GAO: Fiscal Targets Can Assist Deficit Reduction

The Government Accountability Office (GAO) recently published a report, The Nation’s Fiscal Health: Effective Use of Fiscal Rules and Targets. These fiscal rules and targets could include budget balance, spending ceilings, revenue floors, or debt-to-GDP ratio targets. GAO explains that such rules should be part of a broader effort to pursue sustainable budgeting.

This publication builds on a March 2020 GAO report, The Nation’s Fiscal Health: Action is Needed to Address the Federal Government’s Fiscal Future. It is also consistent with warnings in CBO’s Long-Term Budget Outlook and with the International Monetary Fund’s (IMF) call for long-term deficit reduction in the United States.

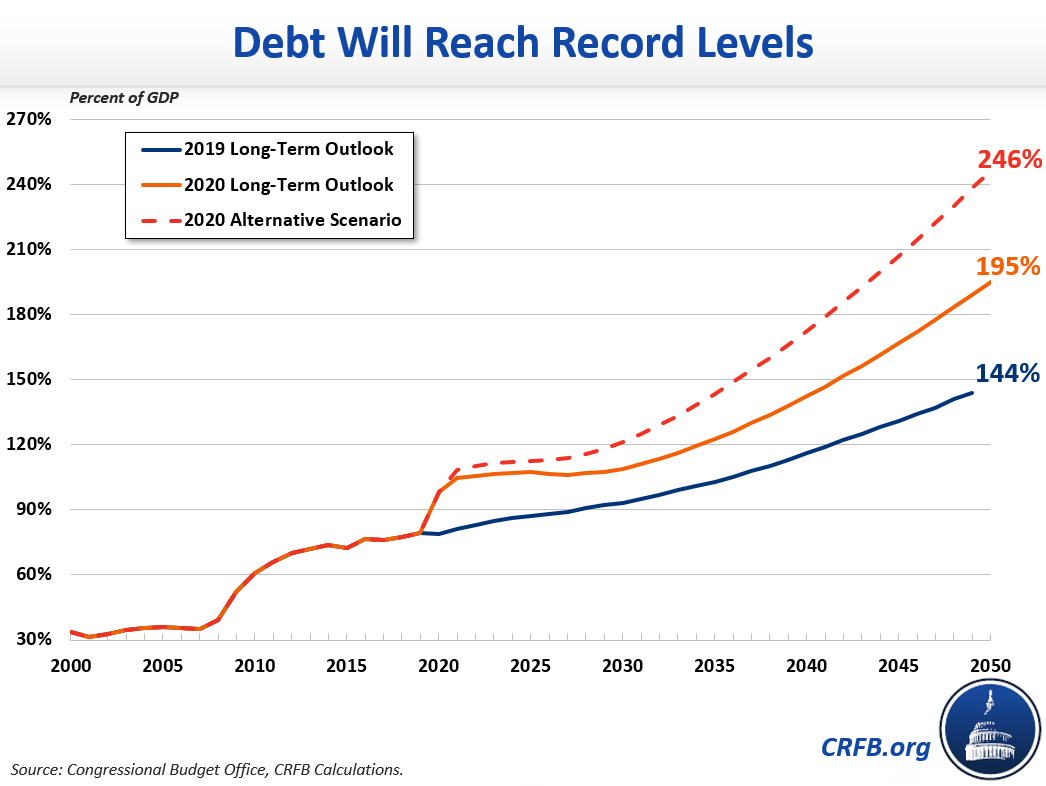

As GAO explains, the United States faces a high and rising level of debt. Debt recently exceeded the size of the economy for the first time since World War II. It is on course to reach two to two-and-a-half times the size of the economy by 2050, according to recent estimates from the Congressional Budget Office (CBO).

GAO recommends that policymakers adopt an agenda to address the budget imbalances primarily responsible for driving the unsustainable growth in the debt. In addition to program reforms, GAO says this agenda should include fiscal rules. Fiscal rules state medium-term objectives and give specific targets that provide annual guidance consistent with those longer-term rules. The IMF reports that more than 90 countries use fiscal rules.

As GAO explains, fiscal rules can target several different metrics. Combinations may be most effective, as any single rule has weaknesses.

Types of Fiscal Rules

| Type of Rule | Description |

|---|---|

| Budget Balance Rule | Constrains deficit levels or targets a budget surplus. |

| Debt Rule | Sets an explicit limit or target for debt held by the public as a share of gross domestic product. |

| Revenue Rule | Sets ceilings or floors on revenues and aims to increase revenue collection or prevent excessive tax burdens. |

| Expenditure Rule | Limits spending, typically in absolute terms or growth rates, and occasionally as a percentage of gross domestic product. |

Source: Government Accountability Office

Likewise, balance rules can take several forms. They too can be combined, such as through a structural primary balance rule.

