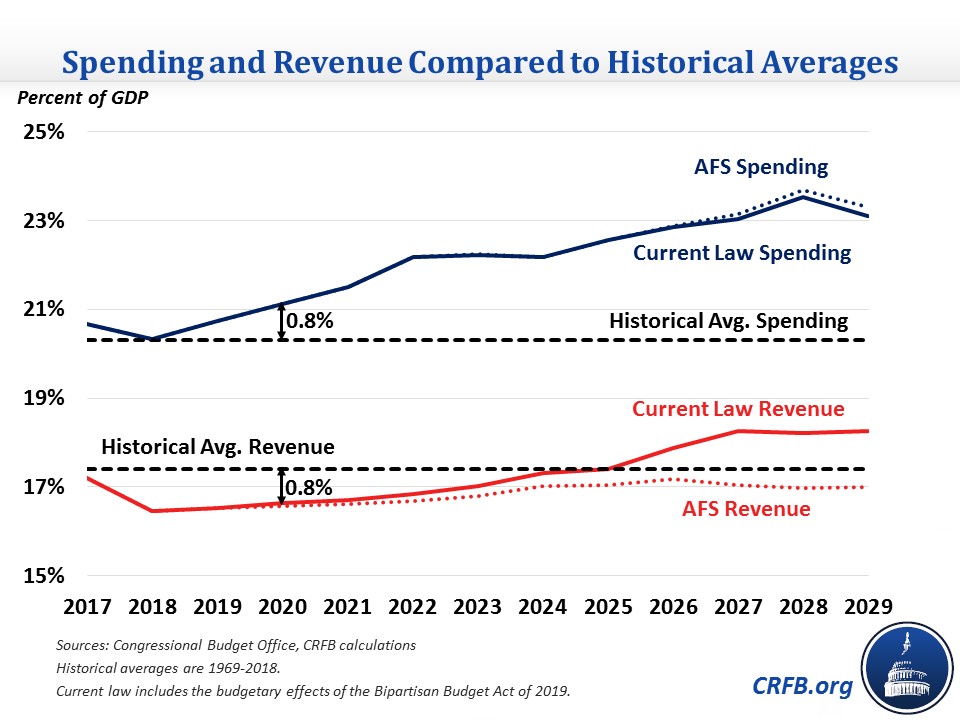

Incorporating the effects of the recent budget deal, federal spending is expected to total 21.1 percent of Gross Domestic Product (GDP) in Fiscal Year (FY) 2020, while revenue is expected to total about 16.6 percent of GDP. With 50-year historical averages for spending and revenue at 20.3 percent and 17.4 percent, respectively, that means spending will be higher and revenue will be lower than their historical averages by about the same amount: 0.8 percent of GDP.

This wasn't always so. As recently as 2017, revenue was close to its historical average, and as recently as 2018, spending was as well. But thanks in large part to the Tax Cuts and Jobs Act (TCJA) and Bipartisan Budget Act of 2019, both have departed from these averages.

Due to the rising costs of health, retirement, and interest spending, spending is projected to diverge from its average even further. We estimate that over the next decade, spending will rise to 23.1 percent of GDP by 2029, which is 2.8 percentage points above the historical average. Revenue will rise above its historical average but largely because the net revenue-losing portions of the TCJA are scheduled to expire, mostly after 2025. If those and other tax cuts were continued as the Congressional Budget Office presents in its Alternative Fiscal Scenario (AFS), revenue would remain below its historical average at least through the next decade, with revenue 0.4 percentage points below that average in 2029.

The fact that spending and revenue are above and below their historical averages, respectively, is troubling, especially since even at these averages debt has risen by about 50 percent of GDP over the past half century to its highest level since just after World War II.

In the past when the economy was strong and unemployment was low, revenue usually rose above average levels as a share of GDP while spending fell below. This time, policymakers have continued to cut taxes and increase spending regardless of the fiscal consequences.