CBO Releases 2019 Long-Term Outlook

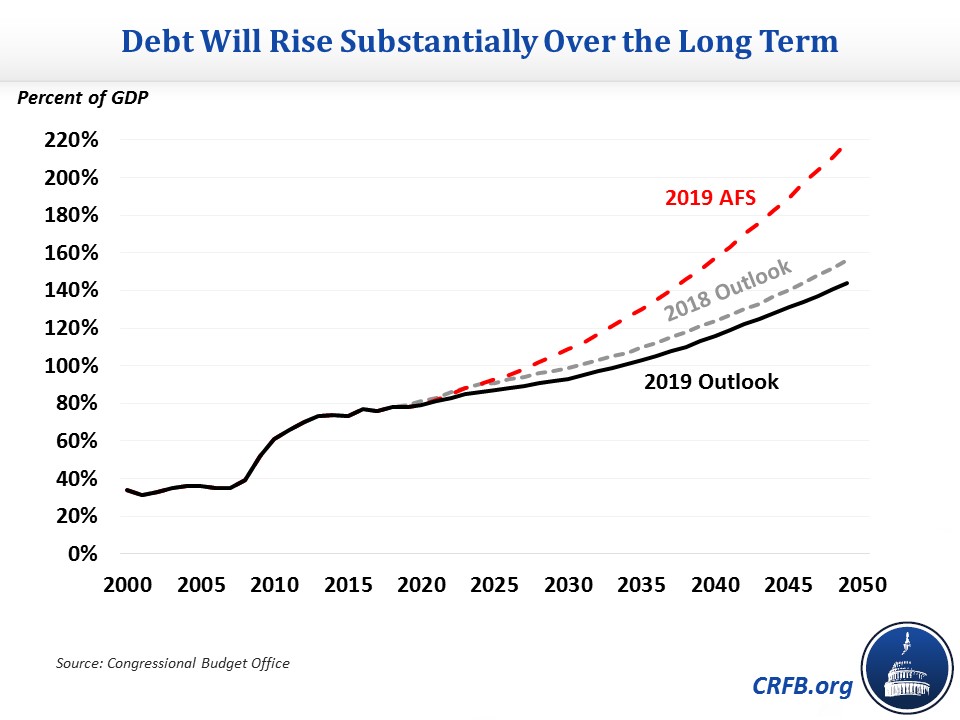

The Congressional Budget Office (CBO) just released its 2019 Long-Term Outlook, again confirming the budget’s unsustainable long-term trajectory. Under current law, CBO projects federal debt held by the public will eclipse the size of the economy by 2034, set a new record at 108 percent of Gross Domestic Product (GDP) by 2037, and reach 144 percent of GDP by 2049. If costly tax and spending increases are extended, debt will reach 219 percent of GDP by 2049.

Deficits will follow a similar trajectory, rising from 4.2 percent of GDP in 2019 to 8.7 percent by 2049 under current law and 15.5 percent of GDP if current policies are continued. CBO’s current law debt projections show debt lower than last year’s projections, as a result of a rise in productivity and lower interest rates.

Rising deficits are driven by a disconnect between spending and revenue. Growth in Social Security and health care spending as well as growing interest from rising debt will lead spending to grow from 20.7 percent of GDP in 2019 to 28.2 percent by 2049. Revenue will fail to keep pace, rising from 16.5 percent of GDP this year to 19.5 percent by 2049 under current law.

CBO warns that failure to confront our mounting debt will have adverse consequences. The unsustainable fiscal outlook slows income growth, increases interest payments and crowds out other priorities, places upward pressure on interest rates, weakens the ability to respond to the next recession or emergency, places an undue burden on future generations, and heightens the risk of a fiscal crisis.

At the same time, CBO projects the five major trust funds – the Highway, Pension Benefit Guaranty Corporation (PBGC) Multi-Employer, Hospital Insurance (HI), Social Security Disability Insurance (DI), and the Social Security Old-Age and Survivors Insurance (OASI) trust funds – will run out of reserves within the next 13 years.

Lawmakers need to come to the table and address the situation before it gets worse. This includes reforming the tax code, setting reasonable and responsible discretionary spending levels, curbing the growth of health care spending, making Social Security solvent, and pursuing a combination of other revenue increases and spending cuts to place debt on a downward path. As CBO shows in its latest report, the longer policymakers wait to make these changes, the harder and costlier the necessary adjustments will be.

Stay tuned for more analysis on the Long-Term Outlook today and throughout the week.