The Response & Relief Act Would Support the Economic Recovery

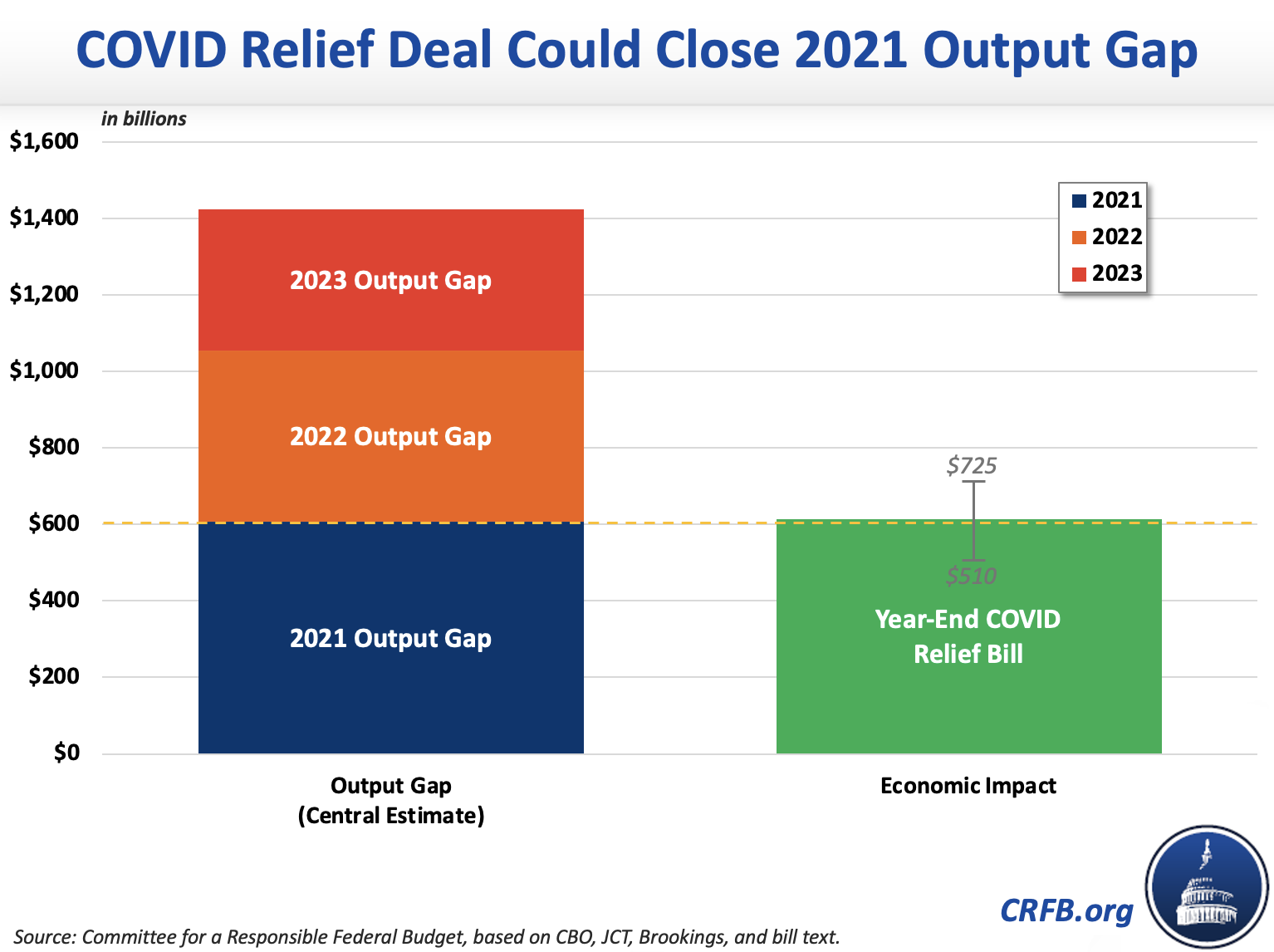

President Trump is yet to sign the year-end bill that contains the Coronavirus Response & Relief Supplemental Appropriations Act and accompanying relief measures, which was passed overwhelmingly by both branches of Congress this week. We estimate this $915 billion package — summarized in detail here — will boost GDP by roughly $615 billion. That boost would be enough to fully close the output gap in 2021 — though as the spend is spread across three years, under our central estimate it would actually close about three-quarters of the economic shortfall in 2021 and a fifth of the projected shortfall in the subsequent two years.

