Can Economic Growth Save Social Security?

When asked whether they would support raising the Social Security retirement age to avert insolvency during last Wednesday’s Republican presidential primary debate, three presidential candidates said they would instead rely on faster economic growth.

Former United Nations Ambassador Nikki Haley and former New Jersey Governor Chris Christie argued for raising the retirement age for younger workers and rightly explained the need for policy changes to prevent Social Security insolvency. However, Florida Governor Ron DeSantis, businessman Vivek Ramaswamy, and South Carolina Senator Tim Scott (who has since suspended his campaign) resorted to an old budget myth that we can grow our way out of the problem by boosting real Gross Domestic Product (GDP) growth to between 3 and 5 percent per year.

In this piece, we explain that:

- No achievable improvement in economic growth will prevent Social Security insolvency.

- The U.S. economy is highly unlikely to grow by 3 to 5 percent per year on a sustained basis.

- As part of a comprehensive reform package, raising the retirement age can meaningfully improve Social Security’s finances and accelerate economic growth.

| US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office. |

Faster Economic Growth Cannot Save Social Security

The Social Security retirement trust fund is only about ten years from insolvency, at which point the law calls for an effective 23 percent across-the-board benefit cut – a $17,400 cut in annual benefits for a typical couple retiring in 2033.

To address this looming insolvency, DeSantis, Ramaswamy, and Scott all focused on growing the U.S. economy faster in order to bring more revenue into the trust fund. Although faster growth would certainly be desirable – both for Social Security and for households more broadly – it would not meaningfully extend the life of the Social Security trust fund or prevent imminent exhaustion.

Higher economic growth likely would strengthen Social Security’s finances by increasing wages and therefore payroll tax revenue. However, those same wage increases would result in higher benefit payments over time, as initial benefits are based upon wages and the benefit formula is indexed to wage growth. Furthermore, because the trust fund is only a decade from exhaustion and faces such a large shortfall, even a substantial boost in growth would only slightly delay trust fund depletion.

Indeed, the Social Security Trustees have estimated that a 50 percent increase in real wage growth would only delay Social Security’s insolvency date by one year.1 Specifically, they estimate the theoretically combined Social Security trust fund would deplete its reserves in 2034 assuming average wage growth 1.14 percent above the CPI-W inflation rate and in 2035 assuming average wage growth 1.74 percent above CPI-W inflation.

Candidates Are Calling for Unrealistic Economic Growth Rates

In addition to incorrectly suggesting that faster economic growth can restore Social Security solvency, several of the candidates in Wednesday's debate claimed they could achieve a pace of economic growth that ranges from extremely rosy to completely fantastical.

