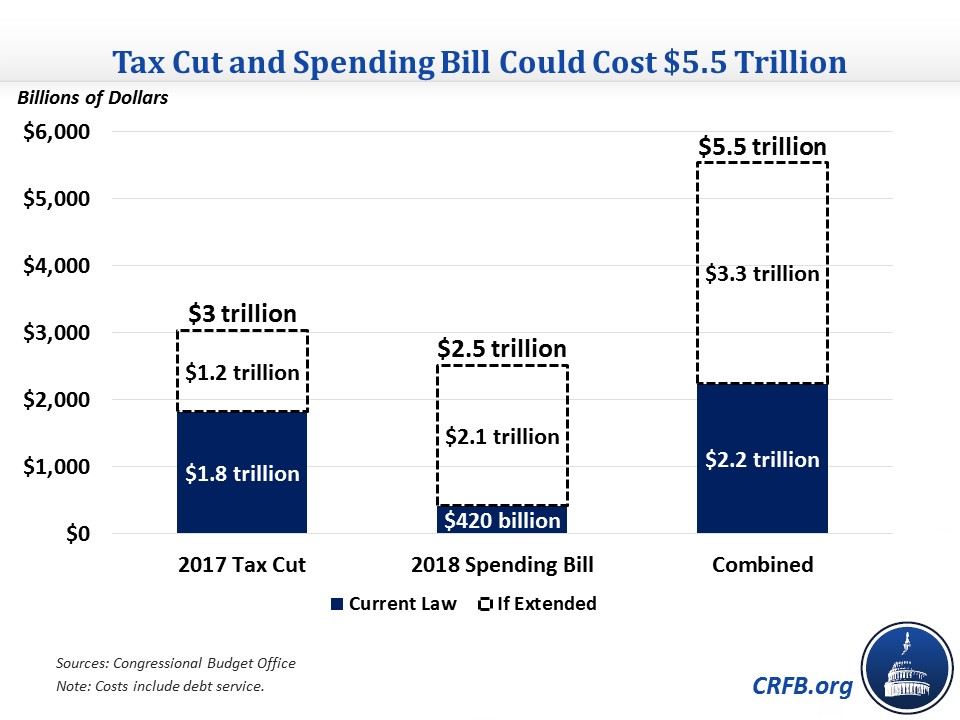

Tax Cut and Spending Bill Could Cost $5.5 Trillion Through 2029

The 2017 tax cut and the 2018 spending bill loom large in the latest Congressional Budget Office (CBO) outlook; the two pieces of legislation as passed cost $2.2 trillion combined, or one-sixth of total 2018-2029 deficits in CBO's projection. However, even these costs may be artificially low since both pieces of legislation contain temporary elements. If these elements are permanently extended, the two laws would cost $5.5 trillion, or one-third of total deficits.

The 2017 tax law is estimated to cost over $1.8 trillion for the 2018-2028 period, including interest. This large cost comes despite the fact that several individual tax provisions will expire over the next decade (mostly after 2025) and the law actually becomes deficit-reducing starting in 2027. Extending these expiring provisions would add another $1.2 trillion for a total cost of $3 trillion.

The 2018 spending bill will cost about $420 billion through 2028. This cost is limited by the fact that the large discretionary spending cap increases, which totaled $296 billion for 2018 and 2019, will expire in 2020, leading to the cap dropping by $126 billion in 2020. If lawmakers avoid these cuts and increase the caps with inflation after 2019, it would cost another $2.1 trillion for a total cost of $2.5 trillion.

Combined, the two laws will account for one-sixth of total 2018-2029 deficits and one-third of total deficits is they are both extended.

2018-2029 Cost of 2017 Tax Cut and 2018 Spending Bill

| Current Law | If Extended | |

|---|---|---|

| 2017 Tax Cut Cost | $1.8 trillion | $3 trillion |

| 2018 Spending Bill Cost | $420 billion | $2.5 trillion |

| Total Cost | $2.2 trillion | $5.5 trillion |

| 2017 Tax Cut Cost (Percent of Deficit) | 14% | 18% |

| 2018 Spending Bill Cost (Percent of Deficit) | 3% | 15% |

| Total Cost (Percent of Deficit) | 17% | 33% |

| Memorandum: Total 2018-2029 Deficits | $13.3 trillion | $16.6 trillion |

Sources: Congressional Budget Office, CRFB calculations.

The two laws are already a significant story in the near-term deficit increase and could be a major story in longer-term deficits if lawmakers extend them without offsets.