What's in the Final COVID Relief Deal of 2020?

Lawmakers passed a new COVID relief deal on December 21, 2020, which was subsequently signed into law by the President on December 27. The deal in many ways resembles recent proposals from a bipartisan group of lawmakers and from Treasury Secretary Mnuchin, both of which cost over $900 billion. It is the fifth major bill enacted in response to the COVID pandemic and economic crisis, and the first since April's Paycheck Protection Program and Health Care Enhancement Act.

The agreement includes support for small businesses, expanded unemployment benefits, recovery rebates, funding for schools, transportation spending, money for COVID testing and vaccines, and a variety of other programs. The summary and analysis below is compiled from legislative summaries, CBO/JCT scores, and the bill text. Our figures are slightly higher than the CBO scores for the Response & Relief sections of the bill, because we include COVID-related measures in other parts of the legislation, including tax provisions and other emergency appropriations.

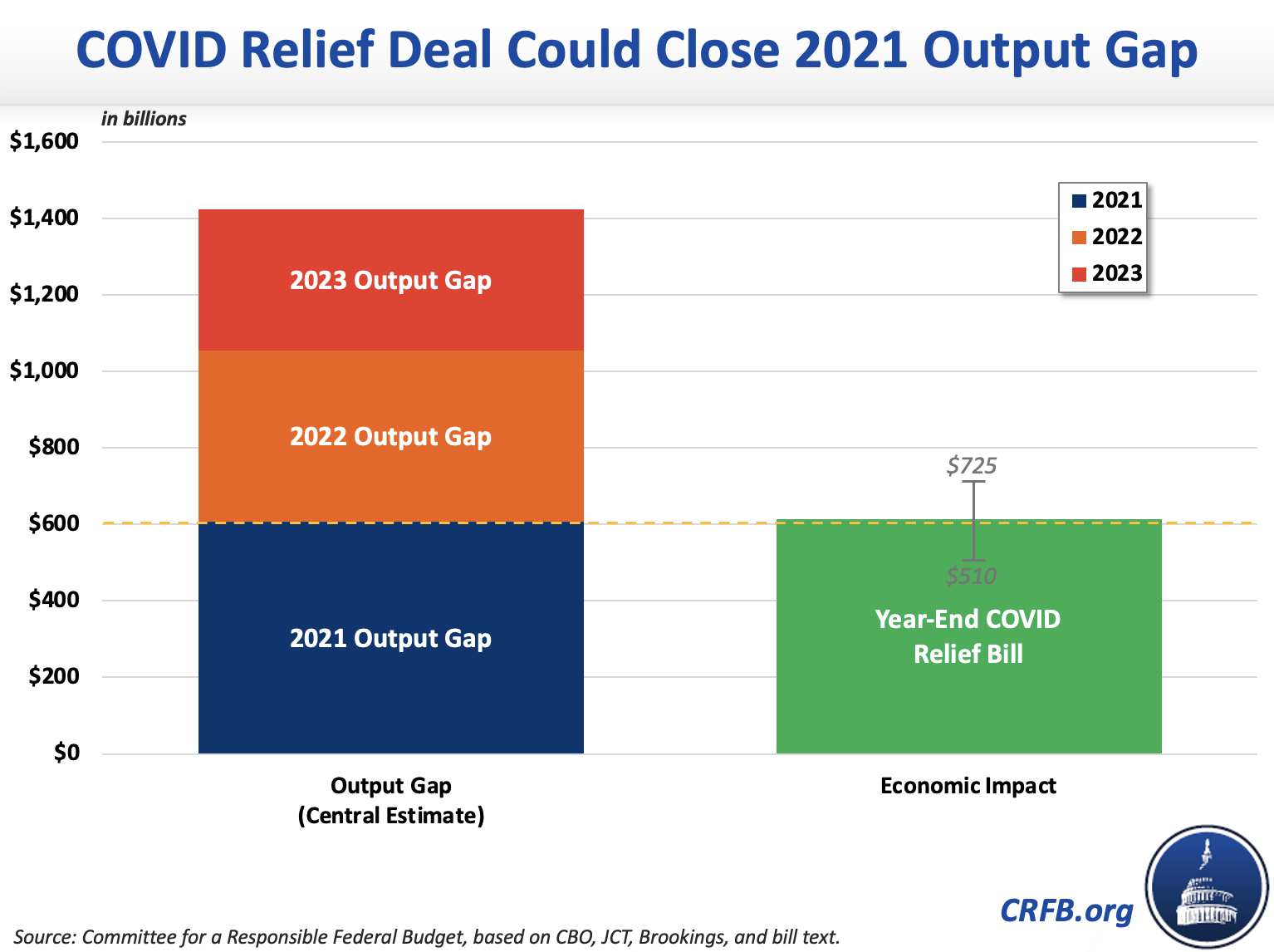

Under our central estimates, the package will cost about $915 billion and would boost economic output by $615 billion (3 percent of 2021 GDP), which is equivalent to closing the entire estimated output gap for 2021 and almost half of the total estimated output gap through 2023. The bill will also propel personal income to record levels in the first quarter of 2021.

Major Provisions in the Year-End COVID Relief Bill

| Provision | Ten-Year Cost |

|---|---|

| Aid to Small Businesses | $302 billion |

| Paycheck Protection Program (PPP) Second Draw | $261 billion* |

| Economic Injury Disaster Loan Advances | $20 billion |

| Emergency Grants to Venues | $15 billion |

| Other Small Business Relief and Program Expenses | $6 billion |

| Deductibility of expenses paid for by PPP loans | ^† |

| Extend and Augment Unemployment Benefits (+$300/week) for 11 weeks | $121 billion |

| Stimulus checks of $600/person | $166 billion |

| Education | $82 billion |

| K-12 Education Grants | $54 billion |

| Higher Education Grants | $20 billion |

| Governor's Emergency Education Relief Fund | $4 billion |

| Grants for HBCUs, Minority-Serving Institutions, and Tribal Colleges | $2 billion |

