Debt Could Reach Record Levels by 2030

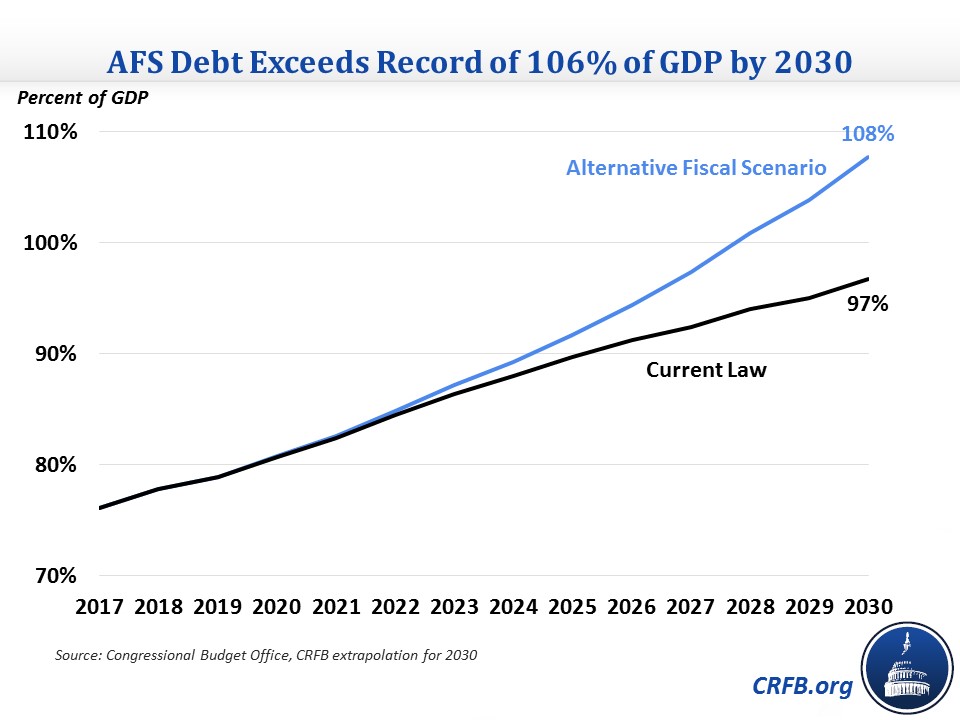

The Congressional Budget Office's (CBO) latest budget projections point to high and rising debt under current law, but the situation is far worse if lawmakers continue current policies as in CBO's recently released Alternative Fiscal Scenario (AFS). Under the AFS, deficits would pass the trillion-dollar mark by next year and exceed $2 trillion by 2028, while debt as a share of Gross Domestic Product (GDP) would reach a new record level by 2030.

CBO's AFS starts with current law assumptions, but it assumes various expiring tax policies are extended and discretionary spending continues to grow at the rate of the economy.

Under current law, various "tax extenders" expired at the end of 2017, more will expire after this year and by 2021, many of the tax cuts in the 2017 Tax Cuts and Jobs Act will expire after 2025, and a number of regularly-delayed taxes from the Affordable Care Act will take effect. CBO's AFS instead assumes the policies in effect today (or in some cases, in 2017) are generally extended, which would cost $1.7 trillion over ten years.

Bridge From Current Law to Alternative Fiscal Scenario

| 2020-2029 Deficit Increase | |

|---|---|

| Current Law Deficits | $12.2 trillion |

| Extend 2017 tax law's individual tax cuts | $974 billion |

| Grow discretionary spending with GDP instead of inflation | $827 billion |

| Extend delays of health care taxes | $387 billion |

| Extend 100% bonus depreciation from 2017 tax law | $179 billion |

| Extend expired or expiring "tax extenders" | $159 billion |

| Interest cost | $190 billion |

| Alternative Fiscal Scenario Deficits | $14.9 trillion |

| Memo: Total deficit increase from Alternative Fiscal Scenario | $2.7 trillion |

Source: Congressional Budget Office.

On the spending side, CBO's current law baseline and AFS assume the recent $160 billion per year discretionary spending hike will increase spending beyond 2021, when the spending caps expire. Under current law, discretionary spending is assumed to grow with inflation after 2021, leading the spending deal to cost $1.7 trillion. Under their AFS, CBO instead assumes that spending will grow with the economy after 2021, adding another $830 billion to the debt.

The $2.7 trillion cost of these changes means higher deficits and debt than under current law.

Under the AFS, budget deficits would increase from $960 billion (4.5 percent of GDP) this year to $2.2 trillion (7 percent of GDP) by 2029, compared to $1.5 trillion (4.8 percent of GDP) under current law. Spending would rise from 20.8 percent of GDP in 2019 to 23.9 percent in 2029, compared to 23 percent under current law, while revenue would rise slightly from 16.3 percent of GDP in 2019 to 16.9 percent in 2024 before flattening at around that level.

Fiscal Metrics in CBO's Alternative Fiscal Scenario (Percent of GDP)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Spending | |||||||||||

| Current Law | 20.8% | 21.0% | 21.1% | 21.4% | 21.7% | 22.0% | 22.1% | 22.4% | 22.6% | 22.8% | 23.0% |

| AFS | 20.8% | 21.0% | 21.1% | 21.4% | 21.9% | 22.2% | 22.5% | 22.9% | 23.3% | 23.6% | 23.9% |

| Revenue | |||||||||||

| Current Law | 16.3% | 16.4% | 16.6% | 16.7% | 16.9% | 17.2% | 17.3% | 17.8% | 18.2% | 18.1% | 18.2% |

| AFS | 16.3% | 16.4% | 16.5% | 16.6% | 16.7% | 16.9% | 16.9% | 17.1% | 16.9% | 16.8% | 16.9% |

| Deficits | |||||||||||

| Current Law | 4.5% | 4.6% | 4.5% | 4.6% | 4.8% | 4.8% | 4.8% | 4.6% | 4.4% | 4.7% | 4.8% |

| AFS | 4.5% | 4.7% | 4.6% | 4.8% | 5.2% | 5.3% | 5.6% | 5.8% | 6.3% | 6.8% | 7.0% |

Source: Congressional Budget Office.

Numbers are adjusted for timing shifts that artificially increase or reduce deficits in certain years.

Debt would rise from 79 percent of GDP this year to exceed the size of the economy in 2028 and reach 104 percent in 2029, compared to 95 percent under current law. In 2030, debt would almost certainly exceed the prior record of 106 percent of GDP set in 1946 just after World War II.

Both CBO's current law and AFS projections show debt rising continuously as a share of GDP, but the AFS shows debt reaching unprecedented levels much sooner. Lawmakers need to ensure that they don't add to debt by extending temporary policies without offsets and then get to work on bringing debt on a downward sustainable path as a share of the economy.