A July Update on the Paycheck Protection Program

The Treasury Department and Small Business Administration (SBA) this week released the names of over 650,000 businesses who received forgivable Paycheck Protection Program (PPP) loans over $150,000 as well as new details on the 4.9 million loans processed to date. In total, PPP has issued about $521 billion in forgivable loans, at least $38.5 billion of which have been canceled or returned, leaving $132 billion of funding still available. Though the original June 30 application deadline has passed, lawmakers recently extended the application deadline until August 8. In this piece, we show how that money has been spent so far. You can read more about the Paycheck Projection Program here.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

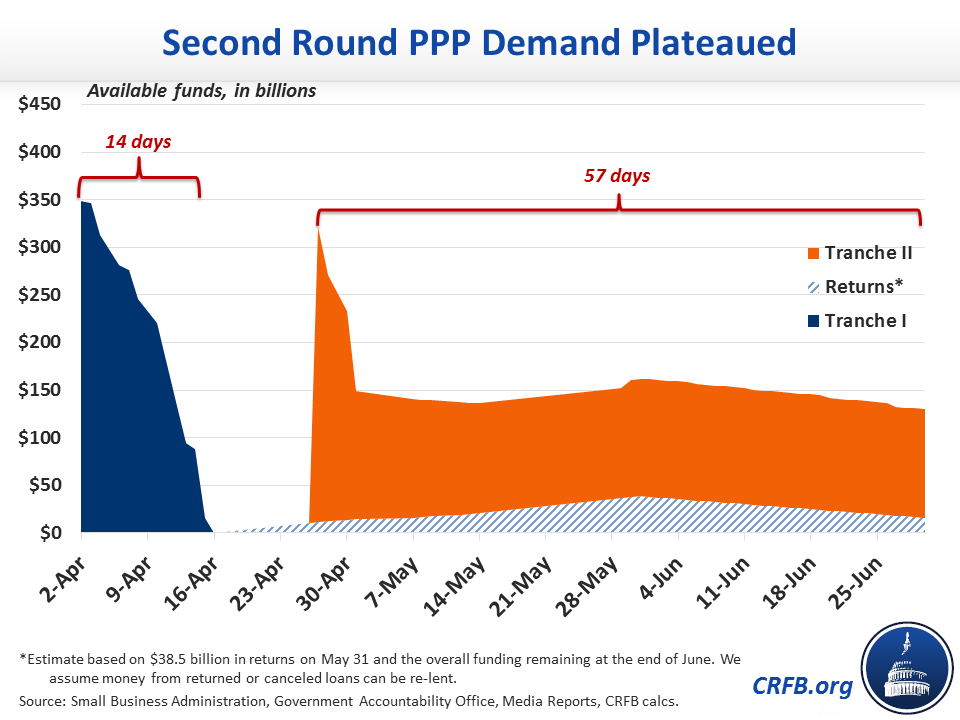

So far, the PPP program has disbursed $521 billion in loan dollars out of its $670 billion appropriation. That includes the entire $349 billion of original funding that quickly ran out, and over 50 percent of the $321 billion in additional funding authorized under the Paycheck Protection Program and Health Care Enhancement Act, with about $40 billion in loans returned or canceled.

The June 30 wrap-up PPP report details loans approved (and not canceled or returned) during both the first and second tranche of PPP applications, showing an average loan size of approximately $107,000. More than a quarter of the money and 86 percent of the loans were for less than $150,000 — meaning they went to entities that generally had less than $720,000 in annual payroll. Another 38 percent of the dollars and 12 percent of the loans were for between $150,000 and $1 million — entities with less than $4.8 million of annual payroll. Loans between $1 and $5 million represented less than two percent of the overall loan count and over one fourth of the net dollars. Only 4,840 loans were between $5 and $10 million — for entities with $24 to $48 million of annual payroll — representing 0.1 percent of the loans and 6.5 percent of the net dollars approved.

All participating businesses and entities who took loans over $150,000 are listed on the SBA website. Users can browse by state to see loans in their area. Not surprisingly, the largest amount of money went to California, Texas, and New York, the three most populous states.

