Nikki Haley's Proposal to Repeal IRA Green Tax Credits

Recently, former United Nations Ambassador and current GOP presidential candidate Nikki Haley made a speech at St. Anselm College in New Hampshire, in which she outlined her comprehensive economic plan that she calls the “Freedom Plan.” As part of that plan, Haley proposes eliminating “Joe Biden’s $500 billion in green energy subsidies.”

| US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office. |

According to the Haley campaign, the “$500 billion in green energy subsidies” refers to most of the energy- and climate-focused tax credits in the Inflation Reduction Act (IRA), including credits for the production of clean energy, purchases of electric vehicles (EVs), manufacturing of green technologies, and energy-saving technologies for commercial and residential buildings.

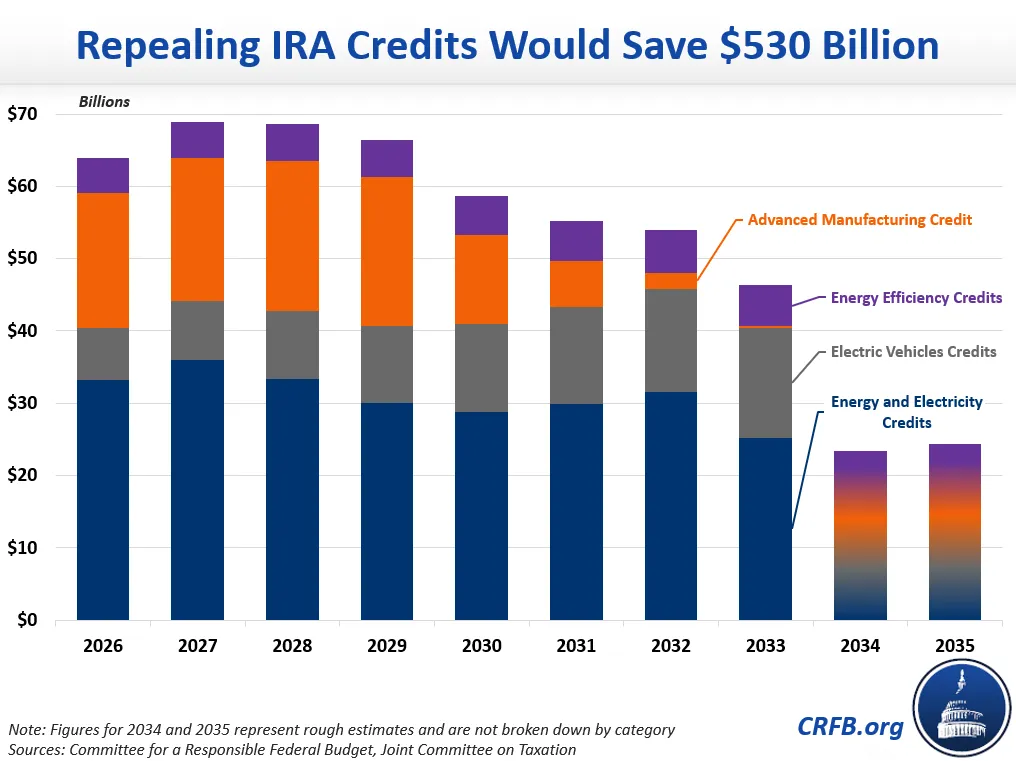

Assuming the credits were repealed, effective in tax year 2026, we estimate these repeals would save approximately $530 billion over the ten-year period from Fiscal Year (FY) 2026 through FY 2035.1

| Savings (FY '26 – FY '35) | |

|---|---|

| Energy and Electricity Credits | $270 billion |

| Electric Vehicle Credits | $110 billion |

| Advanced Manufacturing Credit | $100 billion |

| Energy Efficiency Credits | $50 billion |

| Total | $530 billion |

Sources: Committee for a Responsible Federal Budget, Joint Committee on Taxation

About half of the savings – about $270 billion – would come from repealing several credits related to energy and electricity. Specifically, the proposal would roll back extensions and modifications made to existing clean energy production and investment tax credits specific to certain renewable sources, as well as repeal new, technology-neutral clean energy production and investment tax credits. A new tax credit for zero-emission nuclear power facilities would be repealed, along with expansions made to an existing tax credit for advanced energy projects.

Another $210 billion of savings would come from the repeal of credits related to electric vehicles and advanced manufacturing. Specifically, the proposal would roll back an enhancement of the Section 30D tax credit for purchases of certain new EVs, which is currently worth up to $7,500, and repeal a new tax credit for purchases of used EVs, which is currently worth up to $4,000 and limited to 30 percent of the sale price of the vehicle. A new tax credit for qualified commercial EVs would be repealed, as would extensions to the existing tax credit for qualified alternative fuel vehicle refueling properties. The tax credit for manufacturers of components used for clean energy production, such as batteries or solar panels, would also be repealed.

The remaining $50 billion in savings would come from the repeal of credits for energy-efficient technologies for buildings. Specifically, the proposal would roll back extensions and expansions of existing tax credits that subsidize construction of new, energy-efficient residential and commercial buildings, retrofitting of existing residential buildings with new, energy-efficient technologies, and investment in clean energy sources for residential areas. Notably, the Haley campaign has said they would leave in place several IRA tax credits, including the credit for carbon sequestration and several credits related to clean or renewable fuels.

Importantly, this $530 billion savings estimate is substantially higher than the original $270 billion scored cost of the IRA tax credits, despite some of the IRA credits being left in place. The difference is due in part to differences in the budget window – the IRA costs were scored from FY 2022 through FY 2031, while our savings estimates cover FY 2026 through FY 2035. More importantly, the IRA is now projected to cost far more than originally scored.

As we previously wrote, the Joint Committee on Taxation (JCT) now believes the IRA tax credits will cost about twice as much as originally estimated. The difference is due to a variety of factors, including higher-than-expected inflation and output, greater-than-expected demand for and interest in subsidized activities, looser-than-expected regulations, and other factors.

While we estimate repealing these provisions would save about $530 billion over the decade from FY 2026 through FY 2035, annual costs would differ dramatically on a year-by-year basis. Specifically, we estimate annual savings would peak at about $69 billion in FY 2027 but taper off over the 2030s as many of the tax credits are scheduled to expire or phase out under current law.

Note that in addition to this proposal, Haley has also proposed repealing various energy- and climate-related direct spending provisions from the IRA, as well as repealing the gas tax. Repealing the spending provisions could save around $100 billion over the decade from FY 2026 through FY 2035, assuming all budget authority could be recovered, while repealing the gas tax (assuming this included diesel) would cost roughly $260 billion.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.

1 This estimate is derived by combining JCT’s estimate of repealing most of the IRA's tax credit provisions under the Limit, Save, Grow Act, JCT’s score of amendments to repeal certain provisions, and JCT’s most recent score of ending the expansion of the electric vehicle credits under the Build It In America Act.