Senate Tax Bill Could Ultimately Cost Up to $2 Trillion

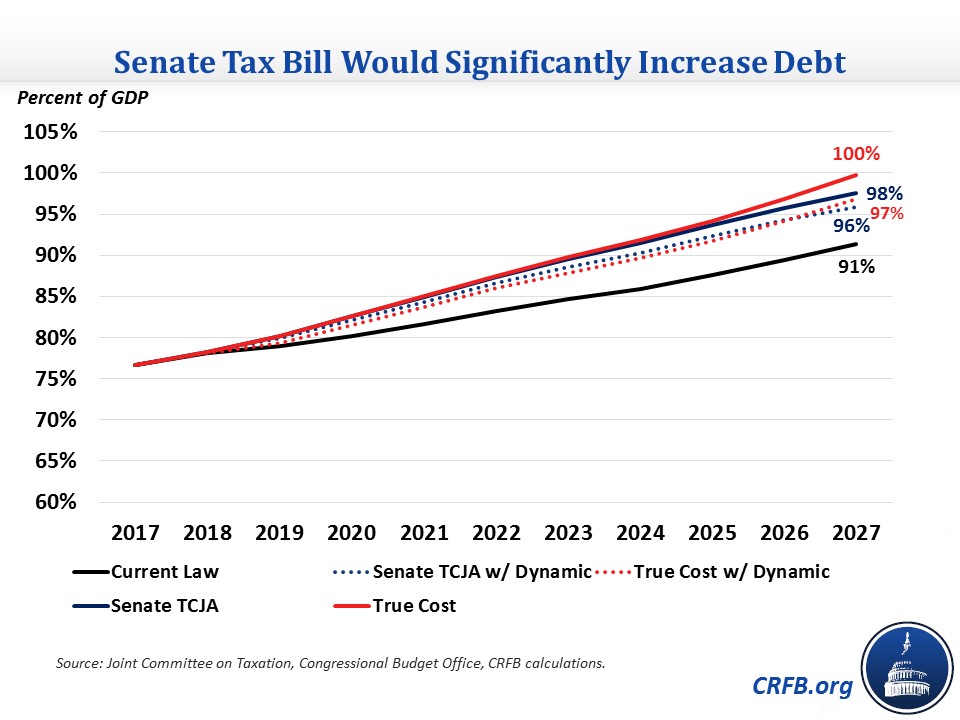

The final Senate version of the Tax Cuts and Jobs Act (TCJA) would cost $1.45 trillion under conventional scoring and over $1 trillion on a dynamic basis, leading debt to rise to between 96 percent and 98 percent of Gross Domestic Product (GDP) by 2027 (compared to 91 percent under current law). However, the bill also includes a number of expirations and late-stage tax hikes meant to reduce the official cost of the bill. These expirations hide $500 billion to $600 billion of potential further costs, which could ultimately increase the cost of the bill to as much as $2 trillion (before interest) on a conventional basis or roughly $1.6 trillion on a dynamic basis. As a result, debt would rise to between 97 percent and 100 percent of GDP by 2027.

This estimate updates our tally of the gimmicks from a previous version of the bill. The changes made last Friday include both tax increases and decreases, with a net decrease increasing the ten-year cost by $34 billion. The largest new revenue increases include reinstating the individual Alternative Minimum Tax (AMT) at a higher income threshold ($133 billion), increasing the deemed repatriation tax to rates higher than the House bill ($97 billion), and reinstating the corporate AMT ($40 billion). The largest tax cuts include allowing $10,000 of property taxes to be deducted ($148 billion), increasing the deduction for pass-through income ($114 billion), and more gradually phasing out full expensing ($34 billion). With these changes, the bill would now have a total cost of $1.45 trillion, or roughly $1.75 trillion with interest. While there is no new dynamic score of the bill, assuming it continues to produce roughly $400 billion of dynamic feedback would reduce that cost to about $1.05 trillion, or roughly $1.25 trillion with interest.

Changes to Senate Tax Cuts and Jobs Act

| Policy | Ten-Year Cost/Savings (-) |

|---|---|

| Committee-Passed Senate TCJA | $1.41 trillion |

| Allow property tax deduction up to $10,000 (committee version included full repeal of SALT deduction) | $148 billion |

| Increase pass-through deduction to 23% (from 17.4% in committee version) | $114 billion |

| Gradually phase down 100% bonus depreciation after 2022 (committee version proposed immediate sunset) | $34 billion |

| Reinstate AMT with higher exemption threshold (repealed in committee version) | -$133 billion |

| Increase deemed repatriation tax to ~7.5%/~14.5% (5%/10% in committee version) | -$97 billion |

| Reinstate corporate AMT (repealed in committee version) | -$40 billion |

| Other adjustments | $8 billion |

| Senate-Passed TCJA | $1.45 trillion |

| Dynamic Effects | ~ -$400 billion |

| TCJA with Dynamic Effects | ~$1.05 trillion |

| TCJA with Interest | ~$1.75 trillion |

| TCJA with Interest and Dynamic Effects | ~$1.25 trillion |

Source: Joint Committee on Taxation and CRFB calculations.

