Analysis of the 2023 Medicare Trustees' Report

The Trustees for the Social Security and Medicare programs have released their annual reports for 2023, updating the financial state of the programs’ trust funds. You can read our analysis of the Social Security Trustees’ report here.

According to the Trustees, the Medicare Part A Hospital Insurance trust fund will be insolvent in eight years, with a 75-year shortfall of 0.62 to 1.46 percent of payroll. Medicare spending as a whole, including Parts A, B, D, and Medicare Advantage, will continue to grow significantly over the coming decades.

Specifically, the Medicare Trustees find that:

- The Hospital Insurance (HI) Trust Fund Will be Insolvent in 8 Years. The Trustees project the HI trust fund will run out of reserves in 2031, when today’s 57-year-olds are first eligible for benefits and newest beneficiaries turn 73.

- The HI Trust Fund Faces a Large Shortfall. Trust fund spending will exceed revenue by $333 billion over the next decade; over 75 years, the Trustees project a shortfall of 0.62 percent of payroll, or 0.3 percent of Gross Domestic Product (GDP). It would take about a 21 percent (0.6 percentage point) increase in the payroll tax rate or a 13 percent spending cut to restore solvency.

- Total Medicare Spending Is Projected to Grow Rapidly. Gross Medicare spending is projected to grow from 3.7 percent of GDP in 2022 to 6.0 percent by 2046, and remain above that level thereafter.

- Medicare’s Financial Outlook Has Improved Since Last Year. The Trustees project the insolvency date will be delayed relative to last year’s estimate of 2028 and future Medicare costs will be lower. The improvements are largely the result of lower-than-expected costs in 2022, higher expected revenue, and Medicare Part D savings from the Inflation Reduction Act.

- Medicare’s Situation Could be Far Worse Than Official Projections. The Medicare Chief Actuary’s alternative scenario – which assumes lawmakers update provider payment formulas over time to ensure continued Medicare beneficiary access – finds total spending would grow to 8.3 percent of GDP in 2097 rather than 6.1 percent. The HI shortfall would be 1.46 percent of payroll instead of 0.62 percent under this scenario.

Despite near-term improvement, the Trustees show that rising health care costs will continue to grow substantially over the next 75 years. Health savings and trust fund solutions would improve the program, prevent any lapses to care, and improve the nation’s fiscal situation.

The Hospital Insurance Trust Fund Will Be Insolvent in 2031

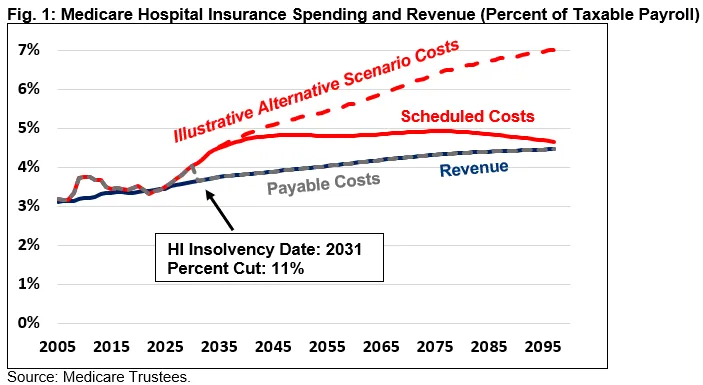

The Medicare Hospital Insurance (HI) trust fund finances Medicare benefits for inpatient hospital services with dedicated revenue from the Medicare payroll tax. Costs for this program are projected to exceed revenues in 2025, resulting in trust fund depletion by 2031. At that point, the law requires spending to be cut 11 percent to match revenue, with the cut growing to 19 percent by 2047. The result would likely be a disruption in health services.

Over the next decade, the Trustees project the HI trust fund will run deficits of $333 billion, with annual deficits rising to 0.54 percent of taxable payroll in 2032, peaking at 0.92 percent of payroll in 2045, and then slowly declining to 0.19 percent of payroll by 2097. Under the Chief Actuary’s alternative scenario (discussed later), the shortfall would grow to 2.55 percent of payroll.

Spending growth can be explained mainly by rising health care costs coupled with an aging population. HI costs have grown from 2.6 percent of payroll in 2000 to 3.4 percent of payroll in 2023. The Trustees project they will rise to 4.2 percent by 2032, 4.8 percent by 2045, and 4.9 percent by 2070. Beyond that, they will slowly decline to 4.7 percent by 2097. Meanwhile, revenue will grow from 3.4 percent in 2023 to 3.9 percent by 2045 and nearly 4.5 percent by 2097.

