Trillion-Dollar Deficits Could Return Next Year, But A Deal Could Make Them Worse

Trillion-dollar deficits will return next year, and a budget deal in the coming weeks could make them much worse. The continuing resolution (CR) that ended the brief shutdown of the federal government continued delays of three taxes from the Affordable Care Act. These delays will cost $31 billion over ten years and will further add to deficits that already drastically increased with the passage of the tax law last year.

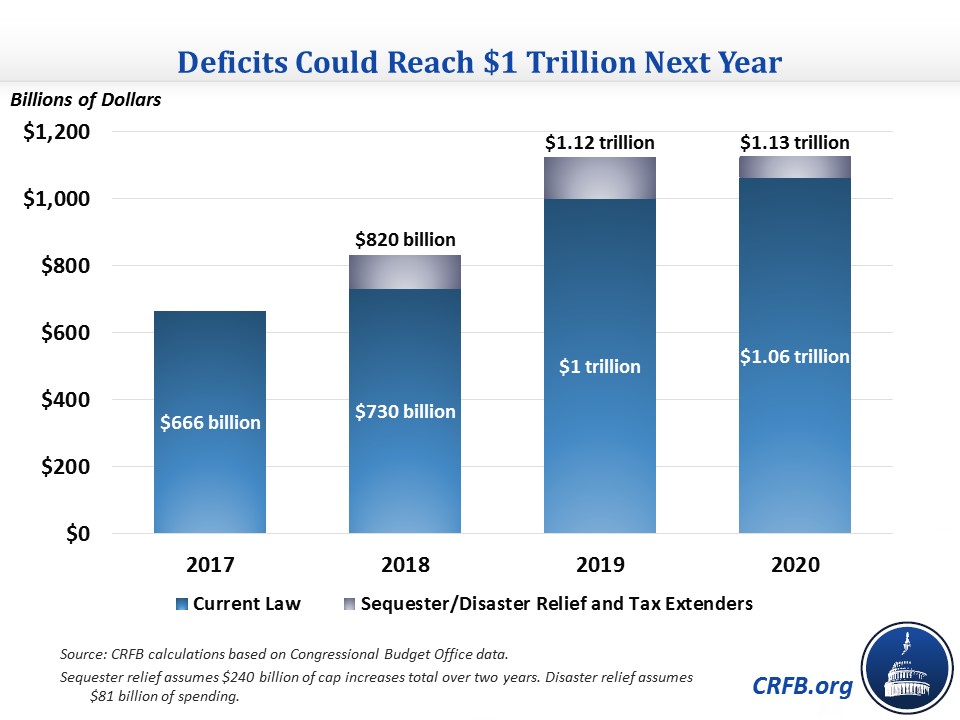

The passage of the CR means we now project, based on the Congressional Budget Office's (CBO) June baseline, that trillion-dollar deficits to return next year rather than 2020 as we previously estimated. After the tax bill, we projected that the deficit would reach $983 billion in FY 2019 and $1.05 trillion in FY 2020. Now the CR will increase the deficit further to $1 trillion in 2019 and $1.06 trillion in 2020.

Unfortunately, lawmakers do not appear to be finished adding to deficits. Among other things, Congress is likely to consider increasing discretionary spending caps for the next two years, disaster relief to deal with last year's hurricanes, extensions of temporary tax provisions that expired at the end of 2016. If we assume that sequester relief will lift the discretionary caps by $240 billion over the next two years (consistent with this press report), disaster relief totals $81 billion, and tax extenders are revived through 2018, the deficit would reach $1.12 trillion in 2019 and $1.13 trillion in 2020. It is quite possible that there will be other costs on top of that from larger sequester or disaster relief and/or other policies that are lumped into a budget deal.

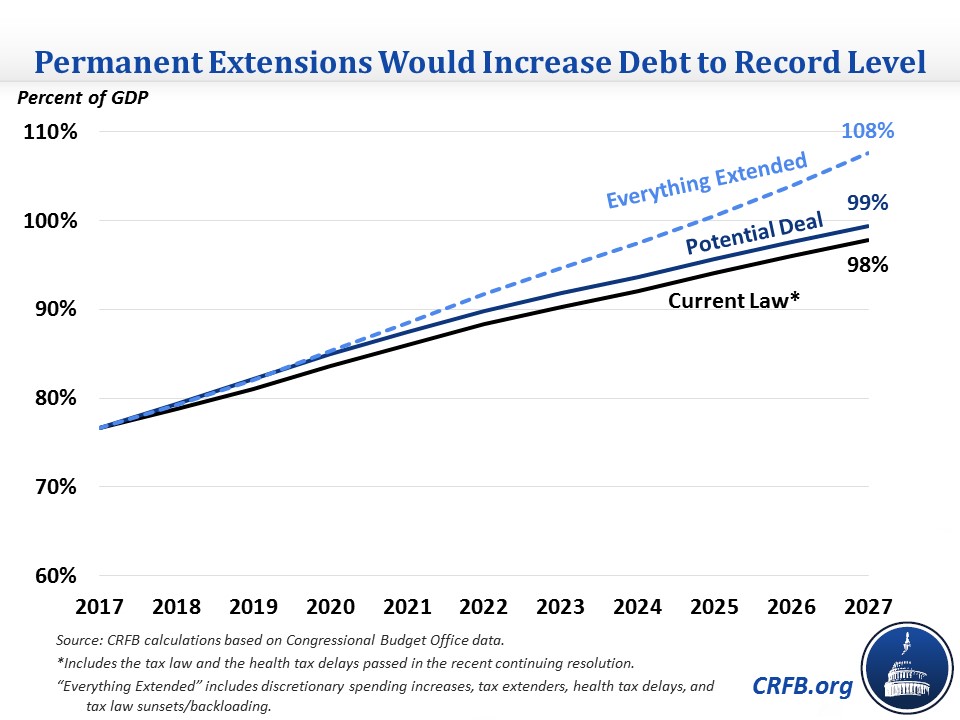

As we have noted before, if these temporary policies are continued, costs would become substantial over the longer term. Including interest, lawmakers have already added $1.8 trillion to ten-year deficits, and upcoming legislation could add another $430 billion. However, if the discretionary increases, health tax delays, and tax extenders were continued and the sunsets and other gimmicks from the tax law were removed, it would add another $2.3 trillion to costs over the next ten years for a total deficit increase of $4.5 trillion.

Permanent Extensions of Policies in Recent or Upcoming Legislation

| Policy | Ten-Year Cost |

|---|---|

| Already Enacted Since December | |

| Tax Law | $1.46 trillion |

| December Continuing Resolution | $5 billion |

| Health Tax Delays in January Continuing Resolution | $31 billion |

| Still to Be Considered | |

| Discretionary Spending Increases for FY2018 and FY2019 | ~$240 billion |

| Disaster Relief | $81 billion |

| Revive Tax Extenders for 2017 and 2018 | $20 billion |

| Interest | $415 billion |

| Total | $2.2 trillion |

| Memo: Total if legislation above is permanently extended (including interest) | $4.5 trillion |

Source: CRFB calculations based on Congressional Budget Office data.

*Assumes $240 billion in cap increases over two years and similar amounts in future years.

The much greater cost of the permanent policies would cause the deficit to exceed $2 trillion by 2027, easily a record in dollars, and the debt would reach an all-time record of 108 percent of GDP that year.

Lawmakers have added to deficits multiple times in recent weeks, and they may do it again in upcoming negotiations. Lawmakers need to get serious about our fiscal situation and make sure that any budget deal doesn't add to the debt or rely on gimmicks.