Factchecking Trump on Taxes

This week's issue of The Economist featured an interview with President Donald Trump covering economic, health, tax, and trade policy. We factchecked some of the claims that President Trump made in the interview:

- We're the highest taxed nation in the world. False

- Ronald Reagan's tax reform increased the deficit. It depends

- Health reform will put $400 to $900 billion of savings towards tax cuts. True

"We're the highest taxed nation in the world"

We've previously factchecked this statement as part of Donald Trump's speech accepting the Republican nomination for President, adapted here:

There are multiple ways to measure levels of taxation, including government revenue as a share of the economy and the tax rates that individuals and businesses pay. As a share of the economy, the United States is nowhere close to the “highest-taxed country in the world” and does not raise nearly as much tax revenue as other developed countries, many of which are in Europe.

According to the Organisation for Economic Co-operation and Development (OECD), total U.S. tax revenue amounted to 26 percent of GDP in 2014, with about one-third of that coming from state and local government taxes. In contrast, the OECD average was 34.4 percent of GDP and the highest rate was 50.9 percent in Denmark.

If Trump was talking about the federal income tax rate that individuals pay, Americans still do not face the highest tax rate in the world. Again according to the OECD, the country with the highest national income tax rate is Austria at 55 percent, more than 15 percentage points higher than the U.S. top federal individual income rate of 39.6 percent.

However, if Trump was talking about marginal corporate tax rates, he would be closer to correct if he said that the U.S. has the highest top marginal corporate tax rate in the OECD countries, though in the entire world the United Arab Emirates and Chad still have higher tax rates.

According to the OECD, the U.S. corporate rate is 39 percent (including an average of state and local taxes), while the OECD's unweighted average is 24 percent. Those figures account for stated tax rates, before deductions and credits. Another measure would be the effective rate, after deductions and credits. Even in that case, the U.S. does not – by any measure we are aware of – have the highest effective corporate tax rate.

Notwithstanding our high corporate tax rate, the U.S. is not close to being the highest-taxed country in the world.

Our Rating: False.

Ronald Reagan's tax reform increased the deficit

Q: Another part of your overall plan, the tax reform plan. Is it OK if that tax plan increases the deficit? Ronald Reagan’s tax reform didn’t.

President Trump: Well, it actually did. But, but it’s called priming the pump. You know, if you don’t do that, you’re never going to bring your taxes down.

Whether Donald Trump's statement is true depends on which of Reagan's tax bills he is referring to. The interviewer is probably referring to the Tax Reform Act of 1986, which included many changes such as consolidating and lowering individual rates (including reducing the top rate from 50 to 28 percent), but that bill was paid for by limiting other deductions, exclusions, and avoidance strategies. The bill was revenue-neutral, neither increasing or decreasing the deficit.

Trump is likely referring to the Economic Recovery Tax Act of 1981, which cut the top tax rate on individuals from 70 percent to 50 percent, lowered the capital gains rate from 28 percent to 20 percent, indexed the income tax brackets to inflation, increased the rate at which businesses could write off expenses, and made other changes. That bill was a very large tax cut, actually the largest since at least 1940 according to available data. It lowered revenue by almost 3% of GDP, or 13% of all revenues (the equivalent of a $6 or $7 trillion tax cut today). Even Reagan's own final budget estimated that the bill decreased revenues and therefore increased the deficit.

However, the 1981 tax cut was too steep. After 1981, it was clear that the budget projections that allowed the cut were overly optimistic, and policymakers determined that the cuts needed to be rolled back. It was followed in 1982 by the second-largest tax increase in history (in inflation-adjusted dollars) and another tax increase in 1984. The Office of Management and Budget estimated that about 40 percent of the initial tax cut was offset with subsequent increases during President Reagan's term.

As an aside, it is certainly possible to "bring taxes down" without increasing the deficit. Policymakers could follow the model of 1986 and pay for tax rate reductions by limiting some of the $1.6 trillion in annual tax expenditures, many of which complicate the code, distort decision-making, pick winners and losers, and tend to be regressive. They could also avoid increasing deficits if they paired tax cuts with an equivalent amount of spending cuts.

