The Fiscal Response to COVID-19 Will be Larger than the Great Recession Response

The Coronavirus Response & Relief Supplemental Appropriations Act has been passed by Congress and awaits the President's signature. Assuming the bill will be signed, Congress will have passed nearly $5 trillion of potential support in response to the COVID-19 pandemic, at a projected net cost of roughly $3.5 trillion over the next 5 years. The new bill includes more than $900 billion of support for small businesses, expanded unemployment benefits, recovery rebates, funding for schools, transportation spending, money for COVID testing and vaccines, and other spending and tax cuts.

In a previous analysis, we compared the first five COVID-response bills passed by Congress to those enacted during the Great Recession between 2008 and 2012, and found them to be similar in size as a percentage of the economy – though with very different timing. With the passage of the Response & Relief Act, COVID relief is now significantly larger.

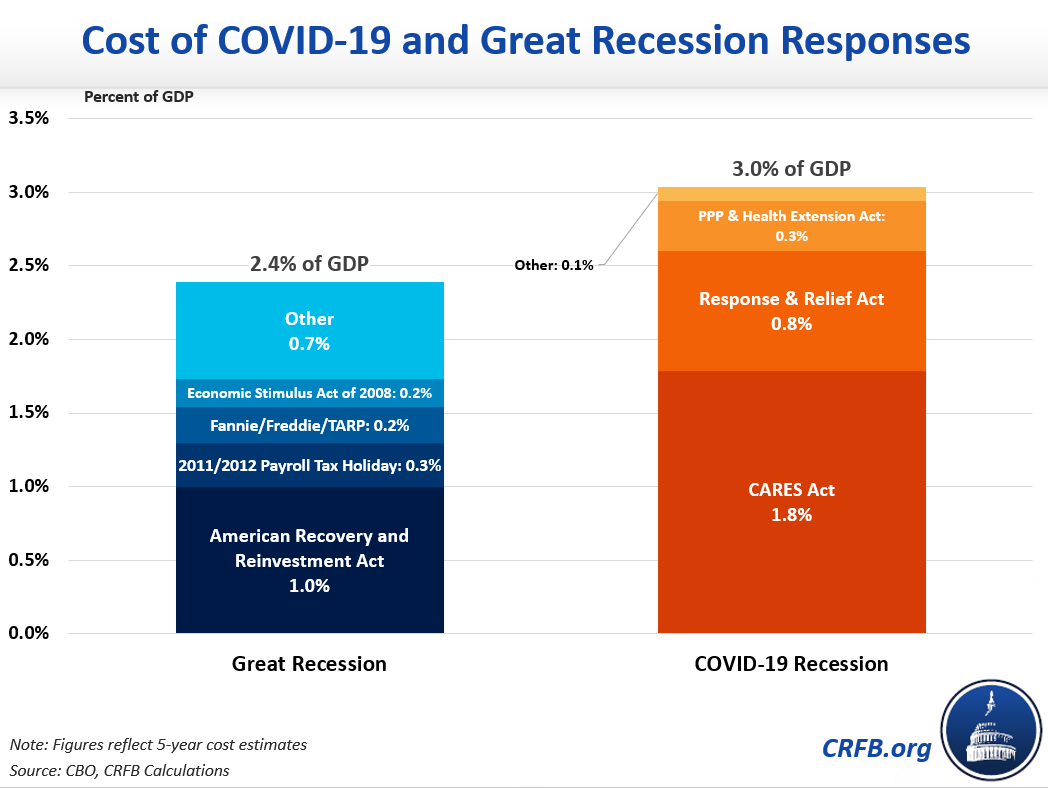

Over the next 5 years, we estimate that the cost of the legislative response to the COVID-19 pandemic will total about $3.5 trillion, or approximately 3 percent of Gross Domestic Product (GDP) through 2024. Between 2008 and 2012, by comparison, Congress enacted roughly $1.8 trillion of fiscal stimulus and other economic support (we tracked these and other measures at Stimulus.org and detailed them in our previous analysis), equivalent to 2.4 percent of GDP.

