What’s In the House Budget Committee’s FY 2025 Budget Resolution?

The House Budget Committee (HBC) recently released, marked up, and approved its Fiscal Year (FY) 2025 budget resolution. In our press release, the Committee for a Responsible Federal Budget praised the HBC for introducing a budget – an important step in the budget process that is too often ignored – and in particular its focus on significant deficit reduction. We also raised some concerns about the assumptions in the budget.

The HBC’s budget, which is very similar to the one proposed for FY 2024, would achieve a budget surplus by 2034, based on its own estimates. Relative to current law, the budget claims to reduce projected deficits by $14.1 trillion – although that includes $3.0 trillion of claimed macroeconomic feedback and relies on some unspecified savings and offsets.

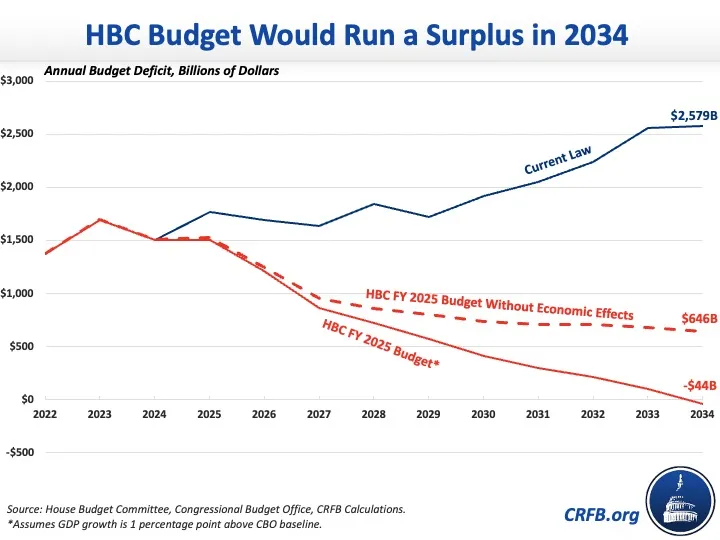

Specifically, the $1.5 trillion deficit in FY 2024 would gradually decline until it becomes a $44 billion surplus by 2034, under the budget, or a $646 billion deficit when claimed macroeconomic gains are excluded. By comparison, the deficit is projected to rise to $2.6 trillion by 2034 under current law.

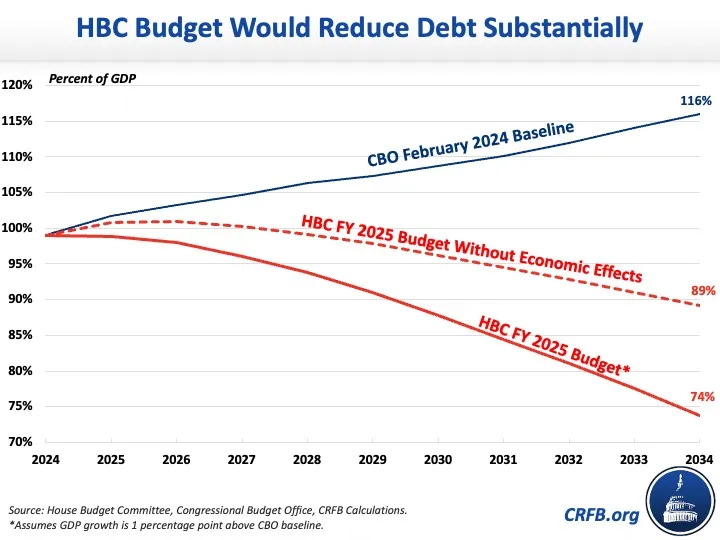

Debt under the budget would grow from $27.9 trillion at the end of FY 2024 to $34.1 trillion by the end of FY 2034 – compared to $48.3 trillion under current law. Based on our understanding of the budget’s economic assumptions, debt as a share of Gross Domestic Product (GDP) would fall from 99 percent at the end of 2024 to 75 percent by 2034 – compared to the Congressional Budget Office’s (CBO) baseline projection of 116 percent of GDP by the end of 2034 under current law. Removing the dynamic effects on GDP growth and macroeconomic feedback, debt would fall to 89 percent of GDP by the end of 2034 under the budget.