SBA also breaks down loans by congressional district. New York’s 10th congressional district came out on top, with companies in the district receiving over $5.7 billion in support. The district covers the lower west side of Manhattan and part of Brooklyn, thus the amount of support given the business density in these areas is unsurprising. The other top congressional districts include Texas’ 2nd district ($4.1 billion), which encompasses northern and western Houston; New York’s 7th ($3.9 billion) and 12th districts ($3.7 billion), which cover parts of Queens, Brooklyn, and Manhattan; and Colorado’s 1st district ($3.7 billion), which covers the metro Denver area.

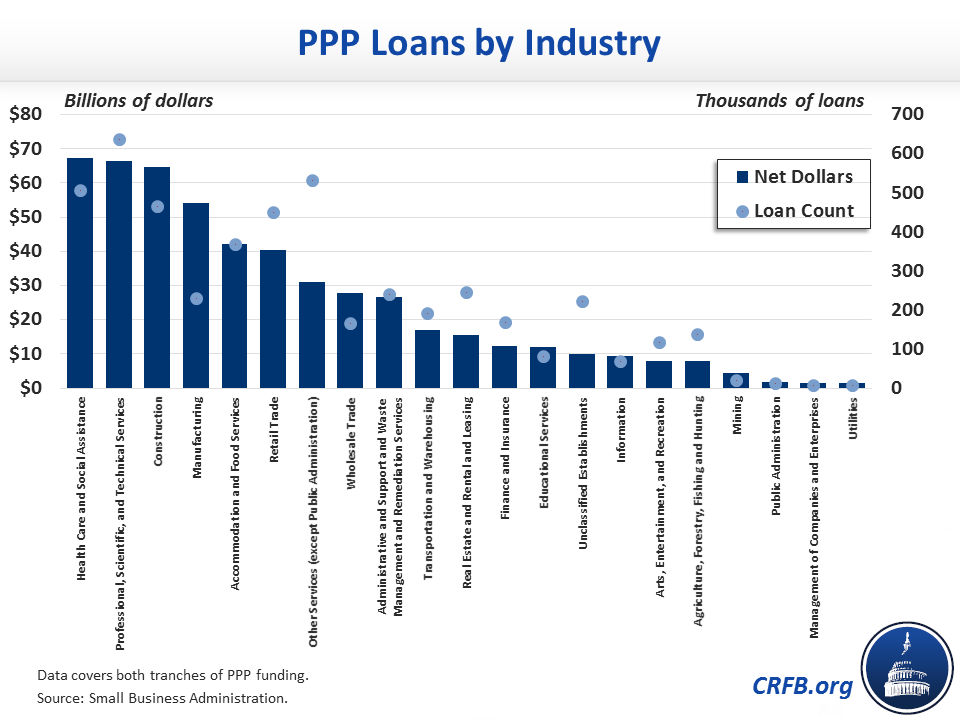

Another helpful way to look at the loans is by industry. Health Care and Social Assistance companies received the most in terms of net dollars — over $67 billion or 13 percent of the total amount of forgivable loans approved. Professional, Scientific, and Technical Services companies received the most in terms of number of loans, with companies in this industry receiving nearly 640,000 loans. Companies in five industries — Health Care and Social Assistance; Professional, Scientific, and Technical Services; Construction; Manufacturing; and Accommodation and Food Services — received over 56 percent of the net dollars, and 45 percent of the total loans approved so far.

Though the Paycheck Protection Program is funded by the Treasury and supported in part by the Federal Reserve, the forgivable loans were provided through banks and other private financial entities who have collected billions of dollars in fees for their services. Most of the top lenders (by net dollars approved) processing SBA loans were some of the largest banks in the country such as JPMorgan Chase, Bank of America, Truist Bank, and PNC Bank. There were some noticeable mid-size and smaller lenders in the top ten such as Zions Bank and Cross River Bank. The top ten lenders originated around 30 percent of total loans and loan dollars.