However, this cost does not account for as much as $585 billion of potential gimmicks that the Senate bill contains.

In the committee-passed version of the Senate bill, we identified $515 billion of arbitrary sunsets and sunrises. Most significantly, nearly all the individual income tax provisions expired after 2025. Additionally, the expensing provisions ("bonus depreciation") expired in 2022 and a number of new tax increases appeared in 2026.

The Senate-passed bill adds to these gimmicks. First, it would increase the cost of expiring individual provisions by expanding the tax deduction for pass-through businesses and retaining part of the state and local tax deduction (SALT). Second, it would temporarily reduce the percent of income floor for the medical expense deduction from 10 percent to 7.5 percent (last year, it was 7.5 percent only for those at age 65 or older), but it would only do so for 2017 and 2018 – clearly setting the stage for further extensions.

On the other hand, the Senate-passed bill would reduce one gimmick from the committee-passed bill thanks to a proposal from Senator Jeff Flake (R-AZ). Rather than expanding expensing ("100 percent bonus deprecation") through 2022 and then allowing it to expire, the Senate-passed bill would phase out bonus depreciation over the subsequent five years (from 100 percent in 2022 to 80 percent in 2023, 60% percent in 2024, and so on). By turning the cliff into a more gradual phase-down, this change reduces the likelihood that lawmakers will enact a costly extension of expensing in 2023; it also reduces the additional cost if they do choose to extend it.

Adding these gimmicks to the cost of the bill would increase the total cost to roughly $2 trillion or perhaps more. Though the dynamic effect of making the bill permanent is unknown, we estimate a permanent bill would produce roughly $450 billion of feedback,* leading to a dynamic cost of very roughly $1.6 trillion. With interest, these costs would rise to $1.8 trillion to $2.3 trillion over a decade.

True Cost of Senate Bill

| Policy | Ten-Year Cost |

|---|---|

| Senate-Passed TCJA as written | $1.45 trillion |

| Sunsetting individual tax provisions after 2025 | $290 billion to 300 billion* |

| Amortizing Research & Experimentation (R&E) expenses after 2025 | $60 billion |

| Making foreign tax provisions more strict after 2025 | $55 billion |

| Sunsetting more generous medical expense deduction after 2018 | $40 billion |

| Phase out of full expensing after 2022 | $0 to 80 billion |

| All other sunsets/backloading | $45 billion |

| Conventional "Real" Cost | ~$2 trillion |

| Potential Dynamic Feedback Effects | -$450 billion* |

| Dynamic "Real Cost" | $1.6 trillion |

| True Cost with Interest | ~$2.3 trillion |

| True Cost with Interest and Dynamic Effects | ~$1.8 trillion |

Source: CRFB calculations based on Joint Committee on Taxation.

*Reflects extending the lowering of the eligibility age for the child tax credit past 2025 on the low end and repealing the age change in 2025 on the high end.

As is, the bill would cause debt to increase from 77 percent of GDP this year to 96 percent or 98 percent of GDP by 2027, depending on whether dynamic effects are included, as compared to the 91 percent projected under current law. If expiring provisions are extended and late-stage tax hikes avoided, debt could reach as high as 97 percent or 100 percent of GDP by 2027. In other words, the national debt could exceed the size of the economy.

Adding $1 trillion to $1.5 trillion to the debt at a time when debt is already at a post-war record high is no way to manage a responsible budget. Setting the stage for an additional half a trillion of future deficit increases would be even worse. In conference, the House and Senate should remove these gimmicks and then work to reduce, or preferably eliminate, the bill's cost.

*JCT estimated the Finance Committee-passed tax bill would generate $407 billion of dynamic feedback, and we believe the Senate-passed bill would generate a similar amount. Making the legislation permanent could produce more or less dynamic feedback. On the one hand, permanent individual reforms will improve labor force incentives in 2026 and 2027 and will improve investment incentives for “pass-through” businesses throughout the budget window. On the other hand, higher debt might increase interest rates and slow growth. Continued expensing beyond 2022 would increase investment late in the decade but might actually reduce investment early in the decade. On net, we believe the result of these and other factors would be more growth and dynamic feedback over ten years but less (and possibly negative) growth over the long run. As a simplifying assumption, we assume the feedback in 2025 continues through 2027 and thus generates $450 billion of net feedback. Actual numbers could differ.