CBO's Estimate of the House-Passed AHCA

The Congressional Budget Office (CBO) just released their updated score of the American Health Care Act (AHCA) as passed by the House of Representatives. The new score includes changes we previously discussed on waiving Essential Health Benefits and community rating, increasing funding for high-risk pools, delaying the repeal of the Medicare surtax, adding funding for maternity and newborn care, and funding a "Federal Invisible Risk Sharing Program."

| Provision | 2017-2026 Cost / Savings (-) | |

|---|---|---|

| Prior AHCA | House-Passed AHCA | |

| End Mandate Penalties | $210 billion | $210 billion |

| Reduce Spending and Tax Subsidies | -$1.62 trillion | -$1.57 trillion |

| Increase Spending and Tax Subsidies | $636 billion | $687 billion |

| Repeal ACA Taxes | $622 billion | $553 billion |

| Total Deficit Impact (Conventional Scoring) | -$150 billion | -$119 billion |

Among the key findings and differences from the last version of the bill include:

- The House-passed AHCA would reduce deficits by $119 billion through 2026 under conventional scoring; the last version would have reduced deficits by $150 billion.

- The House-passed AHCA’s $119 billion of savings is the result of a $1.57 trillion reduction in the cost of spending and tax subsidies with most of the funds used to pay for ending the mandate penalties ($210 billion), increasing spending in other areas while instituting new tax subsidies ($375 billion), and cutting taxes by $553 billion by repealing most of ACA's tax hikes beginning retroactively in 2017.

- On net, the House-passed AHCA would reduce outlays by $1.1 trillion and revenue by $990 billion through 2026 (the last version would have reduced outlays and revenue by $1.15 trillion and $1 trillion, respectively).

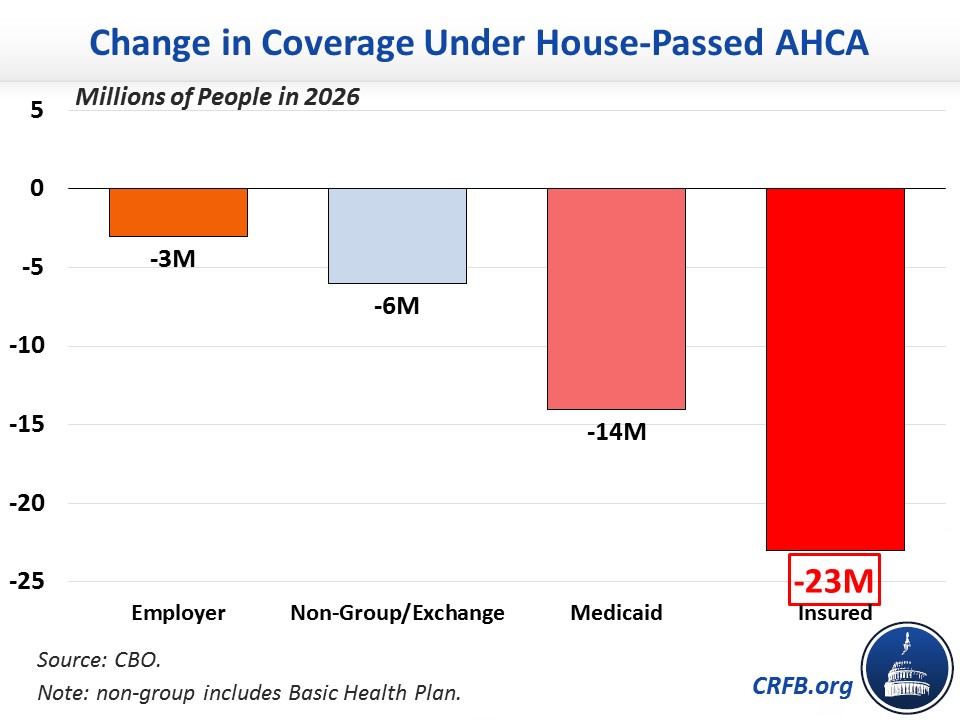

- CBO’s estimate of the bill’s coverage effects is similar to previous estimates though slightly improved. CBO projects the House-passed AHCA would reduce the number of Americans with health insurance by 14 million in 2018 and by 23 million in 2026. The 23 million reduction is the result of 14 million fewer Medicaid beneficiaries, 3 million fewer individuals with employer coverage, and 6 million fewer in other coverage areas including the exchanges. CBO also estimates that a few million additional individuals would obtain some type of insurance but not what they would consider coverage.