The overall relief package would provide a strong economic bridge to the Spring and Summer. More fiscal support may be needed at that time. However, under our optimistic scenario where a successful vaccination campaign helps bolster a strong economic recovery, the Response & Relief Act could prove sufficient to get the economy back on its feet.

Specifically, we estimate the bill would boost GDP by between $510 to $725 billion through 2023. Our central estimate of $615 billion, equates to a one percent boost in GDP over 3 years, and two percent of GDP in 2021 alone.

Estimated GDP Boost From COVID Relief Proposals (billions)

| Economic Impact Estimates | ||||

|---|---|---|---|---|

| Category | Fiscal Impact | Low | Central | High |

| Unemployment Benefits | $120 | $80 | $120 | $155 |

| Economic Impact Payments | $165 | $100 | $135 | $165 |

| Paycheck Protection Program and Other Small Business Support | $320 | $115 | $140 | $160 |

| State and Local Aid (including Education and Transit Funding) | $85 | $75 | $80 | $85 |

| Other Spending and Revenue | $225 | $140 | $150 | $155 |

| Total | $915 | $510 | $615 | $725 |

| Overall Multipliers | 0.56x | 0.67x | 0.79x | |

Totals may not sum due to rounding. CRFB calculations based on CBO and JCT data.

Our economic estimates of the bill are generated by applying different fiscal multipliers to five categories of spending included in the bill: small business relief, expanded and extended unemployment benefits, state and local aid, rebate checks, and other policies. For our low-impact estimate, we used the same category fiscal multipliers estimated by CBO for already-enacted COVID relief. For our high-impact estimates, we used multipliers suggested by Wendy Edelberg and Louise Sheiner at the Brookings Institution, increasing the assumed PPP and small business multiplier to account for increased targeting. For verification, we also generated our own economic projections based on CBO's recent methodology paper and our own social distancing assumptions. Both methodologies result in a central overall multiplier estimate of 0.67x.

Based on our latest economic projections (adapted from CBO's July projections and more recent economic data) the bill is ostensibly large enough to close the entire 2021 output gap, which is the difference between actual economic output and output if the economy were performing at its potential.

In reality, it would be almost impossible to close the full output gap in 2021. Even with massive amounts of income, the pandemic will prevent many firms, consumers, and workers from full participation in the economy. However, we estimate the Response & Relief package would close about three-quarters of the 2021 output gap — front loaded in the first half of the year — and about one-fifth of the gap in 2022 and 2023.

