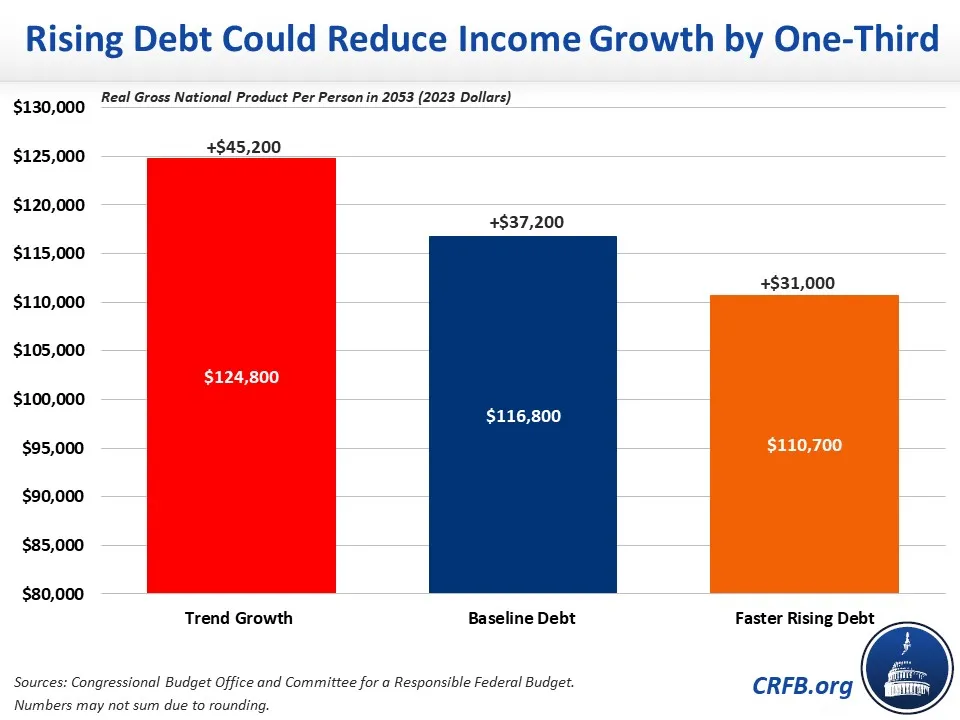

Rising Debt Could Reduce Income Growth by One-Third

A high and rising national debt poses a series of risks and threats, including slower income and wage growth. A new report from the Congressional Budget Office (CBO) estimates the effect of the fiscal outlook on Gross National Product (GNP) per capita – a measure of average income. CBO finds:

- Before accounting for rising debt, annual income is projected to grow by $45,200 per person over the next three decades.

- Rising debt under current law would reduce income growth by one-sixth, or by $8,000 per person in 2053.

- With additional borrowing for tax cuts and spending hikes, debt would reduce income growth by one-third, or by $14,100.

Higher debt reduces future income by exacerbating a phenomenon known as "crowd out," where the availability of debt and changes in interest rates lead investors to devote an increasing share of savings toward Treasury securities at the expense of more productive investments. In fact, CBO's standard model assumes that every new dollar of government borrowing reduces private investment by 33 cents.

Federal debt held by the public is currently 98 percent of Gross Domestic Product (GDP) – about twice the historic average over the past 50 years – and is projected to rise to 181 percent of GDP by the end of Fiscal Year (FY) 2053 under CBO's baseline. Assuming further increases in debt do not crowd-out investment at all, CBO estimates average income in 2023 inflation-adjusted dollars would increase by $45,200 over thirty years, from $79,600 in 2023 to $124,800 in 2053.

Rising debt would substantially slow that income growth. After incorporating the effects of crowd out, CBO projects average income would only grow by $37,200, to $116,800 in 2053. In other words, rising debt would lower income growth by 18 percent and reduce total income by over 6 percent in 2053.

Further increases in debt would slow income growth even more. If, for example, revenue and discretionary spending were held constant at their 30-year historical averages, we estimate CBO would project average income would grow only by $31,000, to $110,700 in 2053. In other words, faster rising debt would lower income growth by 31 percent and reduce total incomes by 11 percent in 2053. This is despite the beneficial effects of lower tax rates and larger public investments on income.

If policymakers slow the growth of the debt, the effects on income will be more muted. For example, in CBO's 'payable benefits scenario,' where Social Security spending is limited to dedicated revenue upon trust fund insolvency and debt only grows to 132 percent of GDP, income per person would increase by $42,400, to $122,000 in 2053. In this scenario, income growth would be 6 percent lower than with no debt growth, and total incomes would be 2 percent smaller.

On the other hand, the actual effects of debt on income could be even larger than CBO estimates. For example, if crowd out is twice as strong as in its model, CBO projects average income under current law would only grow to $95,700 through 2047 and would begin to shrink thereafter. Through 2053, we estimate debt would slow income growth by 69 percent under that scenario and reduce average income by 25 percent in 2053.

Policymakers who want to ensure strong income gains and strong economic growth should work to put debt on a downward trajectory instead of allowing it to continue rising unsustainably. Doing so would not only avoid the risks of high debt levels but also improve Americans' standard of living.