- CBO has still not completed an estimate of the macroeconomic effects of this version of the bill or a second-decade estimate, though we estimated that the last version of the bill would continue to reduce deficits over the long term at a lower magnitude than the first version. In our assessment, the legislation would likely produce modest increases in economic growth under CBO's model.

The table below breaks down the major elements of the CBO score.

| Provision | 2017-2026 Cost / Savings(-) | |

|---|---|---|

| Prior AHCA | House-Passed AHCA | |

| Reduce Individual Mandate Penalty to $0 | $171 billion | $171 billion |

| Reduce Employer Mandate Penalty to $0 | $38 billion | $38 billion |

| Subtotal, End Mandate Penalties | $210 billion | $210 billion |

| Repeal ACA Premium and Cost-Sharing Subsidies in 2020 | -$663 billion | -$665 billion |

| Reduce ACA Medicaid Match to Base Medicaid Rate for “Expansion” Beneficiaries, Establish Per-Capita Caps, & Institute Optional Work Requirements* | -$839 billion | -$834 billion |

| Other Reductions | -$47 billion | -$47 billion |

| Coverage Interactions | -$70 billion | -$23 billion |

| Subtotal, Reduce Spending and Tax Subsidies | -$1.62 trillion | -$1.57 trillion |

| Establish Flat Age-Adjusted Health Care Tax Credits in 2020 | $357 billion | $375 billion |

| Reduce the Medical Expense Deduction Floor from 7.5% to 5.8% | $90 billion | $90 billion |

| Establish Patient and State Stability Fund | $80 billion | $117 billion |

| Repeal Disproportionate Share Hospital Payment Cuts (Medicare & Medicaid) | $79 billion | $74 billion |

| Expand Health Savings Accounts | $19 billion | $19 billion |

| Other Costs | $11 billion | $11 billion |

| Subtotal, Increase Spending and Tax Subsidies | $636 billion | $687 billion |

| Repeal ACA 3.8% Net Investment Income Tax (NIIT) | $172 billion | $172 billion |

| Repeal ACA Health Insurer Tax | $145 billion | $145 billion |

| Repeal ACA Medicare Hospital Insurance 0.9% Surtax | $127 billion | $59 billion (starting in 2023) |

| Delay ACA “Cadillac Tax” Start Date | $66 billion (delayed to 2026) |

$66 billion (delayed to 2026) |

| Repeal Most Other ACA Tax Increases | $112 billion | $112 billion |

| Subtotal, Repeal ACA Taxes | $622 billion | $553 billion |

| Total Deficit Impact | -$150 billion | -$119 billion |

Source: Congressional Budget Office and Joint Committee on Taxation. Note: numbers may not add due to rounding.

The biggest changes in the cost estimate of this version of the bill come from the addition of $8 billion for high-risk pools, provisions to allow states to waive some of the ACA's regulations (like community rating and Essential Health Benefits), $15 billion for a "Federal Invisible Risk Sharing Program," $15 billion for maternity and newborn care, and a delay in the repeal of the 0.9 percent Medicare surtax until 2023 (which reduces that provision's cost by $69 billion). As in the last version of the bill, the medical expense deduction change is considered to be a placeholder for alternative policies that the Senate could use the $90 billion price tag to enact, so CBO's estimate includes the deduction's effect on cost and coverage in spite of the likelihood that it will disappear if the Senate makes changes to the bill.

CBO's estimate of the coverage change improved by 1 million due to an increase of 4 million individuals with employer-based insurance in 2026 and 3 million fewer individuals with individual market insurance. The 1 million increase in coverage also occurs in the last year, with most of the decade showing a 2 million person increase in coverage compared to the last version of the bill. This also does not include an additional few million that CBO estimates would receive some type of insurance but would not constitute coverage under their standards. The chart below shows how much coverage would change in 2026 compared to current law under the ACA.

Importantly, the coverage estimates and cost savings will likely change if the Senate changes the bill or if Senate rules regarding reconciliation challenge some of the provisions of the AHCA (as we wrote about here).

We will have more analysis, including on how CBO projects the waivers will be used, in future blogs.

Further Readings