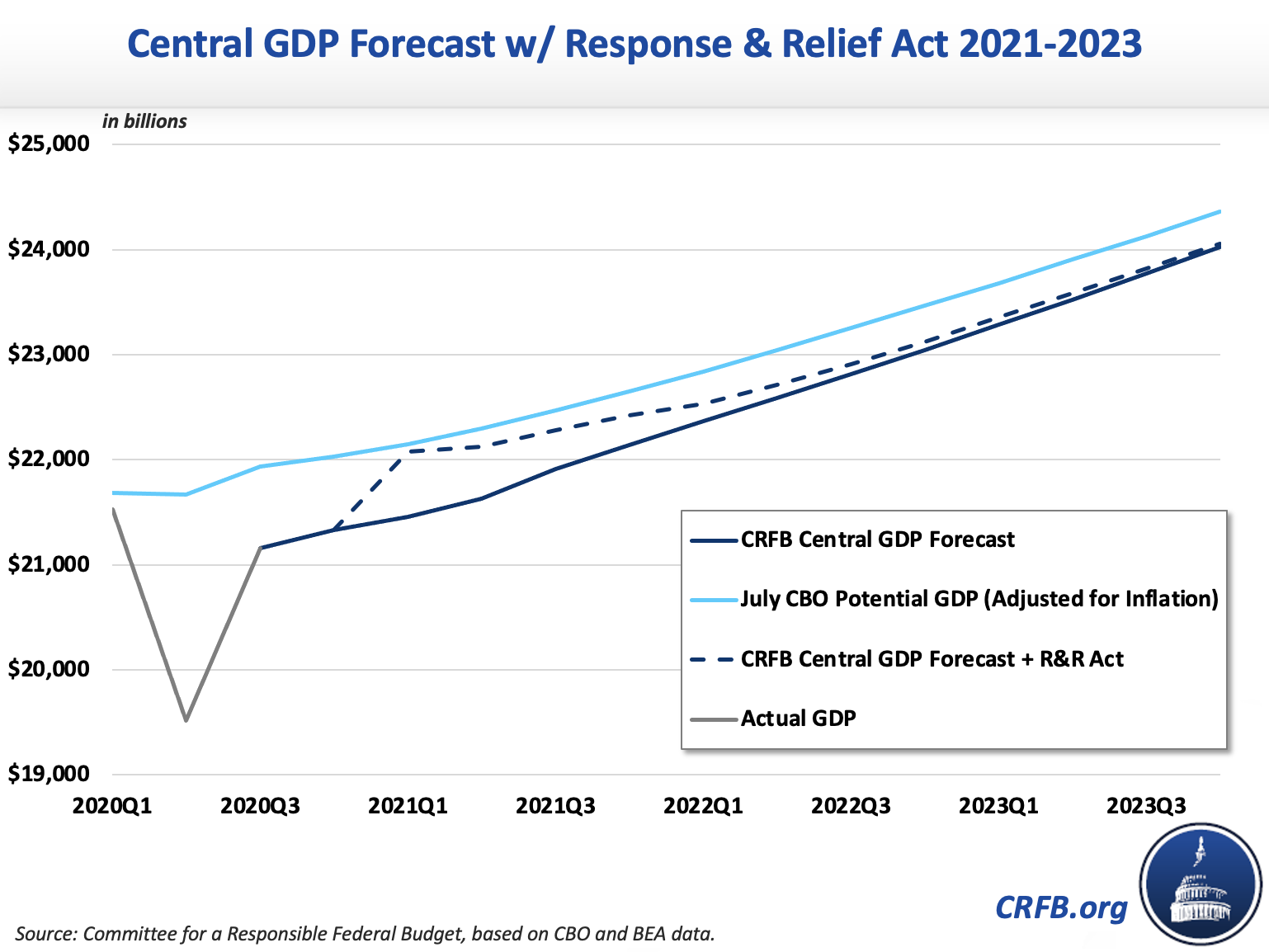

Under our central economic projections, more fiscal support would be needed to support a full economic recovery once the pandemic has essentially ended. However, it is also possible that the underlying economic recovery — thanks to large amounts of savings, a successful vaccination campaign, and expansionary monetary policy — could be strong enough to recover on its own as in our optimistic projections.

