Medicare Premiums Take Center Stage

Adding to the list of things lawmakers want to get done before the end of the year, Congress may take up a relatively obscure Medicare issue that could have significant consequences for some Medicare beneficiaries. Earlier today, House Democrats held a press conference calling for lawmakers to avert a significant Medicare premium increase that could hit a small subsection of beneficiaries next year, and a resulting increase in deductibles for all Medicare beneficiaries.

The issue at stake is the "hold harmless" provision that bars annual increases in Medicare Part B premiums from exceeding the dollar amount of a beneficiary's Social Security cost-of-living adjustment (COLA) for most enrollees. The provision usually does not come into play because Social Security benefits are generally much larger than Medicare premiums, meaning that even a small COLA should cause a large enough benefit increase to clear the bar.

However, with gas prices falling and remaining well below last year's prices, the Social Security Trustees predicted during the summer that there would be no Social Security COLA at all this year since there would be zero inflation. At the same time, Medicare Part B premiums will increase for 2016 because they are calculated for most beneficiaries as being roughly one-quarter of the average per-person Part B costs, which have grown; the deductible grows at the same rate.

Roughly 70 percent of Medicare Part B beneficiaries, therefore, will be protected from premium increases in 2016 due to the hold harmless provision, but the remaining 30 percent would have to shoulder the entire increase necessary to keep premiums at 25 percent of program costs (although the majority of these have their entire premium covered by Medicaid). These 30 percent include:

- High-income beneficiaries who pay higher premiums at 35-80 percent of program costs;

- New beneficiaries;

- Beneficiaries who have not started receiving Social Security;

- Low-income beneficiaries who have their premiums paid by Medicaid; and

- Certain state and local employees who do not participate in Social Security.

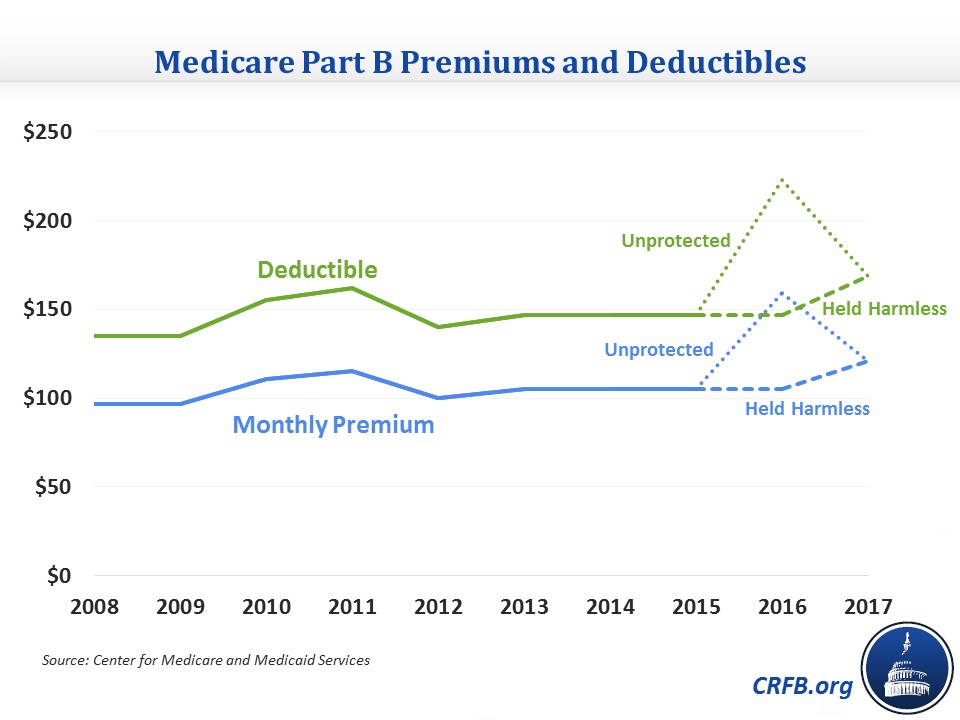

The lack of a COLA for 2016 and resulting impact of the hold harmless provision will cause a steep premium increase both for these beneficiaries and state Medicaid programs. The Medicare Trustees estimate that it will be a 52 percent increase, raising the standard monthly Part B premium from $104.90 to $159.30 per month (a $650 annual increase) and raising the premium for those making over $214,000 who pay the 80 percent premium from $335.7 to $509.8 (a more than $2,000 annual increase). Simultaneously, because the Part B deductible's growth is approximately pegged to premium growth, the deductible for all beneficiaries would rise from $147 to $223.

