Is the Social Security Shortfall Bigger than We Thought?

Last week, the Technical Panel to the Social Security Advisory Board issued a report on the assumptions and methods used by the Social Security Trustees Report. The Technical Panel's role is to improve the way the Trustees analyze the health of the Social Security program. This year's findings and suggested changes to the technical assumptions would result in a worse than the originally projected outlook for Social Security's financial wellbeing.

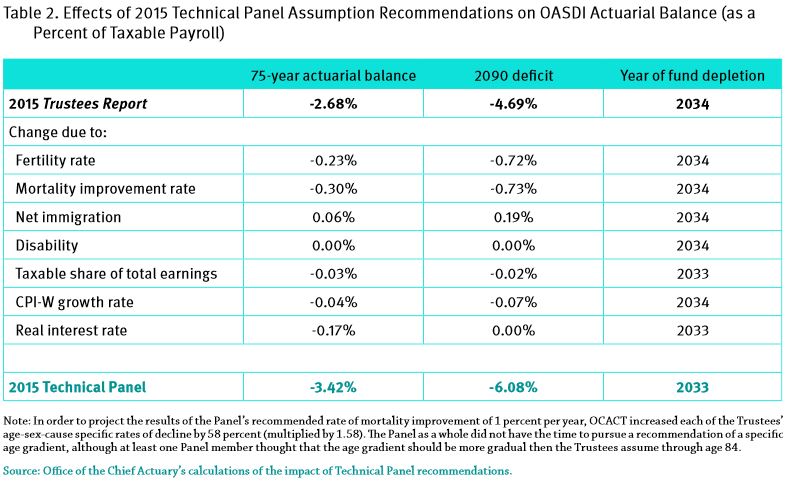

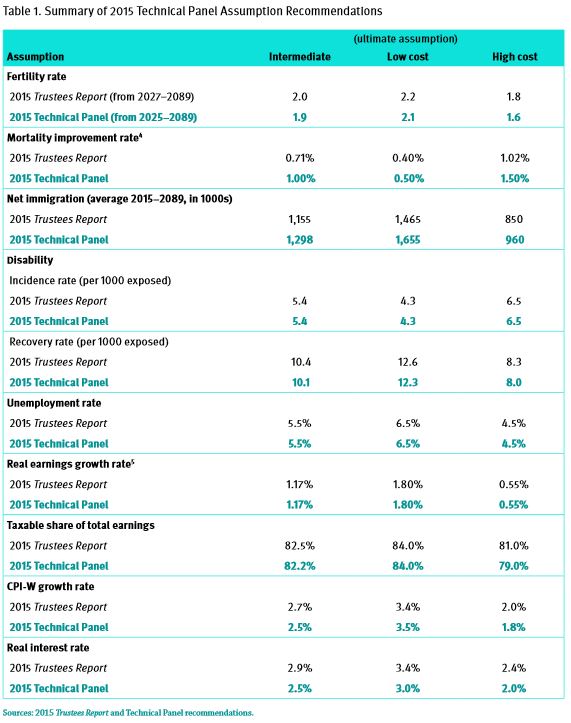

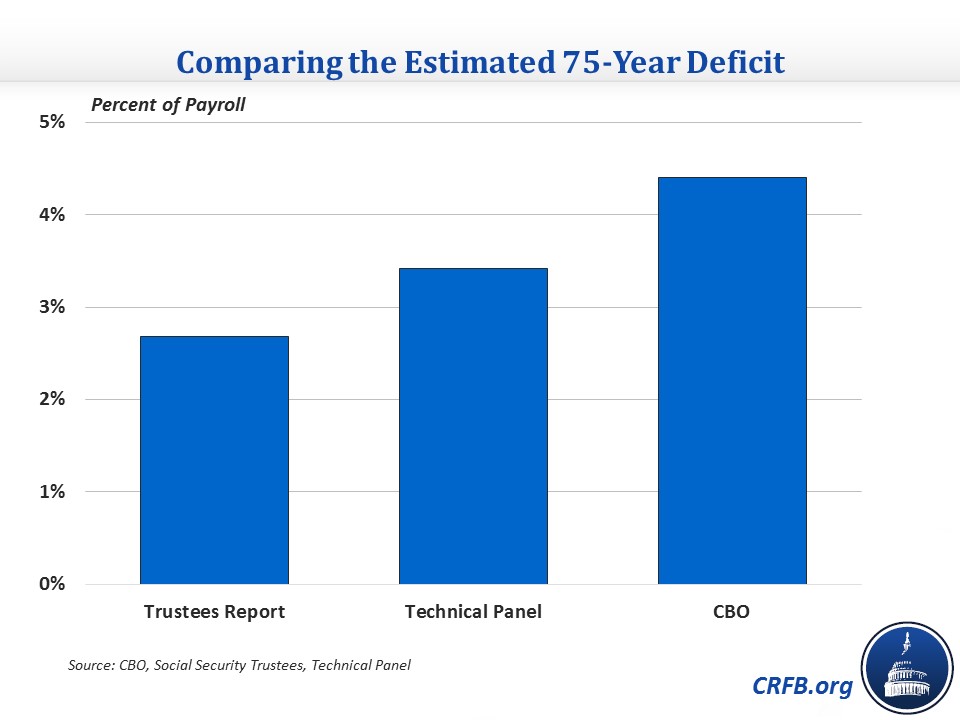

The Technical Panel publishes reports every four years with suggestions for improving the methodology, presentations, and assumptions used by the Trustees to estimate the future financial health of the Social Security Trust Fund. The 2015 Trustees Report projected the 75-year shortfall of the program was 2.7 percent of payroll. Using the more pessimistic assumptions recommended by the Technical Panel, the 75-year shortfall is 3.4 percent. The effects of the panel's recommended assumptions grow larger over time, making the shortfall in the final year of projections (the 75th year) 30 percent higher at 6.1 percent of payroll instead of 4.7 percent.

The recommended changes in assumptions include both demographic and economic variables. The changes to demographic assumptions the panel recommends include: lower fertility rates, longer life expectancy (CBO does as well), slightly higher net immigration, and slightly lower rates for those on disability returning to work. For changes to economic variables, the panel recommends assuming lower wage growth, lower real interest rates, lower inflation, and a lower taxable share of earnings (due to higher income inequality). Overall the changes to demographic assumptions are more impactful on the fiscal health of Social Security

In addition to these technical assumption changes, the panel also recommends changing the way the Trustees present their report. Most importantly, the Technical Panel recommends a greater emphasis and clarity on the underlying uncertainty in the projections. The Panel suggests providing more information on scheduled benefits relative to earnings and increasing supplemental information on the long-run financial outlook.

In its Long-Term Outlook this June, the Congressional Budget Office looked at the solvency of Social Security and was more pessimistic than either the Trustees or the Technical Panel. CBO estimated the 75-year actuarial balance was running a deficit of 4.4 percent of payroll. That is 1 percentage point (nearly 30 percent) worse than the Technical Panel's more pessimistic take on the Trustees report, with the Technical panel assessing shortfalls to be 3.4 percent of payroll instead of the Trustee's estimated 2.7 percent.

The Technical Panel's recommendations should reveal that the Trustees projections are very uncertain and, given what we also know about CBO's projections, Social Security may turn out to be in worse condition than we expected. The Technical Panel also underscores the importance of making Social Security robustly solvent so that changing demographics like longer life expectancy don't put the program back on a course for insolvency. Most importantly, it shows the importance of acting early so policymakers aren't left scrambling if reality turns out to be worse than projected.