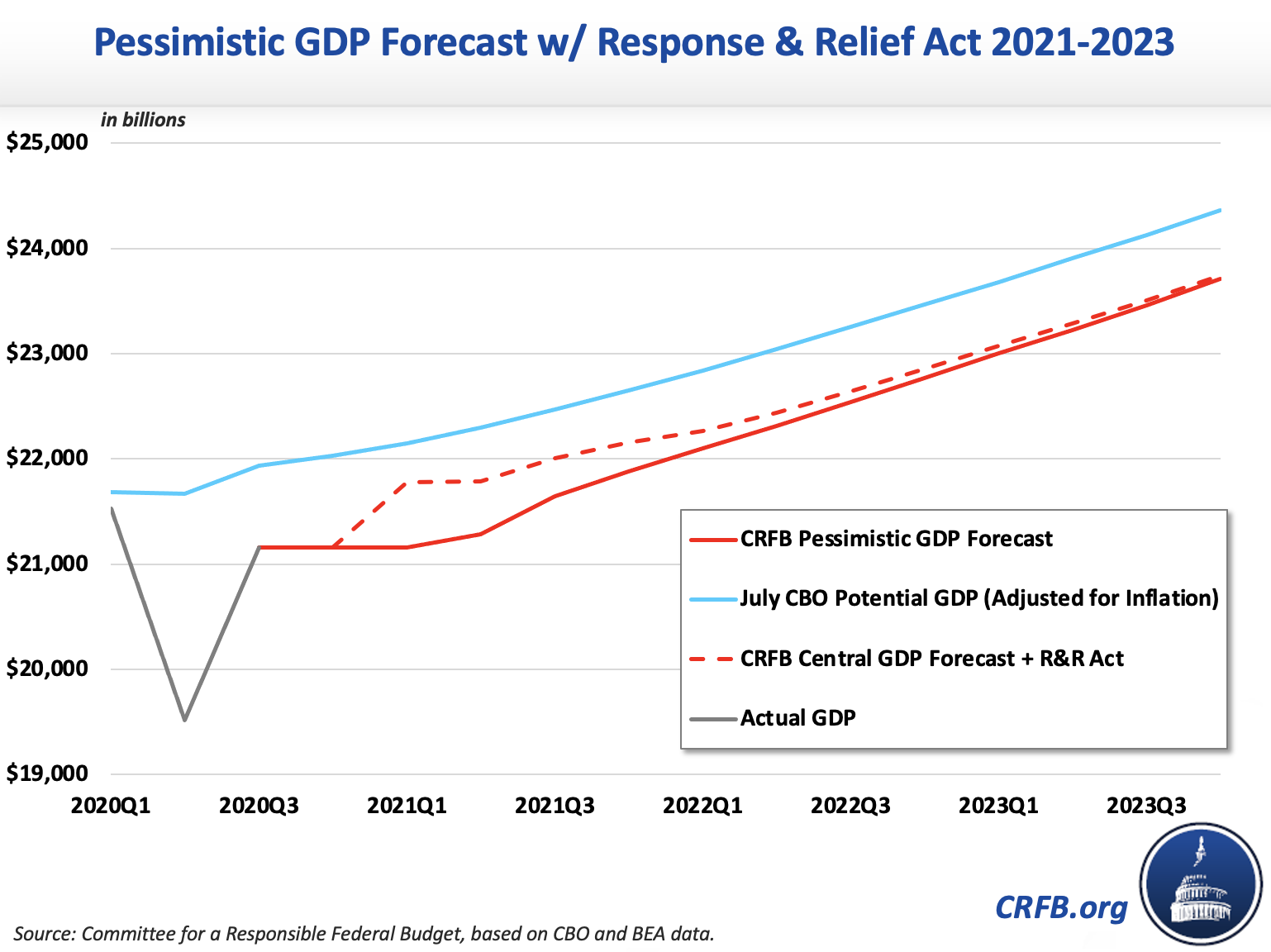

Under our pessimistic economic projections — which effectively assume a modest double-dip recession and slow recovery absent fiscal policy — the Response & Relief bill would still close about half of the output gap in 2021 — though only a small fraction of the gap thereafter.

Our output gap figures are based on recent CBO projections, though there are reasons to think both actual and potential GDP will be somewhat higher than these estimates (the net effect on the output gap is unclear). We discuss our methodology in full at the bottom of our recent piece, Could a COVID Relief Deal Close the Output Gap?

You can also read more about the Response & Relief Act here as well as the $135 billion in unrelated tax breaks in the larger omnibus package here.

To date Congress has enacted the equivalent of $3.4 trillion of net COVID relief, most of which has already been spent (see more at www.COVIDMoneyTracker.org). Despite this, more support is needed. The year-end relief bill is appropriately targeted, of sufficient scale to have a noticeable impact on GDP, and will help close the current output gap. While it is appropriate to enact deficit-increasing legislation in response to a national emergency, the relief package would add to the debt and would also slightly reduce long-term economic output if not offset with future legislation. Based on recent estimates of COVID relief from CBO, we believe GDP would be roughly 0.1 percent smaller in 2030 if this package was enacted.

We will track all of the disbursements from this latest bill, if it is enacted, as part of our COVID Money Tracker initiative.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

This blog was updated on 1/4 to account for slight changes in the economic projections based on updated fiscal impact numbers and on 1/21 to reflect updated scores from the Congressional Budget Office.