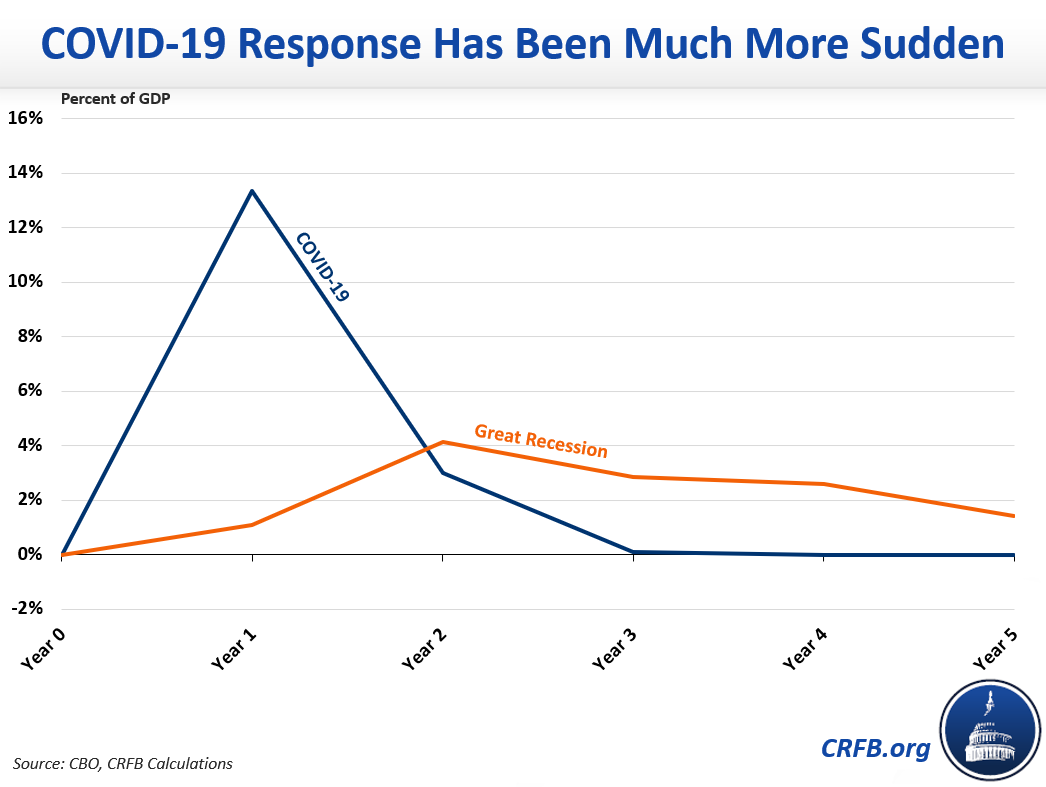

As noted in our previous analysis, the newly-enacted COVID-19 relief will be distributed much more quickly than the Great Recession stimulus. COVID-related fiscal support totaled more than 13 percent of GDP in 2020. We estimate it will total 3 percent of GDP in 2021 – mostly due to the Response & Relief Act – and have little net impact starting in 2022. By comparison, stimulus during the Great Recession rose from 1 percent of GDP in 2008 to above 4 percent in 2009, and continued to offer substantial net fiscal support through 2012.

Importantly, our estimates of the cost of COVID relief are somewhat rough. The Congressional Budget Office (CBO) has not released an official score of the Response & Relief Act, and we have adjusted estimates of prior legislation to account for low take-up of payroll tax deferrals and credits.

Overall, we estimate the Response & Relief Act will boost economic output by about $600 billion through 2023, and that all six major COVID relief bills passed by Congress thus far will ultimately generate an additional $2.2 trillion of economic output over the next five years.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.