New Evidence Suggests Even Larger Medicare Advantage Overpayments

Update 2/2/24: We have updated our estimate for MA overpayments due to new research into coding intensity and favorable selection from MedPAC. We find overpayments could be between $1.0 and $1.4 trillion over the 2024-2033 period.

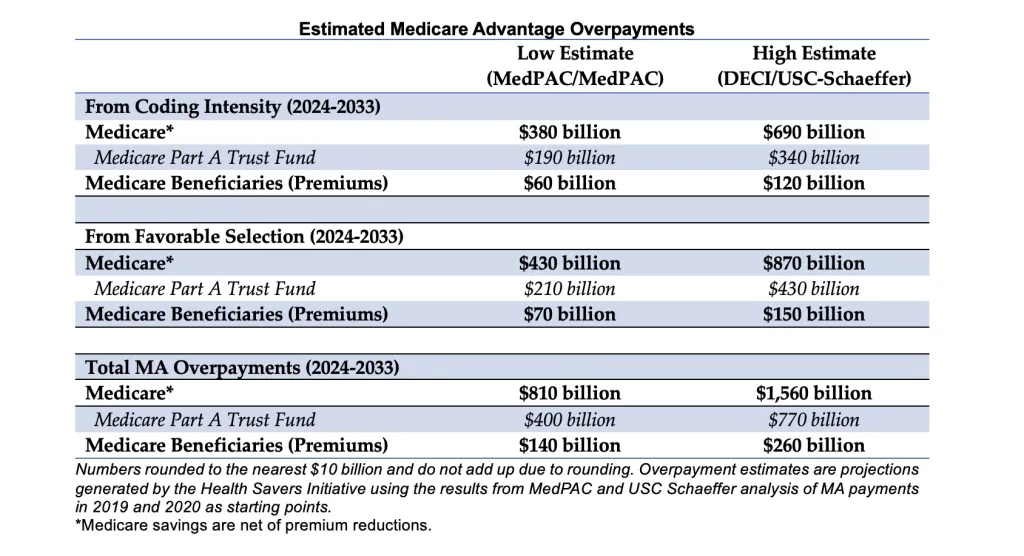

In June, two published studies by the USC Schaeffer Center for Health Policy and Economics and the Medicare Payment Advisory Commission (MedPAC) provided new insight into the degree to which Medicare overpays private Medicare Advantage (MA) plans relative to traditional fee-for-service (FFS) Medicare. When combined with our prior research for the Health Savers Initiative, this new analysis suggests that MA plans might be overpaid by between $810 billion and $1.6 trillion over the next decade.

Private MA plans cost the federal government significantly more per beneficiary than FFS in large part due to diagnostic “coding intensity,” which makes MA enrollees look sicker than demographically similar enrollees in the FFS program. As we have written before, this behavior leads to substantial overpayments from the federal government to MA plans.

In the past, we and others have estimated the size of this overpayment by assuming MA beneficiaries have a similar risk portfolio to those in FFS Medicare. The new USC Schaeffer and MedPAC studies go further by attempting to measure the underlying health status of MA beneficiaries. Both find substantial favorable selection – meaning that the MA population is significantly healthier than the FFS Medicare population and thus are being overpaid more than prior estimates suggest.

By examining groups of enrollees that switched from FFS to MA over time, USC Schaeffer found that due to favorable selection into MA from 2015 through 2019, plans were overpaid by up to 14.4 percentage points. Through a similar type of analysis, MedPAC estimated MA favorable selection of 11 percentage points in 2019, also leading to overpayments.

These differences in health status are being missed by the system of risk adjustment in MA, which is supposed to adjust for health status in order to prevent private insurance plans from gaining advantage by enrolling healthier beneficiaries at the expense of sicker beneficiaries. This problem is in addition to overpayments due to coding intensity, where plans themselves can manipulate risk adjustment scores to make their beneficiaries appear sicker than similar FFS beneficiaries and garner higher plan payments.

USC Schaeffer estimates that overpayments, largely from the combination of favorable selection and coding intensity, totaled $75 billion in 2023.

In our brief, Reducing Medicare Advantage Overpayments, we estimated the magnitude of overpayment due to just coding intensity using both MedPAC research and a “Demographic Estimate of Coding Intensity” (DECI) method that assumes, controlling for demographics, MA members are no healthier or sicker than similar beneficiaries or traditional Medicare.

Combining these estimates with the new MedPAC and USC Schaeffer estimates for favorable selection, we find MA plans could be overpaid by $810 billion to $1.56 trillion through 2033, leading to an additional $140 billion to $260 billion in higher Medicare premiums.

Using MedPAC’s coding intensity estimate through the budget window and adding their estimate for favorable selection would result in $810 billion of overpayments through 2033. This translates into a $400 billion cost to the Medicare Part A trust fund and $140 billion of higher Part B premiums.

The Health Savers Initiative’s DECI estimates for coding intensity are higher than MedPAC’s. Combining the DECI estimates with USC Schaeffer’s favorable selection estimate through the budget window, overpayments could be around $1.56 trillion, with a $770 billion cost to the Part A trust fund and $260 billion in higher premiums.

To be sure, these estimates are highly imperfect and further research is necessary to determine the true size of the MA overpayments. It is also highly unlikely that reforms to risk adjustment would achieve the full amount of budgetary savings implied by these estimates. But under any estimating method, it is clear that the federal government is vastly overpaying MA plans with enormous federal budget ramifications.

Even under the lower-end estimates, the next decade of overpayments will boost the national debt by 2 percent of Gross Domestic Product (GDP) and advance Medicare trust fund insolvency by three years. Under the high-end estimate, overpayments are responsible for 5 percent of GDP in debt and advance the insolvency date by five years.

Medicare Advantage reforms are essential for keeping down costs for the federal government, the Medicare trust fund, and beneficiaries. Both the Centers for Medicare & Medicaid Services and Congress should take appropriate action to rein in overpayments.

Given the degree of overpayments, past experience shows that modest changes can put the program and the federal budget on better long-term footing and can be done without major disruptions to the services provided by MA that are enjoyed by a majority of Medicare beneficiaries.