Restoring solvency to the HI trust fund over the next 75 years would require the equivalent of immediately raising the HI payroll tax by 21 percent (0.6 percentage points) or reducing spending by 13 percent. Under the Chief Actuary’s alternative scenario (discussed later), the shortfall and necessary adjustments would require immediately raising the HI payroll tax by 50 percent (1.5 percentage points) or reducing expenditures by 26 percent.

Total Medicare Spending Will Grow Significantly

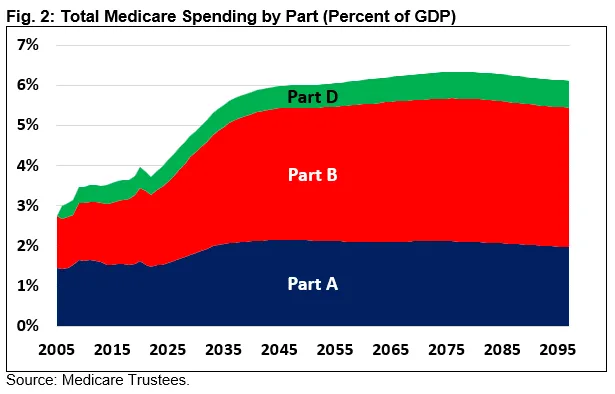

Gross Medicare spending has risen from 2.2 percent of GDP in 2000 to 3.9 percent of GDP in 2023 and will continue to grow under the Trustees’ projections. Specifically, the Trustees project costs will grow further to 5.5 percent in 2035 and 6.0 percent in 2050. Beyond 2050, cost growth will moderate to about the pace of GDP growth, with costs reaching a high of 6.3 percent in 2076 before gradually dipping to 6.1 percent in 2097.

Much of the growth in Medicare will come from the rising costs of Part B (outpatient benefits), which will rise from 1.9 percent of GDP in 2023 to 3.5 percent by 2097. Medicare Part A (Hospital Insurance) will grow from 1.5 percent of GDP in 2023 to a high of 2.2 percent in 2045 and then slowly decline to 2.0 percent by 2097; Medicare Part D (drug benefits) will rise from 0.5 percent in 2023 to 0.7 percent of GDP by 2097. Long-range projections of Part D are lower by 0.2 percent of GDP due to the projected impact of the Inflation Reduction Act (IRA).

The growth of Medicare expenditures is partly due to the rising cost of Medicare Advantage (MA), which only covered about a quarter of Medicare enrollees in 2010 but is slated to cover over half of Medicare enrollees by next year and 56 percent by 2032. MA spending will equal 1.7 percent of GDP in 2023 and is projected to reach 2.7 percent by 2032.

To address rising costs, policymakers could enact policies proposed by our Health Savers Initiative, such as equalizing payments regardless of site of service, reducing excessive Medicare Advantage payments, or reducing prescription drug costs. They could also consider a variety of other options to reduce Medicare costs, increase beneficiary contributions, or raise revenue to support the HI trust fund and other Medicare spending. It would be wise to pursue health savings and trust fund solutions sooner rather than later to help fight inflation, reduce deficits, and improve the financial state of these programs.

Medicare’s Financial Outlook Has Improved from Last Year

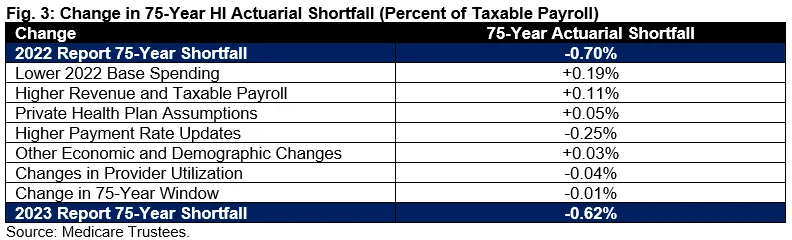

Medicare’s overall financial outlook has improved relative to last year’s Trustees report. In particular, the HI trust fund insolvency date is now three years later – 2031 as opposed to 2028 – and its 75-year shortfall is 0.62 percent of payroll instead of 0.70 percent. The Trustees also project lower future Medicare costs, with gross spending of 5.9 percent of GDP in 2040 and 6.1 percent in 2095, compared to 6.1 percent and 6.5 percent, respectively, in last year’s report. There are a variety of reasons for this improved outlook.

Looking at Medicare spending as a whole, the combination of lower actual spending in 2022, fewer expected beneficiaries as a result of COVID-19 deaths, and long-term prescription drug savings from the IRA will all tend to lower costs. Importantly, some of the Medicare savings from the IRA were used to finance spending and tax cuts in other parts of the budget not accounted for by the Trustees.

