Latest Health Spending Projection Shows Higher Spending Growth Ahead

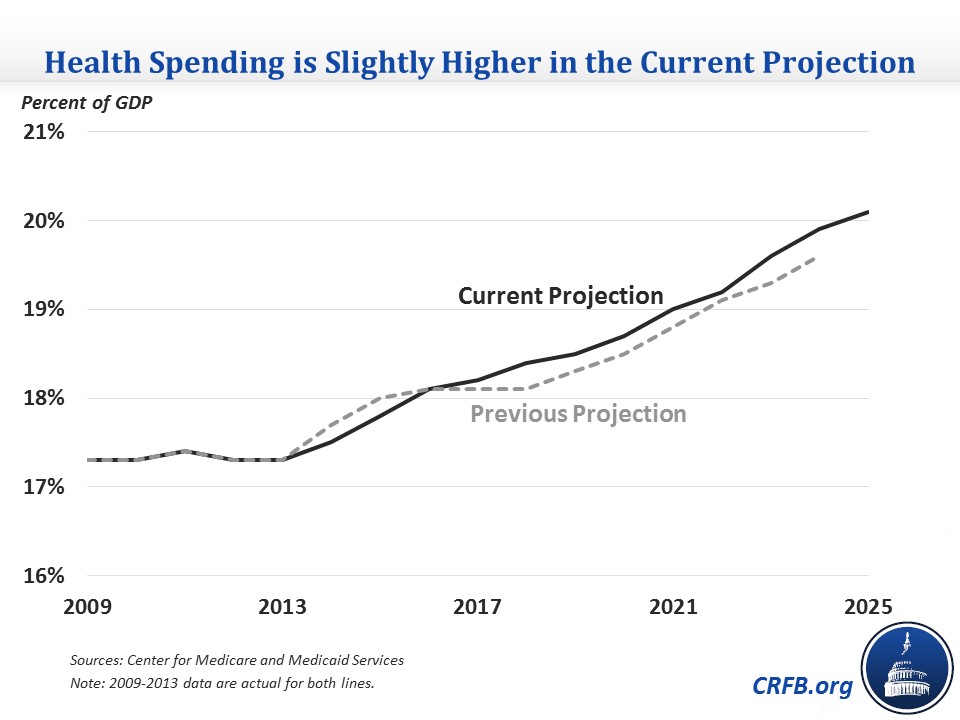

The Center for Medicare & Medicaid Services (CMS) released its National Health Expenditure (NHE) projections for 2015-2025 last week. National health spending is important for the federal budget given all of the different ways the federal government provides or subsidizes health care. CMS's projections show that health spending will continue to grow as a share of the economy in the coming years with spending growth rising somewhat from the very slow growth from 2010-2013, mostly attributable to increasing costs of care and an aging population. The projections update previous ones from last July and are largely similar: nominal dollar health spending is slightly lower, but spending as a share of Gross Domestic Product (GDP) is slightly higher.

