Proposed Budget Agreement Could Cost $1.7 Trillion

Update: A Congressional Budget Office (CBO) score of the deal shows that the offsets are $55 billion rather than $77 billion as reported in the press. The text and table in this blog have been updated to reflect that.

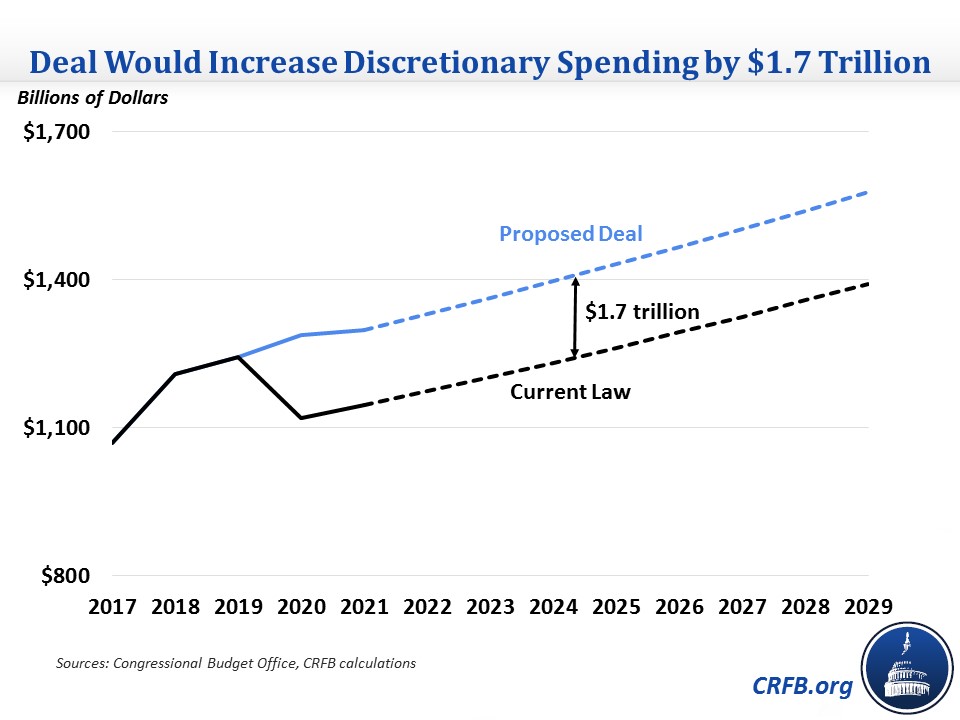

Congress and the President have announced a plan to raise discretionary spending caps for Fiscal Years (FY) 2020 and 2021. The plan would increase discretionary spending by $320 billion over the next two years and, by our estimate, add roughly $1.7 trillion to projected debt levels over the next decade. This estimate is the net effect of $1.5 trillion in discretionary spending increases, $250 billion in interest costs, and just $55 billion of offsets.

Under current law, caps on discretionary spending are scheduled to fall from $1.244 trillion in 2019 to $1.119 trillion in 2020 (they were $1.07 trillion in 2017). This agreement would avert that drop by increasing the 2020 cap by $169 billion, to $1.288 trillion, and would also increase the 2021 cap by $153 billion, to $1.298 trillion. As a result, the direct cost of the cap increases would be $320 billion.

Budgetary Effect of Budget Deal

| Component | Ten-Year Cost/Savings (-) |

|---|---|

| Direct cost of cap increases | $320 billion |

| Offsets | -$55 billion |

| Interest | $95 billion |

| Subtotal, Direct Cost | $360 billion |

| Effect on baseline | $1.2 trillion |

| Interest | $155 billion |

| Total | $1.7 trillion |

Source: Draft budget deal, CBO, and CRFB calculations.

Note: Numbers are rounded to the nearest $5 billion.

However, as we have pointed out before, a two-year caps deal entails future costs because there are currently no caps on discretionary spending after 2021. By convention, the Congressional Budget Office (CBO) assumes that uncapped discretionary spending grows with inflation, so increasing the 2021 cap raises the level at which that spending would grow from, building in higher spending in future years as well. As a result, the two years of cap increases will actually raise spending by $1.7 trillion over ten years.

Overall, the bill would cost about as much as the 2017 tax cuts and nearly twice as much as full discretionary sequester repeal, bringing discretionary spending close to record levels.

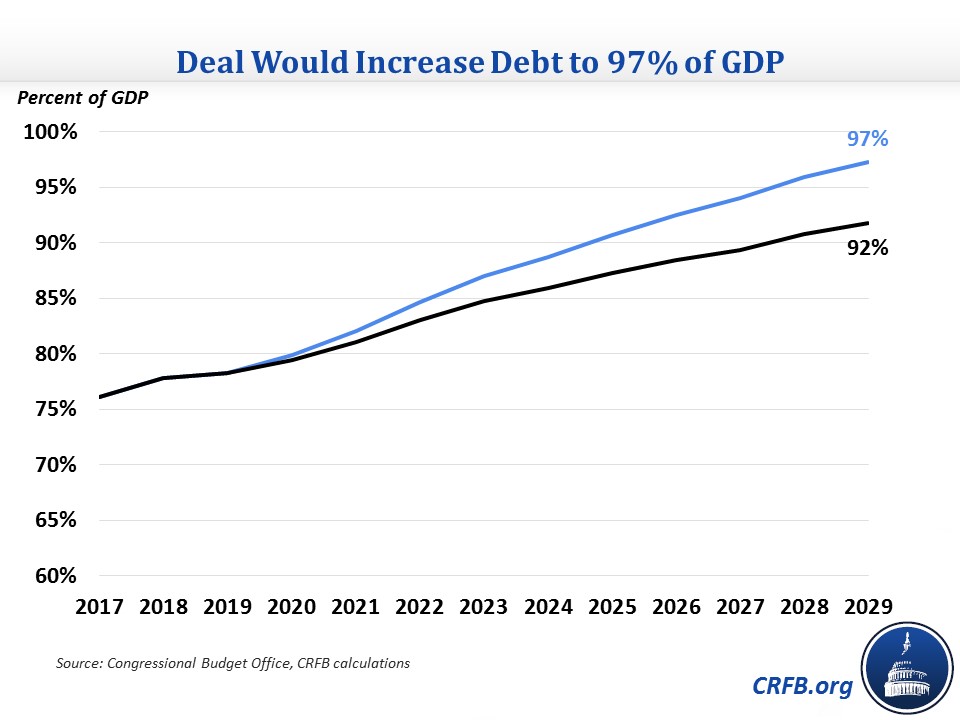

The deal reportedly also includes $55 billion of offsets, including extending the sequester on mandatory spending. These offsets would cover only a sixth of the direct cost of the bill and less than 5 percent of the ten-year impact. As a result, the plan would add roughly $1.7 trillion to the national debt, causing it to rise from 78 percent of Gross Domestic Product (GDP) this year to a projected 97 percent by 2029, compared to 92 percent under current law.

This budget deal would add substantially to the debt both through its two-year cap increase and the follow-up cost that entails. Lawmakers will need to add many more offsets or drastically scale down the size of the increases to make this deal responsible. We've put forward our own plan, along with many options, that could serve as a more helpful starting point.