For the HI trust fund in particular, payroll tax receipts over the next decade are expected to be higher than projected last year, largely due to higher inflation, higher wages, and higher employment. Costs are also projected to be lower as a percent of payroll and GDP throughout the 75-year budget window, declining more significantly toward the end of the century.

From an actuarial perspective, the Trustees attribute the entire net improvement – 0.19 percent of payroll – to lower spending in 2022 relative to expectations. Increases in projected revenue collection and other economic and demographic changes explain an additional 0.14 percent of payroll improvement, and lower private plan spending assumptions decreased the projected shortfall by an additional 0.05 percent of payroll.

Offsetting much of this improvement, higher inflation and other factors led the Trustees to project increased provider payment updates (0.25 percent deterioration) and higher utilization of hospital care relative to post-acute care (0.04 percent net deterioration). The addition of 2097 into the projection window added a final 0.01 percent of payroll to the shortfall.

Medicare Would Grow More Costly in the Actuary’s Illustrative Alternative Scenario

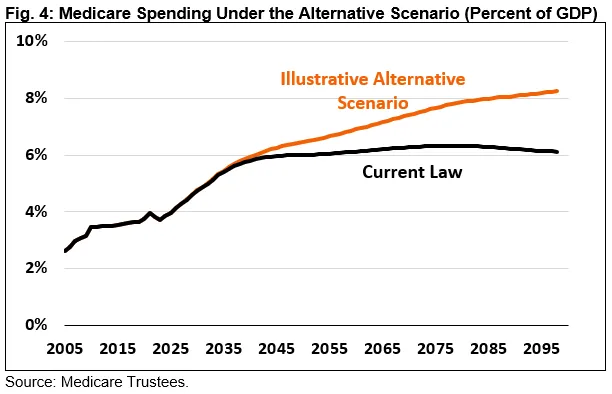

The Medicare Trustees’ estimates are based on current law, which assumes that laws governing payment rates remain unchanged. However, the Trustees raise questions about payment adequacy over the longer term, as both inpatient hospital payments and physician payments are scheduled to grow more slowly than underlying medical costs.

The Chief Actuary produces an illustrative alternative scenario that assumes the constraints under current law are gradually weakened and some currently scheduled physician bonus payments are continued over the long term. With these assumptions, payments would grow more slowly than the private sector for the next two decades but then grow at about the same rate after.

Under this scenario, spending would grow substantially higher than in the Trustees’ official forecasts, both for the HI trust fund and Medicare spending more broadly.

HI spending would rise from 1.5 percent of GDP in 2023 to 2.3 percent of GDP in 2050 and 3.0 percent by 2097 (instead of 2.1 percent in 2050 and 2.0 percent in 2097 under the official projections). As a result, the 75-year shortfall would total about 1.5 percent of payroll and 0.6 percent of GDP, almost 2.5 times as large as the official projections.

Medicare Part B spending would grow from 1.9 percent of GDP in 2023 to 3.6 percent in 2050 and to 4.6 percent in 2097 (compared to official projections of 3.3 percent and 3.5 percent, respectively).

As a result, total gross Medicare spending grows much faster over the very long term, rising from 3.9 percent of GDP in 2023 to 6.5 percent in 2050 and 8.3 percent in 2097. Under official projections, Medicare spending hovers between 6.0 and 6.3 percent of GDP between 2050 and 2097.

Conclusion

The Medicare Trustees’ report shows the HI trust fund will be insolvent in eight years and Medicare spending will rise rapidly as a share of GDP over the next quarter-century. Action is needed soon to constrain the rising costs of Medicare.

It is particularly imperative that lawmakers act sooner rather than later to secure the Medicare HI trust fund by increasing revenues, reducing costs, or some combination. If they do not act, Medicare payments from the trust fund would be abruptly and indiscriminately reduced or delayed, leading to a potential loss of access to care for enrollees.

Many options are available to secure and improve Medicare for future generations. In particular, there are a number of reforms that would lower costs overall without substantially reducing quality of care. Many of these policies have broad bipartisan support and could be enacted as part of upcoming budget discussions.

Our Trust Funds Solutions Initiative and Health Savers Initiative will continue to put forward and analyze existing and new ideas to reduce Medicare costs and bring new funding into the program. Along with the Social Security trust funds and the Highway Trust Fund, these three major trust funds are headed for insolvency in the next 11 years. Securing these trust funds would prevent abrupt across-the-board benefits cuts, assure a more sustainable debt path, promote faster economic growth, and help to achieve a number of important policy goals.

What's Next

-

Image

-

Image

-

Image