| Grants to For-Profit Colleges to Provide Financial Aid | $1 billion |

| Education Grants for Tribes and Territories | $1 billion |

| Health Care | $72 billion |

| Funding to States for Testing, Tracing, and COVID Mitigation | $22 billion |

| Vaccine Procurement | $20 billion |

| Vaccine Distribution Through the States & CDC | $8 billion |

| Mental Health Funding | $4 billion |

| Overseas Vaccine Response | $4 billion |

| Additional Health Care Provider Grants | $3 billion |

| Repeal the Medicare Sequester through March 2021 | $3 billion |

| Increase Physician Pay Schedule | $3 billion |

| Other Health Funding | $4 billion |

| Distribute Majority of Existing Provider Relief Fund to Struggling Health Providers | ** |

| Transportation | $44 billion |

| Second Round Payroll Support Program for Airline Workers | $15 billion |

| Transit Infrastructure Grants | $14 billion |

| State Highway Funding | $10 billion |

| Grants to Transportation Service Providers Like Buses and Ferries | $2 billion |

| Airport Grants | $2 billion |

| Amtrak Funding | $1 billion |

| Other Spending | $88 billion |

| Nutrition and Agriculture Programs | $26 billion |

| Rental Assistance | $25 billion |

| Community Lender Support | $12 billion |

| Child Care Grants | $10 billion |

| Broadband Grants and Investment | $7 billion |

| Provide Additional Emergency Funding to Agencies | $5 billion |

| Disaster Relief Funding for COVID Funeral Expenses | $2 billion |

| Community Development Block Grants | $2 billion |

| Write-Off $10 Billion U.S. Postal Service Loan | $0 |

| Other Tax Cuts | $40 billion |

| Extend and Expand Employee Retention Tax Credit | $21 billion |

| Reinstate 100% Business Meals Deduction for 2021 and 2022 | $6 billion |

| Increase Earned Income and Child Tax Credit by Allowing Taxpayers to Use 2019 Income | $4 billion |

| Extend CARES Act Charitable Provisions | $4 billion |

| Extend CARES Act Employer-Paid Student Loan Exclusion Through 2025 | $3 billion |

| Extend Families First Paid Leave Credits Through March 2021 | $2 billion |

| Total | $915 billion |

| "Offsets" (reductions in previous budget authority) | -$626 billion |

| Net Total (budget authority) | ~288 billion*† |

Source: Legislative summaries, bill text, JCT, CBO, CRFB calculations.

