WEP/GPO Repeal Would Mean Earlier Insolvency for Social Security

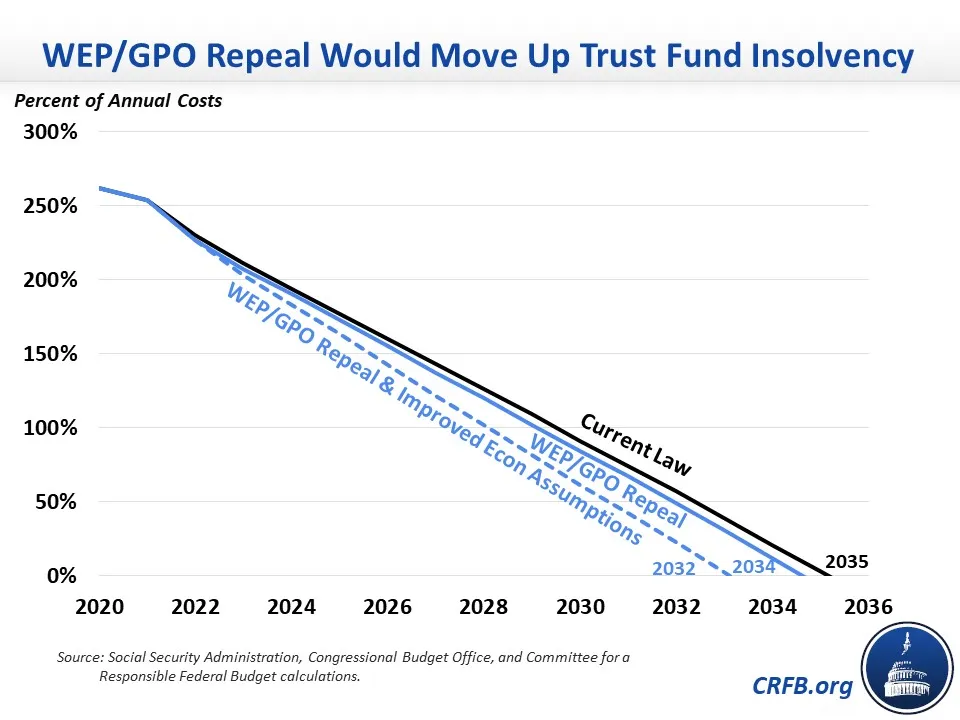

Congress may soon consider legislation to repeal Social Security's Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), provisions designed to reduce certain excessive Social Security payments. While the WEP and GPO provisions are imperfect, full repeal would lead to large overpayments in Social Security benefits and would advance Social Security insolvency by over a year, to 2034 or sooner. The legislation would also cost $150 billion this decade alone, worsening inflationary pressures and increasing debt held by the public.

Currently, some workers pay into state and local pensions instead of the Social Security system. The WEP adjusts Social Security for retirees with some years of earnings covered by these state and local pensions and some years of earnings covered under Social Security, while the GPO makes similar adjustments for spouses and survivors. While neither formula is perfect, the goal is to avoid treating those with a limited number of years covered by Social Security as if they were low-income workers for purposes of Social Security's benefit formula.

A number of proposals have been put forward to improve or replace the WEP and GPO formulas, including from President Obama, former House Ways and Means Committee Chairman Kevin Brady, the Bipartisan Policy Center, and a number of experts on the left, right, and center. Instead, the so-called "Social Security Fairness Act" (H.R. 82) would eliminate the WEP and GPO provisions all together.

Unfortunately, this elimination would be quite costly. The Social Security Administration's Chief Actuary estimates the bill would cost nearly $150 billion through 2031 and worsen Social Security's 75-year shortfall by 0.12 percent of taxable payroll. On its own, this would advance Social Security's insolvency by over a year, to early 2034 based on the Trustees' 2022 projections.

With more accurate economic assumptions, especially in light of surging inflation and its effect on cost-of-living adjustments (COLAs), insolvency could hit as soon as 2032.1 That's when today's youngest retirees will turn 72. At that point, benefits would be cut across the board by about a fifth, absent action.

Contrary to its name, the Social Security Fairness Act would also make Social Security less fair, not more. Repealing the WEP and GPO without a replacement would deliver a windfall benefit to many workers, essentially allowing them to partially "double dip" from Social Security and the state and local alternative. This disproportionately benefits those in higher-income households.

Rather than repealing the WEP and GPO, most serious Social Security thinkers have proposed replacing these formulas with a more proportional benefit adjustment that would reduce rather than increase Social Security's costs.

Social Security is only 11 to 13 years from insolvency as is. Policymakers should work to restore trust fund solvency, not risk advancing insolvency to within a decade.

1 Currently, the Social Security Trustees project insolvency in 2035, and the Congressional Budget Office projects insolvency in 2033. We estimate higher-than-projected inflation will advance insolvency by about a year.