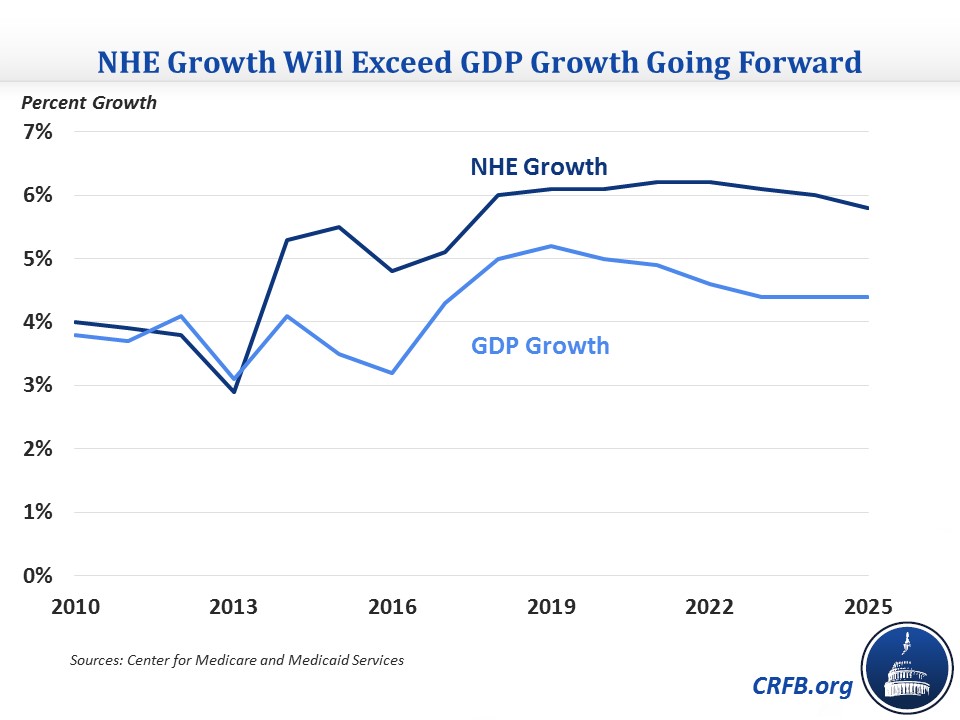

After NHE spending growth increased from 2.9 percent to 5.3 percent between 2013 and 2014, it is estimated to have ticked up slightly again to 5.5 percent in 2015. Growth will subside slightly in 2016 and 2017 to rates of 4.8 percent and 5.1 percent, respectively, then stabilize at a 6.1 average percent from 2018 through 2025. Health spending will grow faster than the economy during each year of the 2015-2025 period, resulting in health spending increasing from 17.5 percent of GDP in 2014 to 20.1 percent by 2025. This is in contrast to 2009-2013 when health care spending as a share of GDP remained flat at about 17.3 percent.

Overall, NHE growth will average 5.8 percent over the 2015-2025 period, 1.3 percent faster than GDP growth. This is an increase above the NHE growth rate the years following the Great Recession when growth averaged 4.0 percent from 2010 to 2014 but also below the growth rates that prevailed prior to the recession from 2000 to 2007 when NHE growth averaged 7.5 percent, which was 2.5 percent faster than economic growth.

Within the overall numbers, there are some interesting trends worth examining.

Enrollment and Spending by Category

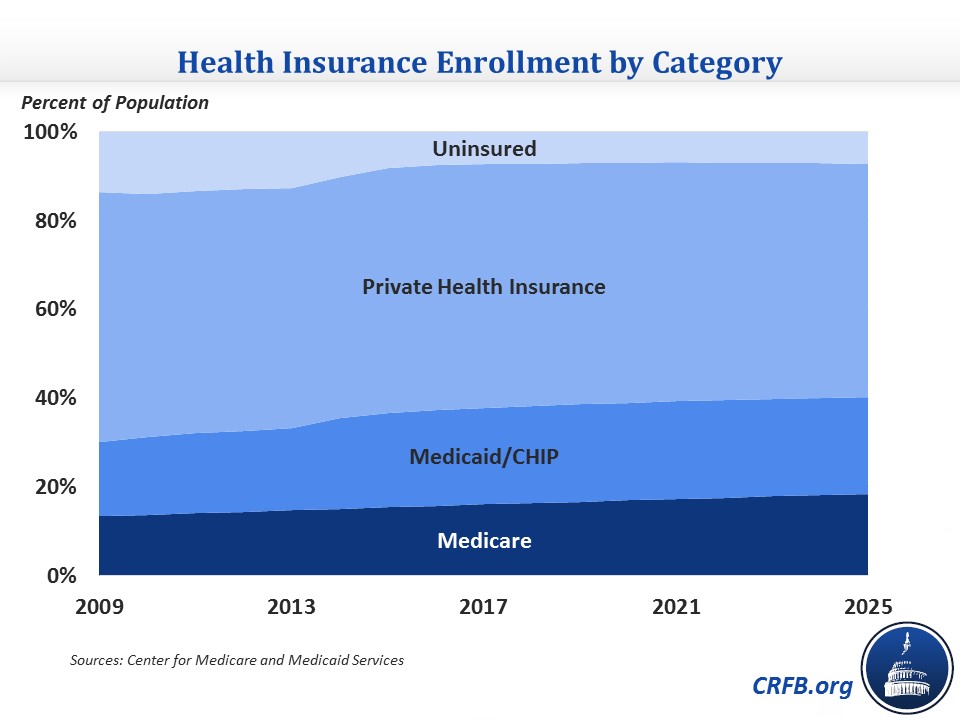

Not surprisingly, the Affordable Care Act (ACA) has changed the composition of health spending and enrollment in insurance coverage, and that composition is also expected to change going forward. Enrollment in Medicaid has increased from about 17 percent of the population in 2013 to 20 percent in 2015, where it is expected to stabilize. Medicare enrollment, which has already grown as a share of the population from about 13 to 15 percent since 2013, will grow further to 18 percent by 2025 as more baby boomers retire. Individual private insurance has also edged up from covering 6 percent of the population to 7 percent in 2015 and will grow to 8 percent by 2025. On the other hand, employer-sponsored insurance coverage will fall from 55 percent of the population in 2015 to 52 percent by 2025 as other sources of coverage take on a greater market share. The uninsured rate has declined from 14 to 9 percent between 2013 and 2015 and is expected to decline further to 7 percent by 2020, when 26 million people will be uninsured.

Spending composition will change similarly. Medicare spending will increase from 20 percent of NHE in 2015 to 23 percent by 2025 because of both the greater number of beneficiaries and the aging of beneficiaries within the program. Medicaid spending has risen from 15 percent of NHE in 2012 to 17 percent in 2015 and will stabilize there. Private health insurance will decline as a share of NHE from 33 percent in 2015 to 31 percent by 2025 as a result of the lower share of enrollment and the older baby boomers leaving the private market and enrolling in Medicare. Out-of-pocket spending is expected to very gradually decline over time from 11 percent of NHE in 2015 to 10 percent in 2025.