*Total amount allocated for the renewed PPP program is actually $284 billion, but our net cost reflects a roughly 92 percent subsidy rate, as some forgivable loans will be repaid.

** The bill requires that at least 85 percent of the unobligated PRF balance be used for more distributions to health providers that incurred losses in Q3 and Q4 of 2020 and Q1 of 2021. This represents around $20 billion in potential distributions.

^ This change may reduce tax revenues by up to $200 billion relative to current law (or less if there are limits imposed on deductibility, as reported by some sources), but much of the cost was inadvertently scored in the original bills so it would not be counted as an additional cost by CBO.

†Although the proposal rescinds funds from the PPP and small business programs ($146.5 billion) and the Federal Reserve’s lending facilities ($454 billion), those funds would not have been spent under current law so the actual deficit impact is reflected in the total ten-year cost of $914 billion. The ultimate deficit impact could change — for example, unemployment benefits could cost more or less depending on unemployment levels and PPP loans may not be fully utilized.

The package provides a total of $300 billion of spending for small businesses, including $284 billion (net cost of $261 billion) for a second round of forgivable Paycheck Protection Program loans, $20 billion of Economic Injury Disaster Loans advance grants, which will provide up to $10,000 for businesses that continue to remain severely impacted by the ongoing slowdown, $15 billion in emergency grants for shuttered entertainment venues, movie theaters, and museums, and other business support. The bill would also allow businesses to deduct expenses paid out of past and new PPP funds for tax purposes, contrary to current IRS regulations. While this provision would not score with any cost (since it was already assumed in CBO's initial score), it could cost up to $200 billion relative to current practices based on estimates from Adam Looney at the Brookings Institution.

The package also extends the current temporary unemployment programs for gig workers – Pandemic Unemployment Assistance (PUA) – and for those that have exhausted regular unemployment benefits (Pandemic Emergency Unemployment Compensation), along with other unemployment provisions, for 11 weeks from December 26 through March 14, 2021. Weekly unemployment benefits would also be boosted by $300 per week over that period, which is half of the $600 per week supplement provided through July, but in line with the Administration's six-week Lost Wages Supplement and enough to replace roughly 100 percent of work income for the average unemployed worker. Unemployment benefits would be boosted by an additional $100 per week for those with both self-employment and wage income, reflecting that the PUA formula does not credit wage income. New PUA applications would cease on March 14, but workers could continue receiving benefits through April 5.

In addition, the package includes a second round of recovery rebates or "Economic Impact Payments," equal to $600 per person. That is half the size of the $1,200 rebates provided for adults in the CARES Act, but would represent a $100 increase for children. The payments would phase out at higher incomes. Families with mixed-immigration status would be made newly eligible for both the first and second Economic Impact Payments. The bill would expand and increase funding for nutrition programs like SNAP, provide rental assistance through states, and provide funding for child care and broadband.

The legislation contains nearly $70 billion in health care funding. Most significantly, lawmakers agreed to provider $22 billion for state COVID testing and tracing programs, $20 billion to purchase vaccines to be made available at no cost, and $9 billion to assist states and the CDC in distributing vaccines. The bill also repeals the Medicare sequester (which had been paused by the CARES Act) for all of 2021, and funds mental health, COVID research, and other health spending. The bill also provides an additional $3 billion in grants to health providers to account for lost revenue of expenses related to the ongoing public health emergency, and requires that around $20 billion in existing Provider Relief Fund money is disbursed to health providers that incurred losses at the end of 2020 and into 2021.

While the bill does not include any unconditional funding for state and local governments, it does include approximately $85 billion in state and local aid earmarked for specific purposes, including $54 billion for K-12 schools, an additional $5 billion in general education funding that can be spent by state governors, tribes, and territories, $14 billion in grants to transit systems, and $10 billion in state highway funding.