Types of Balance Rules

| Type of Rule | Description |

|---|---|

| Overall Rules | Target difference between total spending and revenues. |

| Primary Rules | Target difference between non-interest spending and revenues (exclude interest on the debt). |

| Golden Rules | Target difference between non-investment spending and revenue. |

| Cyclically-Adjusted Rules | Adjust for economic fluctuations by using estimates of potential GDP. |

| Structural Rules | Like cyclically-adjusted balance rules, also "exclude large, non-recurring fiscal measures." |

Source: Government Accountability Office

Rules can simply be political commitments, or they can be codified in statute or even enshrined in the Constitution. In many countries, combinations of both form and type are used. The U.S. lacks effective fiscal rules, GAO argues, despite the potential of well-designed fiscal rules to guide policy, “even if they are not strictly complied with.”

America’s two existing fiscal rules fall short, according to GAO. The Statutory Pay-As-You-Go (PAYGO) Act only applies to legislated changes to direct spending and revenue, not to fiscal impacts from demographic shifts or other economic and technical factors. Although GAO does not say so in this report, Congress also often waives PAYGO rules.

In addition, the discretionary spending caps from the Budget Control Act (BCA) of 2011 are limited to about 30 percent of overall spending and do not affect revenue at all. Congress has repeatedly increased them – recently without offsets – and those caps will end after 2021.

Though the United States has a broader rule that applies to all debt, GAO argues the debt limit is not a fiscal rule. The debt limit “only restricts the Department of the Treasury’s authority to borrow and finance the decisions already passed by Congress and signed into law by the President; it does not restrict Congress’s ability to pass spending and revenue legislation that affects the level of debt.”

In the report, GAO provides an overview of factors that policymakers should consider when designing new or improved fiscal goals and targets. The report provides examples by reference to budget practices in Australia, Germany, and the Netherlands.

Key Considerations for the Design, Implementation, and Enforcement of Fiscal Rules and Targets

| Key Consideration | Supporting Explanation |

|---|---|

| Alignment with Fiscal Policy Goals and Objectives | Setting clear goals and objectives can anchor a country's fiscal policy. Fiscal rules and targets can help ensure that spending and revenue decisions align with agreed-upon goals and objectives. |

| Design Tradeoffs and Features | The weight given to tradeoffs among simplicity, flexibility, and enforceability depends on the goals a country is trying to achieve with a fiscal rule. In addition, there are tradeoffs between the types and combinations of rules, as well as the time frames over which the rules apply. |

| Legal Framework and Permanence | The degree to which fiscal rules and targets are binding, such as being supported through a country's constitution or nonbinding political agreements, can impact their permanence, as well as the extent to which ongoing political commitment is needed to uphold them. |

| Integration with Budgetary Processes | Integrating fiscal rules and targets into budget discussions can contribute to their ongoing use and provide for a built-in enforcement mechanism. The budget process can include reviews of fiscal rules and targets. |

| Flexibility to Address Emerging Issues | Fiscal rules and targets with limited, well-defined exemptions, clear escape clauses for events such as national emergencies, and adjustments for the economic cycle can help a country address future crises. |

| Clear Roles for Supporting Institutions | Institutions supporting fiscal rules and targets need clear roles and responsibilities for supporting their implementation and measuring their effectiveness. Independently analyzed data and assessments can help institutions monitor compliance with fiscal rules and targets. |

| Transparency and Communication | Having clear, transparent fiscal rules and targets that a government communicates to the public and that the public understands can contribute to a culture of fiscal transparency and promote fiscal sustainability for the country. |

Source: Government Accountability Office

GAO concludes that “agreement on a fiscal goal can assist in framing the difficult choices that must then be made in designing the mix of fiscal rules and targets adopted.”

***

Process reforms alone cannot force Congress and the President to enact fiscal improvements. Nonetheless, our Better Budget Process Initiative reflects the conviction that process improvements can create better frameworks for deliberation and decision-making. Fiscal rules and targets can help to frame choices and guide options.

We have long advocated that Congress and the White House set fiscal goals to stabilize and then reduce the level of debt as a percentage of GDP. Doing so could mitigate the risks from high debt burdens while increasing the likelihood that policymakers have sufficient fiscal space for emergency response.