President Trump’s $4 Trillion Debt Increase

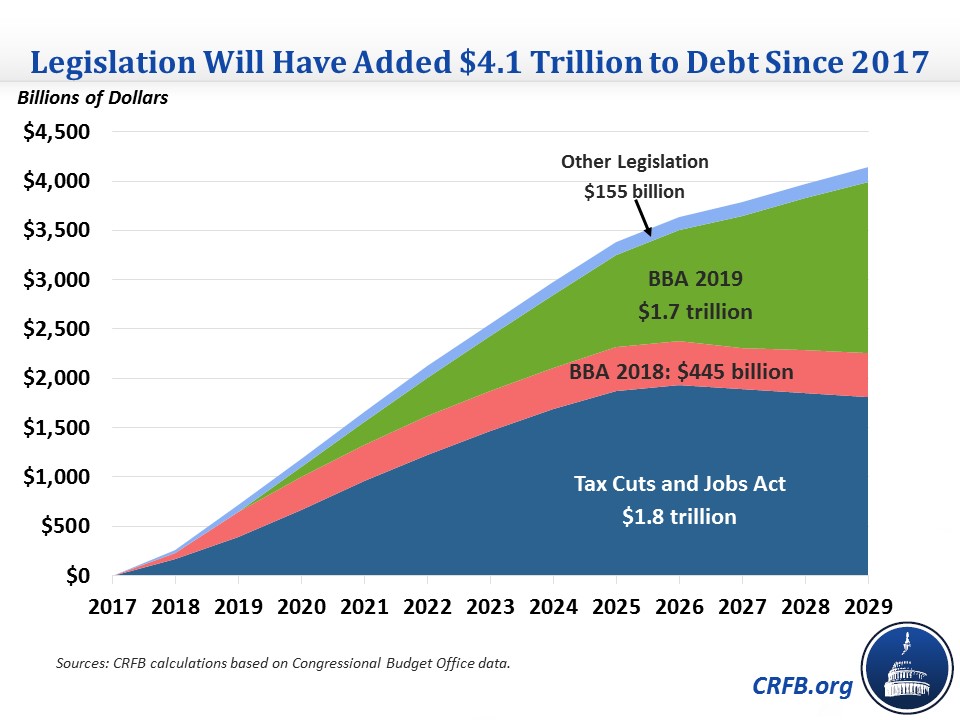

If the recent budget deal is signed into law, it will be the third major piece of deficit-financed legislation in President Trump's term. In total, we estimate legislation signed by the President will have added $4.1 trillion to the debt between 2017 and 2029. Over a traditional ten-year budget window, the President will have added $3.4 to $3.8 trillion to the debt. The source of the debt expansion is split relatively evenly between tax and spending policy.

The Tax Cuts and Jobs Act (TCJA) was the single largest contributor to the $4.1 trillion figure, increasing debt by $1.8 trillion through 2029 (more than the entire cost is through 2027). This number could easily climb higher if lawmakers extend the individual tax cuts that are set to expire after 2025, which would add another $1 trillion to the debt.

The Bipartisan Budget Act (BBA) of 2018 was nearly as costly on an annual basis, adding nearly $450 billion to the debt due to its two-year nature. However, the Bipartisan Budget Act of 2019 would effectively make the increases in the BBA 2018 permanent, and in doing so, add another $1.7 trillion to the debt through 2029.

Smaller pieces of legislation are responsible for nearly $150 billion of debt. This includes several different bills containing disaster relief or emergency spending and continued delays of three Affordable Care Act (ACA) taxes, among other bills.

This analysis does not include the fiscal impact of many executive actions taken by the President, some which would increase deficits and others which would reduce them. It also assumes that temporary policies expire as scheduled.

If we evaluate the debt added over the standard ten-year window the Congressional Budget Office (CBO) uses, the numbers are similar but slightly smaller. Using the ten-year period (2018-2027) employed in 2017, lawmakers have added $3.8 trillion to deficits. Using the current ten-year period of 2020-2029, the debt increase is $3.4 trillion. Debt added is lower in the later period because some of the laws, like the TCJA and 2018 BBA, had larger short-term, rather than long-term, costs.

Debt Added Since 2017 Over Different Periods

| Legislation | 2018-2027 Cost | 2020-2029 Cost | 2017-2029 Cost |

|---|---|---|---|

| Tax Cuts and Jobs Act | $1.9 trillion | $1.4 trillion | $1.8 trillion |

| Bipartisan Budget Act of 2019 | $1.3 trillion | $1.7 trillion | $1.7 trillion |

| Bipartisan Budget Act of 2018 | $420 billion | $190 billion | $445 billion |

| Other Legislation | $140 billion | $90 billion | $155 billion |

| Total | $3.8 trillion | $3.4 trillion | $4.1 trillion |

Source: CRFB calculations based on Congressional Budget Office data.

Importantly, the $4.1 trillion of debt signed into law by President Trump is on top of the $16.2 trillion we already owe and the $9.8 trillion we were projected to borrow over the next decade absent these proposals. It would bring debt to about 97 percent of Gross Domestic Product (GDP) in 2029, compared to 84 percent if no debt-increasing legislation had been passed.

To avoid the huge run-up in debt that is projected in the coming decades, lawmakers should reject unpaid-for spending increases, pay for the tax bill, and address the rising costs and looming insolvency of our nation’s largest health and retirement programs.