An Overview of the President's FY 2020 Budget

Moments ago, President Trump released his Fiscal Year (FY) 2020 budget proposals, outlining his tax and spending proposals for the next decade.

We will be publishing our full analysis of the President's FY 2020 budget later today, but this blog gives a brief overview of the budget and its contents. Stay tuned to CRFB and The Bottom Line throughout the day and the rest of the week as we take closer looks at all aspects of the budget.

The Budget Claims Substantial Deficit Reduction

The policies called for in the President's budget would reduce deficits by $2.8 trillion relative to its own baseline, the result of $1.1 trillion of new spending and tax cuts and $3.9 trillion of deficit reduction (mostly on the spending side). As a result of the claimed deficit reduction and economic growth in the budget, debt as a share of the economy would fall from 78 percent Gross Domestic Product (GDP) today to 71 percent by 2029. By comparison, debt would remain at about 80 percent of GDP under the Office of Management and Budget's (OMB) baseline (incorporating generous economic growth assumptions).

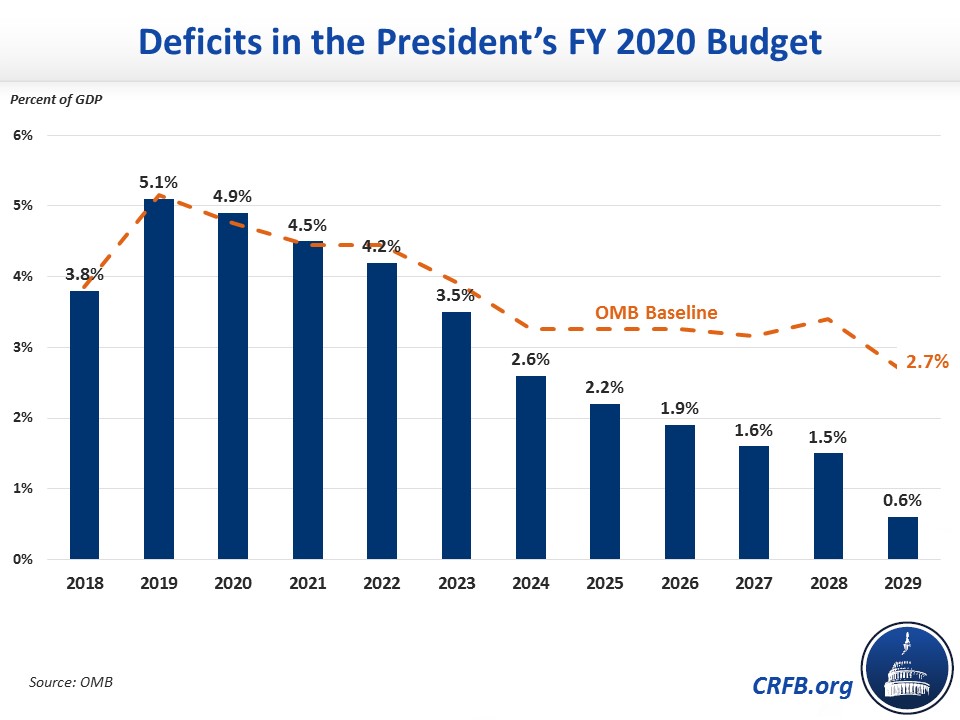

Deficits would also ultimately decline under the President's budget – though not disappear. Under the President's budget's estimates, deficits would peak at 5.1 percent of GDP in 2019 and then fall gradually to 0.6 percent of GDP by 2029. By comparison, baseline deficits would fall to 2.7 percent of GDP – again, driven by extremely generous economic growth assumptions.

The Budget Includes Significant Spending Cuts, Along with Spending Increases and At Least One Major Budget Gimmick

The budget calls for significant reductions in spending, the largest source being $1.1 trillion of cuts to non-defense discretionary spending. The budget also proposes about $660 billion in savings from repealing and replacing the Affordable Care Act (ACA or "Obamacare"); $645 billion in other health care savings (mostly Medicare reforms); $330 billion from reductions in and reforms to safety net programs; $205 billion in higher education reforms; and over $100 billion from modifying health and retirement benefits for federal employees.