Our Rating: It depends.

Health reform will put $400 to $900 billion of savings towards tax cuts

President Trump: Now, if we get the health-care [bill through Congress], this is why, you know a lot of people said, “Why isn’t he going with taxes first, that’s his wheelhouse?” Well, hey look, I convinced many people over the last two weeks, believe me, many Congressmen, to go with it. And they’re great people, but one of the great things about getting health care is that we will be saving, I mean anywhere from $400bn to $900bn.

Mr Mnuchin: Correct.

President Trump: That all goes into tax reduction. Tremendous savings.

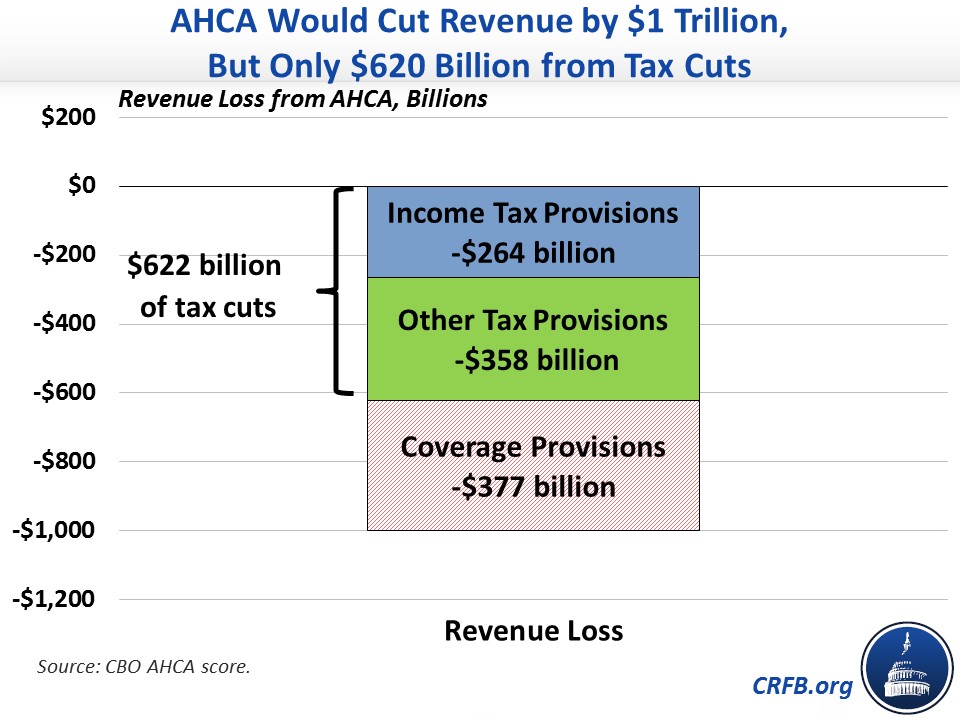

It is true that the American Health Care Act (AHCA) reduces both taxes and spending. The most recently scored version of the AHCA includes $622 billion of tax cuts, outside of coverage provisions, which are fully paid for by reducing spending. The final House-passed version, which is expected to be scored by CBO in a few weeks, reduced that number by $65 billion and the Senate may reduce it more, but it seems likely that the final version would repeal at least some Affordable Care Act taxes. President Trump's range of $400 billion to $900 billion is plausible.

For a detailed breakdown of the AHCA's changes to revenues and outlays, view our analysis of the last CBO score or how it may be changed by the subsequent amendments.

While it is true that the AHCA reduces both spending and taxes, that's different than the claim that the tax cuts in AHCA allow for more tax cuts in tax reform – they don’t. In a factcheck last month, You Can't Pay for Tax Reform With Health Reform, we explained that the AHCA's savings cannot be used to finance tax reform. AHCA might make tax reform somewhat easier, but even that assertion is somewhat uncertain.

Our Rating: True.