These increases are unprecedented and much steeper than the only other time this issue arose in 2010 and 2011, when premiums increased by "only" 15 percent. At that time, while a bill passed overwhelmingly in the House to prevent the 2010 premium increase, the Senate did not act, so the increase took effect as scheduled.

The reason that next year's projected increase is so much larger than 2010's is both because Part B spending is now growing faster and 2015 Part B expenditures were underestimated, meaning that premiums for 2016 were already set to rise to roughly $121/month for everyone, or by about 15 percent, before even accounting for the effects of hold harmless.

Secretary of Health and Human Services Sylvia Mathews Burwell has said that she will try to use her authority to limit the premium increase. Barring that, it would cost about $10 billion to freeze everyone's premiums at 2015 levels or about $7.5 billion if the unprotected beneficiaries' premiums were allowed to simply increase as normal with program costs.

To some extent, the talk about the premium increases somewhat overstates the urgency of dealing with it. The primary groups experiencing the premium increase include the most well-off 5 percent of beneficiaries who pay higher premiums already, new beneficiaries who aren't really experiencing increases since they didn't pay Medicare premiums before (and may be better off relative to their previous insurance), and dual eligibles who don't pay Medicare premiums anyway. The increase does have the potential to cause an issue for state budgets, though, who unexpectedly have to cover the higher premiums for dual eligibles, and it could cause hardship for some of those in the remaining categories of beneficiaries outlined above.

If lawmakers wish to limit or eliminate the premium and deductible increases, they should offset the cost. There are plenty of small health care options that could work as offsets. One closely-related policy would be to freeze the income thresholds at which some beneficiaries pay higher income-related premiums for another three years. Those thresholds, which normally grow with inflation, will remain where they are through 2019; extending this freeze through 2022 would be roughly enough to offset the cost of holding down Medicare premiums in 2016. Another option could be to adopt a policy from the President's Budget to increase the Part B deductible by $25 in 2019, 2021, and 2023 for new beneficiaries, saving $7 billion.

There are also many other small options to reduce health care spending that are listed in the table below.

| Options to Offset Premium Changes | |

| Policy | Ten-Year Savings |

| Freeze means-tested premium thresholds for 3 years through 2022 | ~$10 billion |

| Increase Part B deductible for new beneficiaries | $7 billion |

| Encourage generic drug use by low-income beneficiaries | $18 billion |

| Accelerate discounts in the Part D "donut hole" | $17 billion |

|

Increase Medicaid drug rebates

|

$10 billion |

| Reduce indirect medical education cost reimbursement | $8 billion |

| Encourage more efficient use of physician-administered drugs | $7 billion |

| Accelerate development of generic drug equivalents | $7 billion |

| Limit Medicaid DME reimbursement to Medicare rates | $4 billion |

Source: CBO

Lawmakers could also look at ways to make the hold-harmless provision less punitive for those are not protected. One way would be to not require the unprotected beneficiaries to make up all of the increases themselves. Instead, those unprotected could have their premiums increase as they would have under the normal calculation, while the protected beneficiaries would make up the premium increase they were exempted from over the next few years by having their premiums grow slightly more than they would with the standard calculation. This would ensure a smoother path for premiums while not adding to deficits.

If lawmakers want to address the large premium increases set to occur next year for some beneficiaries, they should have no difficulty doing it in a fiscally responsible manner. Not only are there many policies that would offset the cost of averting the increases, they could also restructure the hold harmless provision to smooth out the premium increases without adding to deficit. Either way, there is no need to make our fiscal issues worse.