Indeed, the budget renews and actually builds upon a number of thoughtful spending reforms that we praised last year. The focus on controlling Medicare costs is especially important, with policies focused on slowing cost growth for beneficiaries as well as the taxpayer. Ideas to reform disability programs, student loans, and other program are also worthy of consideration.

On the other hand, many of the spending cuts are unrealistic. For example, the budget assumes non-defense discretionary spending will fall 9 percent between 2019 and 2020, and 26 percent by the end of the decade - despite inflation increasing overall prices by 26 percent. Lawmakers are far more likely to consider a deal to extend the high discretionary spending levels set by last year's Bipartisan Budget Act of 2018 – though we would urge them to set responsible and realistic discretionary spending levels.

The budget also calls for a number of spending increases, including about $1 trillion in defense spending through increases to Overseas Contingency Operations funds and base defense spending after 2021, as well as $200 billion of infrastructure and a variety of other initiatives. Using the OCO designation to increase non-war defense funding while avoiding raising discretionary spending caps is a blatant gimmick and effectively reneges on previous promises to move away from this practice.

In addition, the budget calls for extending the individual income tax reforms from the Tax Cuts and Jobs Act (TCJA) beyond their December 2025 expiration – and assumes that $1.1 trillion cost in its baseline.

Adjusted for timing shifts, outlays would rise from 20.3 percent of GDP in 2018 to 21.3 percent in 2019 before falling to 18.7 percent in 2029. Revenue would dip from 16.5 percent in 2018 to 16.1 percent in 2019 as the TCJA takes full effect before rising to 18.1 percent by 2029.

The Key Numbers in the President's Budget (Adjusted for Timing Shifts)

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | Ten-Year | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | |||||||||||||

| % of GDP | 16.5% | 16.1% | 16.3% | 16.5% | 16.7% | 17.0% | 17.4% | 17.6% | 17.7% | 17.8% | 17.9% | 18.1% | 17.3% |

| Outlays | |||||||||||||

| % of GDP | 20.3% | 21.3% | 21.2% | 21.0% | 20.9% | 20.5% | 20.0% | 19.8% | 19.6% | 19.4% | 19.5% | 18.7% | 20.0% |

| Deficit | |||||||||||||

| $ (billions) | $779 | $1,092 | $1,101 | $1,068 | $1,049 | $909 | $700 | $631 | $577 | $513 | $508 | $202 | $7,259 |

| % of GDP | 3.8% | 5.1% | 4.9% | 4.5% | 4.2% | 3.5% | 2.6% | 2.2% | 1.9% | 1.6% | 1.5% | 0.6% | 2.6% |

| Debt Held by the Public | |||||||||||||

| $ (trillions) | $15.75 | $16.92 | $18.09 | $19.22 | $20.33 | $21.30 | $22.06 | $22.76 | $23.39 | $23.96 | $24.52 | $24.77 | N/A |

| % of GDP | 77.8% | 79.5% | 80.7% | 81.6% | 82.1% | 81.9% | 80.7% | 79.3% | 77.7% | 75.9% | 74.0% | 71.3% | N/A |

The Budget Relies on Overly Optimistic Economic Assumptions

Unfortunately, like the previous two years, the budget relies on some extremely rosy economic assumptions and budget gimmicks that inflate its savings and distract from its actual policy reforms. The budget assumes real GDP growth will average around 3 percent over the next decade. This is substantially higher than estimates from other mainstream economic forecasters – who project growth rates closer to 2 percent per year over the next decade.

Absent these rapid growth assumptions, debt under the President's budget would likely be about $2 trillion higher by 2029. And debt as a share of GDP would reach roughly 85 to 90 percent.

A realistic assessment of the President's budget is unlikely to show anywhere close to the deficit reduction needed to put the debt on a sustainable path.

***

We will publish a more detailed analysis of the President’s FY 2020 budget later today and over the course of the week. Our analyses of past budgets can be found here.