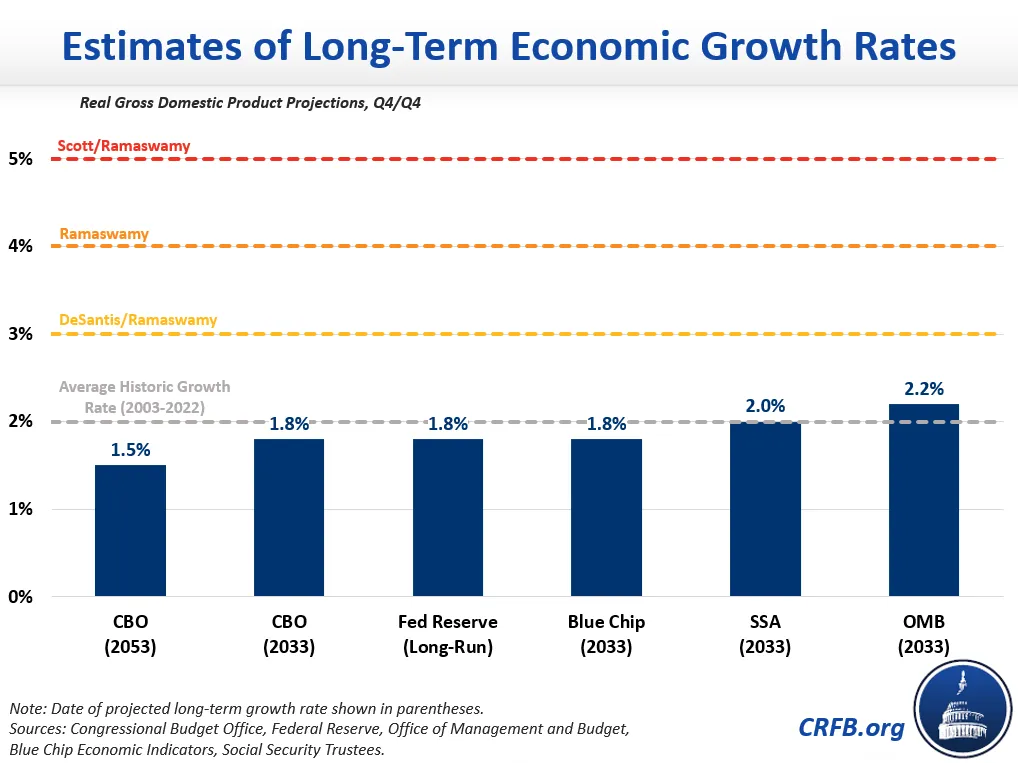

DeSantis called for “at least 3 percent” real (inflation-adjusted) economic growth, while Scott claimed his plan would result in 5 percent growth, and Ramaswamy suggested “3 percent, 4 percent, maybe even 5 percent” would be possible.

While aiming for these rates of economic growth is a noble goal, actually achieving and sustaining them is not realistic. Over the past two decades, the economy has grown by an average of 2.0 percent per year. Various public and private forecasters project future long-term growth of somewhere between 1.5 percent and 2.0 percent per year.2 In other words, the candidates are claiming they can increase economic growth by at least 50 percent and in some cases more than triple the average growth rate.

In our 2017 paper, How Fast Can America Grow?, we demonstrated that even achieving sustained 3 percent growth would require either record levels of productivity growth or levels of productivity, capital, and labor participation growth not seen since the 1990s and not easily replicable. Even enacting every available growth-improving policy in the political discourse would likely not be enough. The paper also concluded that “there is no plausible path to sustained 4 percent growth.”

To be sure, stronger economic growth is certainly a worthy policy goal that would improve Social Security’s finances, strengthen the nation’s fiscal outlook, and boost household income. Setting 3 percent growth as an aspirational target could result in meaningful policy improvements. However, lawmakers should not count on achieving 3 percent growth as an excuse to ignore Social Security’s looming insolvency and other economic and fiscal challenges.

Raising the Retirement Age Can Help Strengthen Social Security and Boost Growth

Rather than relying on faster economic growth to save Social Security, Christie and Haley both said they supported raising the retirement age for younger Americans who are still decades away from retirement.

While such a policy would likely take effect beyond 2033 and therefore not delay Social Security’s insolvency date, it could substantially reduce Social Security’s long-term imbalances. Each one-year increase in the normal retirement age would reduce Social Security’s structural deficit by about one-sixth once fully phased in. In other words, a three-year increase would ultimately close about half the gap.

Raising the retirement age would also boost economic growth by encouraging those who are able to delay their retirements to do so. Each one-year increase in the normal retirement age increases output by an estimated 50 basis points, based on data from the Congressional Budget Office.

To fully restore solvency, increases in the retirement age would need to be coupled with other revenue and/or spending changes. Both Christie and Haley mentioned reducing benefits for wealthy retirees, which could close a substantial share of Social Security’s funding gap, depending on design. Many other options are also available (design your own plan with our Social Security Reformer), and a combination of approaches will likely be needed.

Of course, stronger economic growth can be part of the solution, and Social Security reform itself can help promote that economic growth. But efforts to improve economic growth cannot come at the expense of concrete steps to improve Social Security solvency and do not serve as a valid excuse for ignoring its looming insolvency.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.

1 The Social Security Trustees measure “real wages” relative to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which understates the actual growth in wages since it overstates the true rate of inflation.

2 The President’s budget assumes 2.2 percent economic growth. However, this assumes the policies in the budget itself will meaningfully boost the economic growth rate.