There are several COVID-related tax provisions included in the omnibus. For one, the bill expands and extends the Employee Retention and Paid Sick Leave payroll tax credits from the CARES Act, for a net cost of $22 billion. The bill also reinstates a full deduction for business meals for 2021 and 2022 at a cost of $6 billion, with half of the effect occurring in FY 2022. The bill also allows low-income taxpayers to use their 2019 earned income for purposes of claiming the Earned Income and Child Tax Credit if the result would be more favorable than using 2020 earned income. JCT estimates this will reduce federal revenues by $4 billion. The bill also extends several CARES Act tax provisions, the above-the-line charitable deduction and looser donation limits through December 31, 2021 and the employer-paid student loan exclusion through the end of 2025, for a total combined cost of $7 billion. The non-COVID portion of the bill continues several tax extenders, permanently continues lower tax rates on alcohol, and extends tax breaks for clean energy, hiring certain disadvantaged groups, and investing in certain areas.

How Much Will the Package Boost the Economy?

Overall, we estimate this $915 billion package will boost GDP by between $510 to $725 billion, with a central estimate of $615 billion. That would be enough to close the full output gap in 2021 in our base estimate, though in reality some of the economic gains would occur in 2022 and 2023.

To generate our range of estimates, we applied different fiscal multipliers to five categories of spending included in the bill: small business relief, expanded and extended unemployment benefits, state and local aid, rebate checks, and other policies. For our low-impact estimate, we used the same category fiscal multipliers estimated by CBO for already-enacted COVID relief. For our high-impact estimates, we used multipliers suggested by Wendy Edelberg and Louise Sheiner at the Brookings Institution, increasing the assumed PPP and small business multiplier to account for increased targeting. The aggregate result is a multiplier of between 0.56x and 0.79x. For our central estimate, we took the average of this range, 0.67x.

Estimated GDP Boost From COVID Relief Proposals (billions)

| Economic Impact Estimates | ||||

|---|---|---|---|---|

| Category | Fiscal Impact | Low | Central | High |

| Unemployment Benefits | $120 | $80 | $120 | $155 |

| Economic Impact Payments | $165 | $100 | $135 | $165 |

| Paycheck Protection Program and Other Small Business Support | $320 | $115 | $140 | $160 |

| State and Local Aid (including Education and Transit Funding) | $85 | $75 | $80 | $85 |

| Other Spending and Revenue | $225 | $140 | $150 | $155 |

| Total | $915 | $510 | $615 | $725 |

| Overall Multipliers | 0.56x | 0.67x | 0.79x | |

Totals may not sum due to rounding. CRFB calculations based on CBO data.

Importantly, this relief package will provide a tremendous boost to the economy, increasing expected output by about 1 percent over the next three years, the equivalent of 3 percent in 2021 alone (though not all of the effect will take place in the first year). Assuming a $600 billion output gap in 2021 – which represents our best estimate based on CBO's July projections and more recent economic data – the bill could be sufficient to cover the entire output gap. Over three years, it would close nearly half of our projected output gap.

Our output gap figures are based on recent CBO projections, though there are reasons to think both actual and potential GDP will be somewhat higher than these estimates (the net effect on the output gap is unclear). We discuss our methodology in full at the bottom of our recent piece, Could a COVID Relief Deal Close the Output Gap?

As we receive more information on the package, we will update this analysis and provide additional analysis. We will also update our COVID Money Tracker.

To date Congress has enacted the equivalent of $3.4 trillion of net COVID relief, much of which has already been spent (see more at www.COVIDMoneyTracker.org). The year-end relief bill is appropriately targeted, of sufficient scale to have a noticeable impact on GDP, and will help close the current output gap. We will track all of the disbursements from this latest bill as part of COVID Money Tracker, as we have continued to do since the Spring.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

This blog was updated on 12/22, 1/4, and 1/21 to include additional details available in the legislative text, JCT and CBO estimates, as well as the fact that the bill was signed by the President.