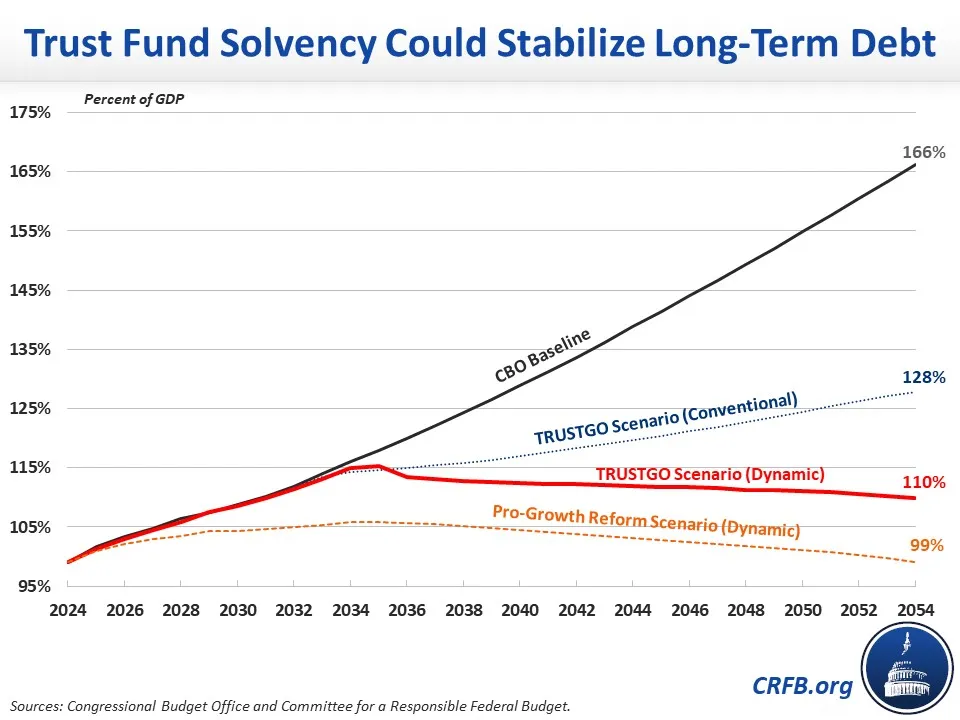

Trust Fund Solvency Could Stabilize the Debt

Restoring solvency to the major trust funds could stabilize debt as a share of the economy, albeit at a very high level. We estimate that when dynamic effects are incorporated, limiting highway, Social Security, and Medicare spending to available revenue could stabilize debt at about 110 percent of GDP within three decades, while more thoughtful reforms could reduce debt to below 100 percent of GDP. By comparison, debt is projected to reach 166 percent of Gross Domestic Product (GDP) by the end of Fiscal Year (FY) 2054 under the Congressional Budget Office's (CBO) latest baseline.

CBO's latest Long-Term Budget Outlook projects that federal debt held by the public will rise from 99 percent of GDP at the end of FY 2024 to a record 106 percent by 2028 and to 166 percent of GDP by the end of 2054, and the budget deficit will grow from 5.6 percent of GDP to 8.5 percent. Under that same baseline, three major federal trust funds are projected to deplete their reserves and become insolvent within the next 11 years. CBO's projections assume that scheduled spending on highways, Social Security, and Medicare continues after the programs' trust funds deplete their reserves, though the law requires deep across-the-board cuts.

As we've shown before, restoring solvency to the major trust funds rather than allowing them to borrow from the general fund would substantially improve the long-term fiscal outlook. Under our "TRUSTGO Scenario".1 - which assumes highway, Social Security, and Medicare spending would be cut to dedicated revenue upon insolvency - we estimate debt would stabilize at 110 percent of GDP within three decades. Specifically, we estimate debt under that scenario would peak at 115 percent of GDP in FY 2035 - just before the Medicare trust fund runs out of reserves -- and then gradually decline to 110 percent of GDP by the end of 2054. At that point, the budget would be in rough primary (non-interest) balance and interest rates would be below the economic growth rate, suggesting that debt-to-GDP would continue to slowly decline indefinitely.

Of the 56 percent of GDP reduction in projected debt-to-GDP under our TRUSTGO Scenario, about two-thirds is the direct result of the lower spending and the remaining third is due to dynamic feedback. In other words, lower spending on Social Security, Medicare, and highways would be enough to reduce debt to 128 percent of GDP by the end of FY 2054. We estimate this lower spending and debt would accelerate long-term economic growth and stem the rise in interest rates. These dynamic effects would lower debt-to-GDP by another 18 percentage points to 110 percent of GDP.

Policymakers could improve the debt outlook even further if they pursued thoughtful pro-growth trust fund solutions in advance of the trust funds' insolvency dates, rather than relying on abrupt cuts. Such reforms could improve labor force participation, boost private investment, lower health care costs, and improve the way we build and fund infrastructure. Under one illustrative package, we estimate debt could be plausibly fall to 99 percent of GDP by the end of FY 2054 under a dynamic estimate. By that year, the budget would be in primary surplus with the growth rate well above the interest rate, suggesting continued improvements in the very long run.

Importantly, these scenarios require lawmakers to not only restore solvency to the major trust funds, but also avoid any unpaid for spending increases, tax cuts, or extensions. They also require avoiding any solvency-improving changes that might widen borrowing in the general fund (for example, raising the Social Security employer-side payroll tax would lower taxable wages and thus reduce income tax revenue). And they leave very little room for error in case spending grows faster, or revenue lower, than CBO projects. And even with these assumptions, debt would remain larger than the economy for the next three decades or more.

For those reasons, restoring trust fund solvency is unlikely to be enough to truly fix our debt. Policymakers should thus pursue additional spending reductions, revenue increases, and reforms on top of restoring the major trust funds to balance.

Still, enacting trust fund solutions sooner rather than later would make a tremendous difference in improving our long-term fiscal outlook.

1 Under our TRUSTGO Scenario, we estimate that GDP would be 5.2 percent above the baseline in 2054 and average interest on the debt would be 51 basis points below the baseline. Under our Pro-Growth Reform Scenario, we estimate GDP would be 8.3 percent above the baseline in 2054 and interest rates would be 51 basis points below the baseline. Our estimates are meant to approximate what we believe CBO would find, though based on our own modeling. As a point of reference, CBO previously estimated that a Payable Benefits Scenario (essentially “TRUSTGO” for Social Security only) would boost Gross National Product by 5 percent in 2053 and reduce interest rates on new ten-year bonds by 50 basis points. In addition, we previously estimated that pro-growth Social Security reform would boost output by 3.5 to 13 percent in 2050. In addition, the Penn Wharton Budget Model previously estimated a package of entitlement reforms would boost GDP by 5 percent in 2050.