This deficit reduction would be achieved with $8.4 trillion of spending reductions, $2.7 trillion of interest savings, and $3.0 trillion of assumed macroeconomic feedback. The budget would save $2.5 trillion on the discretionary side by lowering spending levels by about 7 percent between FY 2025 and 2026 and then limiting growth to 1 percent per year, consistent with the proposed levels in the House-passed Limit, Save, Grow Act. On the mandatory side, the budget calls for nearly $6 trillion of savings, including $2.2 trillion from Medicaid, $1.6 trillion from unspecified government-wide savings, more than $960 billion from income security programs, nearly $500 billion from Medicare, more than $365 billion from education and training programs, $105 billion from commerce and housing programs, and $85 billion from general government programs.

While budget resolutions don’t dictate the specific policies to meet their targets, the HBC budget does suggest a number of specific reforms. This includes adopting site-neutral payments in Medicare; expanding work requirements for the Supplemental Nutrition Assistance Program, Medicaid, and Temporary Assistance for Needy Families recipients; extending discretionary spending caps; repealing President Biden’s student loan changes; repealing the Inflation Reduction Act’s clean energy subsidies; putting in place per-capita caps for Medicaid recipients; and equalizing payments to states for the Affordable Care Act expansion population, among other changes. The budget also calls for revenue-neutral, pro-growth tax reform, which the committee has said would include extending the 2017 tax cuts and other reforms (though the committee rejected an amendment to require its reserve fund for these extensions to be deficit-neutral). (See our Build Your Own Tax Extensions Tool to design your own plan to extend them.)

On top of these specific policy changes, the HBC calls for the establishment of a bipartisan fiscal commission consistent with the committee-reported Fiscal Commission Act of 2024. The budget also includes a number of budget process reforms aimed at restricting the use of budget gimmicks.

The budget relies on several unrealistic savings to reach its goal. Most notably, the budget assumes the economy will grow about 50 percent (1 percentage point) faster per year than under CBO’s baseline, resulting in at least $3 trillion of dynamic deficit reduction. It also assumes improper payments would be reduced by 50 percent, saving an additional $1.0 trillion. While promoting faster economic growth and reducing improper payments are worthy and important goals, the growth estimates are likely far too optimistic and improper payment savings are orders of magnitude larger than estimates of previous efforts.

The budget also lacks a number of important specifics. For example, the budget provides very few details as to how it would finance the over $3 trillion cost of extending the expiring tax cuts through FY 2034 (See our Build Your Own Tax Extensions Tool to design your own plan). And while the budget calls for $2.5 trillion of discretionary spending reductions – the equivalent of a 21 percent cut in 2034 if applied across the board or a 41 percent cut if applied only to nondefense spending – the budget does not specify which agencies or functions would absorb those cuts.

The House Budget Committee deserves credit for proposing a budget and putting forward a fiscal goal but would be better served by a more realistic goal. As Committee for a Responsible Federal Budget president Maya MacGuineas noted:

This budget includes many important objectives such as improving our fiscal trajectory, specific reforms to lower and equalize Medicare payments, acknowledgment that continuation of expiring tax cuts should be designed to be deficit neutral, calls to improve the budget process and reduce gimmicks, and a bipartisan fiscal commission.

At the same time, and as with last year’s proposed budget, this budget is unrealistic in its assumptions and outcomes.

Thus far, the House Budget Committee, Republican Study Committee, and the President have put forward FY 2025 budget proposals. The Senate Budget Committee should put forward its proposal (as should any other lawmakers who have ideas) and then both chambers should debate and eventually adopt a budget. The April 15 deadline for Congress to complete action on a budget resolution is quickly approaching and policymakers should do their job and produce one.