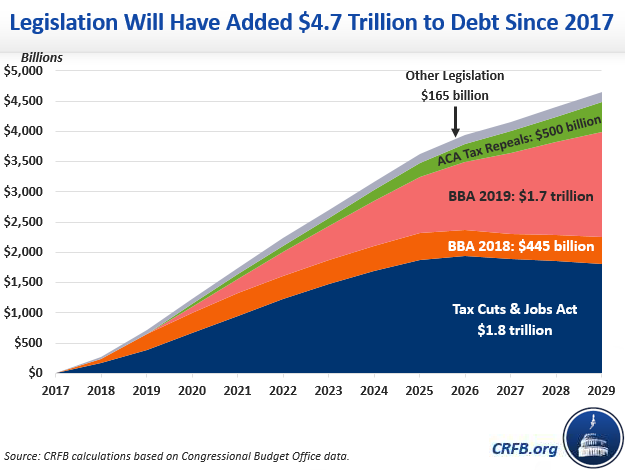

President Trump has Signed $4.7 Trillion of Debt into Law

Our US Budget Watch 2020 project analyzes, estimates, and explains the fiscal implications of proposals introduced during the presidential campaigns. These proposals offer important insights on each candidate’s fiscal priorities. So too do their past records, especially the record of the candidate who has already served as President for three years – President Donald Trump.

During the 2016 campaign, we estimated then-candidate Trump’s campaign plans would add $5.3 trillion to the debt from 2017 to 2026 (assuming policies were enacted immediately). In this analysis, we show that President Trump has already signed into law $4.2 trillion of debt over a comparable budget window and $4.7 trillion from 2017 through 2029.

This analysis is part of US Budget Watch 2020, a project covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers, factchecks, and analyses here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including but certainly not limited to their approaches on deficits and debt.

Our recent estimates of $4.7 trillion in new debt are higher than the $4.1 trillion we estimated in July of 2019 – with the additional debt the result of new and extended tax cuts in the December 2019 appropriations bills. Roughly half of the new debt President Trump signed into law is the result of tax cuts, and the other half of spending increases.

The Tax Cuts and Jobs Act (TCJA) alone added a projected $1.8 trillion to the debt, including interest and dynamic effects, through 2029. Even this number assumes that the individual tax cuts under the law expire as scheduled after 2025. An additional $1 trillion could be added to the debt through 2029 if the individual tax cuts are extended.

The Bipartisan Budget Act (BBA) of 2018 and Bipartisan Budget Act of 2019 added a combined $2.2 trillion to projected debt, mainly by dramatically increasing defense and non-defense spending caps for 2017 through 2021. Since no budget caps exist after 2021, CBO assumes spending will continue to grow with inflation after 2021, so the bills will increase spending by similar amounts in future years.

Finally, the December 2019 spending deal added $500 billion of debt by tacking onto ordinary appropriations a number of tax cuts. Most significantly, the bill permanently repealed three taxes meant to fund the Affordable Care Act, including the Cadillac tax that economists agree would have slowed health care cost growth and significantly reduced deficits over the long term. The legislation also revived a series of temporary special-interest zombie tax breaks, most of which had been expired for two years.

Other pieces of legislation account for nearly $165 billion of debt. This includes several different bills containing disaster relief and emergency spending as well as continued delays of the three ACA taxes that were subsequently repealed in December’s spending package deal, among other small items.

Importantly, this analysis does not account for any regulatory changes and covers a 13-year period from 2017 to 2029 (though nearly all costs are from 2018-2029). Using a standard ten-year budget window, we estimate President Trump signed $4.2 trillion of debt increases into law between 2018 and 2027, or $3.9 trillion from 2020 to 2029. The slightly lower cost in the later window is driven by the individual tax cut expirations after 2025.

Debt Added Since 2017 Over Different Periods

| Legislation | 2018-2027 Cost | 2020-2029 Cost | 2017-2029 Cost |

|---|---|---|---|

| Tax Cuts and Jobs Act of 2017 | $1.9 trillion | $1.4 trillion | $1.8 trillion |

| Bipartisan Budget Act of 2018 | $420 billion | $190 billion | $445 billion |

| Bipartisan Budget Act of 2019 | $1.3 trillion | $1.7 trillion | $1.7 trillion |

| Consolidated Appropriations Act, 2020 | $350 billion | $500 billion | $500 billion |

| Other Legislation | $150 billion | $100 billion | $165 billion |

| Total Increase in Debt | $4.2 trillion | $3.9 trillion | $4.7 trillion |

| Average Annual Increase in Deficit as Share of GDP | +1.7% | +1.6% | +1.5% |

| Increase in Debt-to-GDP in Final Year | +14.5% | +12.8% | +15.1% |

Source: CRFB calculations based on Congressional Budget Office data. Note: Numbers may not add due to rounding.

The $4.7 trillion of debt signed into law by President Trump is on top of the current $17.2 trillion debt held by the public and the $9.2 trillion we were already expected to borrow over the next decade absent these proposals. Debt is projected to be about 97 percent of Gross Domestic Product (GDP) in 2029, compared to 82 percent if none of this debt-increasing legislation had been passed.

It is worth keeping in mind that Congress – not the President – is primarily responsible for setting the federal budget and shaping federal tax and spending policy. While it is difficult for Congress to pass legislation without the President’s signature, it is impossible for the President to sign legislation without it passing both houses of Congress. Responsibility for the $4.7 trillion in new debt should therefore be shared between the President, the House, and the Senate – with nearly two-thirds of the legislation enacted on a bipartisan basis.

In future analysis, we will estimate the cost of extending the policies President Trump signed into law as well as the fiscal impact of enacting the President’s campaign agenda. We will continue to work to bring transparency to proposals put forward by candidates in both political parties.

****

This policy explainer is part of our US Budget Watch series covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here.

- Bernie Sanders’s Social Security Expansion Act

- Elizabeth Warren's Higher Education Plan

- Cory Booker's "Baby Bonds" Plan

- Joe Biden's Preschool and K-12 Education Plan

- After the 2020 Election, Fiscal Challenges Await

Update 1/23/2020: The descriptive text has been updated since publication. The numbers are unchanged.