| Lender Name | Loan Count | Net Dollars Lent | Average Forgivable Loan Size |

|---|---|---|---|

| JPMorgan Chase Bank | 269,424 | $29,066,127,405 | $107,882 |

| Bank of America | 334,761 | $25,203,076,316 | $75,287 |

| Truist Bank | 78,669 | $13,075,965,877 | $166,215 |

| PNC Bank | 72,908 | $13,038,347,212 | $178,833 |

| Wells Fargo Bank | 185,598 | $10,470,396,296 | $56,414 |

| TD Bank | 82,773 | $8,468,624,019 | $102,311 |

| KeyBank | 41,487 | $8,138,794,697 | $196,177 |

| U.S. Bank | 101,377 | $7,444,906,047 | $73,438 |

| Zions Bank | 46,707 | $6,941,735,934 | $148,623 |

| M&T Bank | 34,680 | $6,791,223,167 | $195,825 |

| Huntington Bank | 37,122 | $6,528,043,675 | $175,854 |

| Fifth Third Bank | 38,197 | $5,434,319,532 | $142,271 |

| Cross River Bank | 134,472 | $5,361,597,126 | $39,871 |

| Citizens Bank | 49,670 | $5,007,022,864 | $100,806 |

| BMO Harris Bank | 21,362 | $4,815,533,089 | $225,425 |

| Others | 3,356,181 | $365,698,104,500 | $108,963 |

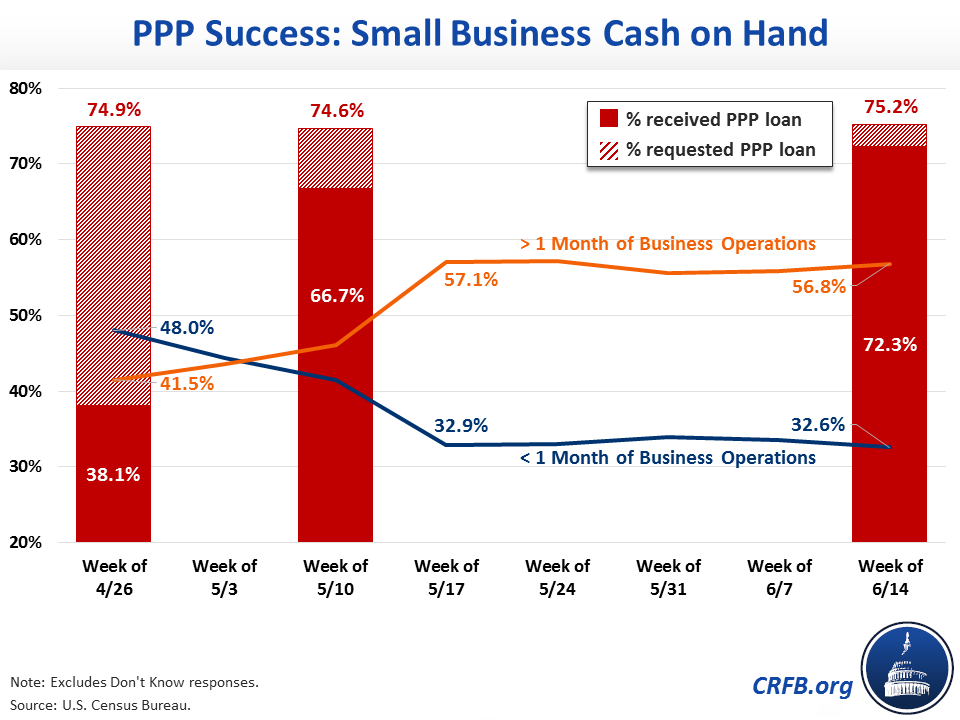

According to the Census Bureau’s Small Business Pulse survey, 75 percent of small businesses have applied for a PPP loan and this has held steady since the end of April. Only about half of applicants had received the loan by the end of April, but over 90 percent did by the week ending May 16 and 96 percent have as of mid-June. The increase in PPP loan receipts coincides with an increase in small business cash on hand, with the percentage of businesses claiming they have greater than one month’s cash on hand rising from 41.5 percent in late-April to 57 percent by mid-May and remaining relatively steady since then.

We will continue to report on PPP loans and other COVID-related federal disbursements as part of our COVID Money Tracker project. Our forthcoming interactive database will allow users to search and view every large beneficiary of the PPP.