Prescription Drugs

Prescription drug spending was a major factor in the pick-up of health spending growth after 2013, as a slowdown in patent expirations and new specialty drugs reversed trends that had previously led to very slow spending growth. Prescription drug spending growth increased 9.8 percentage points in a single year, jumping from 2.4 percent in 2013 to 12.2 percent in 2014, and though it will subside in the next few years, it will grow faster than overall health spending every year through 2025, settling in at 7 percent growth in 2025. As a result, prescription drugs' share of NHE will grow from 9 percent in 2013 to 11 percent in 2025. In general, CMS anticipates the growth in prescription drug spending to slow in the near term because fewer and less expensive new drugs will be approved in the coming years than in the last few, but increased use of prescription drugs due in part to population aging will drive spending growth in the latter half of the decade.

Cadillac Tax

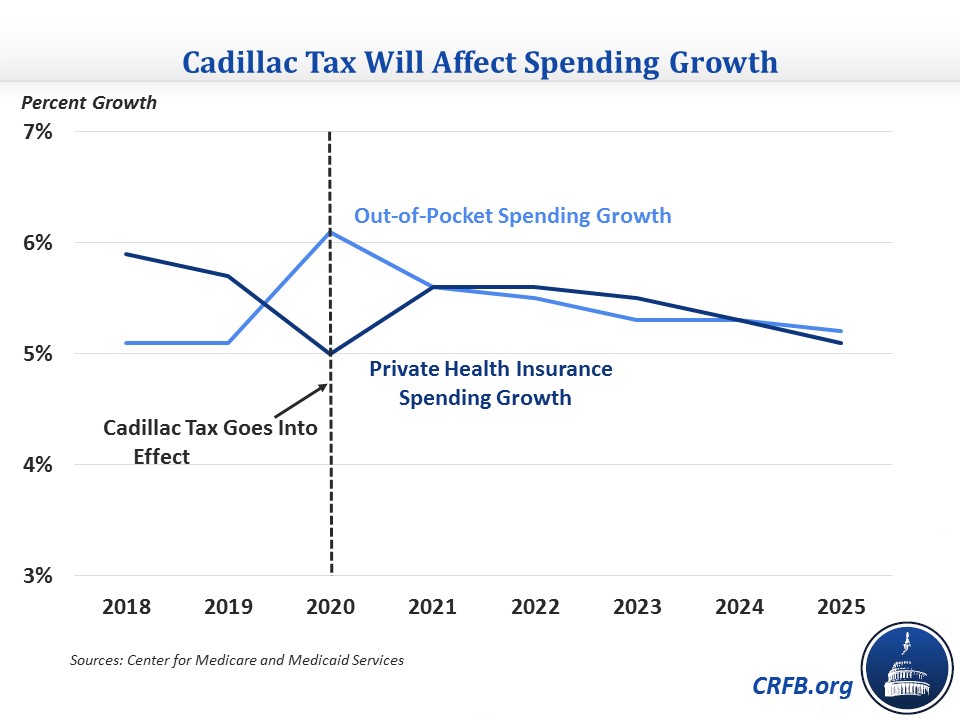

The Cadillac tax is a 40 percent excise tax imposed on employer-provided insurance plans with a value greater than $10,200 for individual coverage and $27,500 for family coverage. The tax was originally supposed to go into effect in 2018 but was delayed until 2020 in last year's tax deal. While there are questions about whether the tax will ever be allowed to go into effect, for now it is on the books and underlies CMS's numbers, particularly in 2020. Private health insurance spending growth is expected to dip from 5.7 percent in 2019 to 5 percent in 2020 as employers reduce the generosity of their insurance packages then recover to 5.6 percent in 2021. The flip side is that out-of-pocket spending growth jumps from 5.1 percent in 2019 to 6.1 percent in 2020 before falling back to 5.6 percent in 2021. CMS cites the Cadillac tax as slowing the rate of growth of private health insurance spending in the years after the tax goes into effect.

High-Deductible Insurance Plans

Physician services is one major category that is expected to grow slower than overall health spending. CMS attributes this to the increased prevalence of high-deductible insurance plans, whose higher cost-sharing tends to disproportionately affect the use of physician services. High-deductible plans also show up in out-of-pocket spending growth, and CMS expects those plans to contribute to higher spending growth in the latter part of the decade (5.4 percent from 2020 to 2025) than during the first part of the decade (4.1 percent from 2015 to 2019).

*****

Overall, health spending will grow as a share of the economy over the next decade as it has in the past, albeit at slightly lower rates. This excess cost growth is part of the reason that the Congressional Budget Office forecasts continuously growing health care spending as a share of GDP over the long term, a major factor in growing debt. CMS's projections show that while the health spending outlook is a little bit more favorable than it has been historically, lawmakers still have work to do to get it under control.