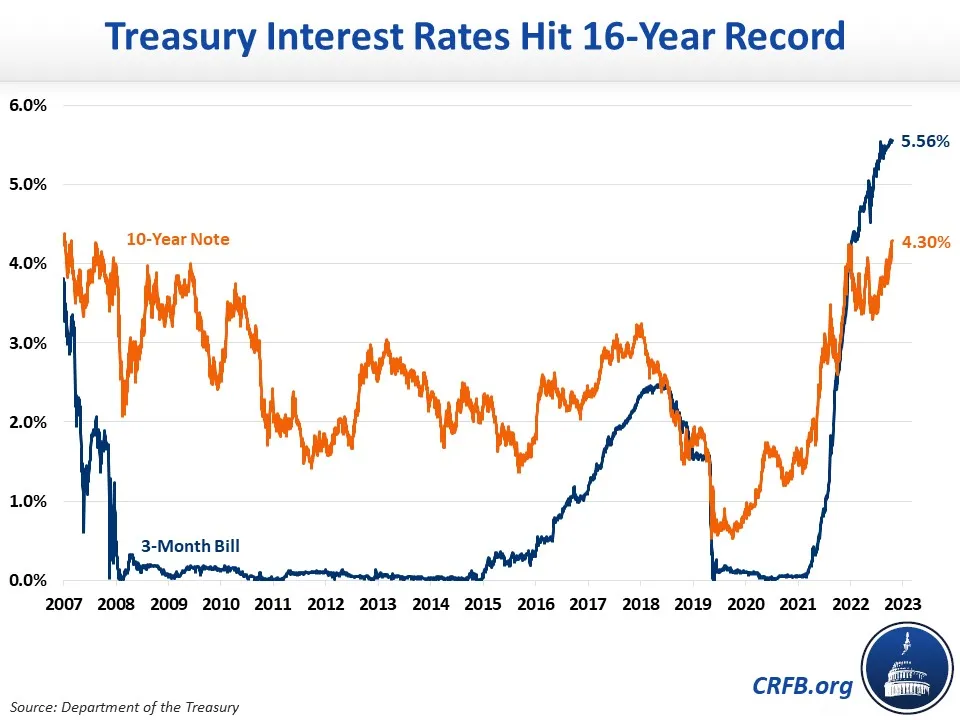

Interest Rates Hit 16-Year Record

Interest rates are on the rise, with daily Treasury yields up in nearly every maturity since the beginning of August. This piece takes a closer look at what's going on with Treasury interest rates, showing:

- Treasury yields are at a 16-year high, with the ten-year note closing at 4.30 percent on Thursday.

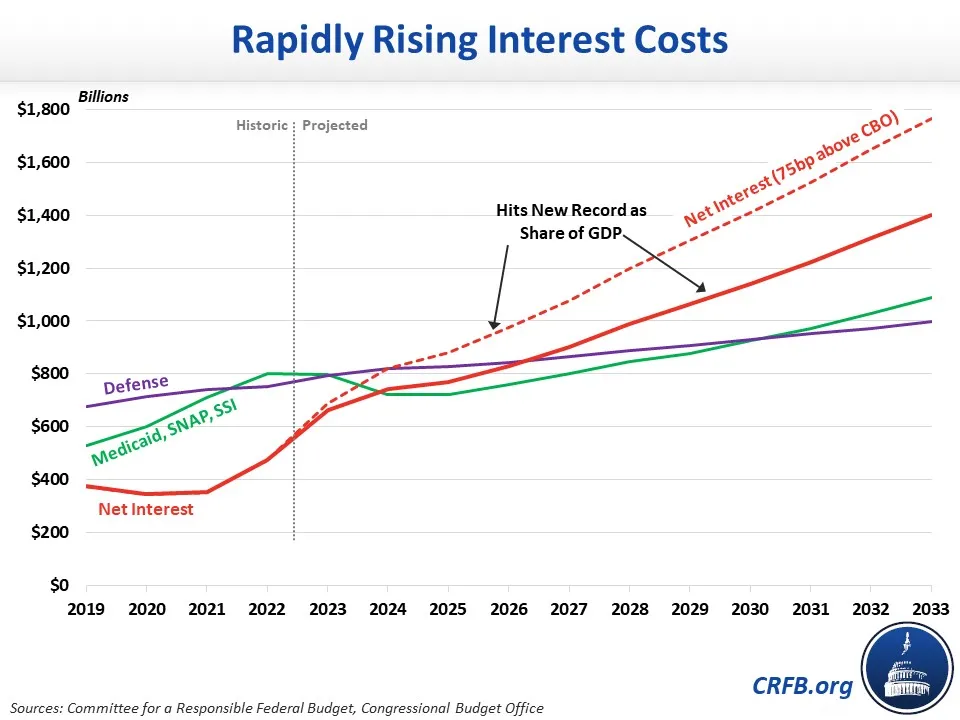

- Average interest rates are roughly 75 basis points above the projections in the Congressional Budget Office's (CBO) baseline; if this gap remained, it would add $2.3 trillion to the debt over the next decade.

- All rates are above the expected long-term rate of nominal growth of 3.8 percent according to the Federal Reserve or 3.7 percent according to CBO; if interest rates remain above the growth rate (r>g), it could create the risk of a debt spiral.

The ten-year Treasury Note interest rate closed at 4.30 percent on Thursday, the highest since 2007. Meanwhile, the three-month Treasury Bill rate closed at 5.56 percent and the 30-year Treasury Bond at 4.41 percent. All three are at or near their highest level in 16 years. Interest rates have been on the rise over the last two and a half years, growing from 0.93 percent at the beginning of 2021 to around their pre-pandemic level of 2 percent by March of 2022 and 3.5 to 4 percent through most of 2023. Rates have increased further and dramatically in just the past few weeks, with the ten-year rate rising over 50 basis points from 3.75 percent on July 19 to 4.30 percent on August 17.

CBO's most recent baseline projections are based on a ten-year rate of 3.9 percent and a three-month rate of 4.6 percent this quarter. Based on this, we estimate that interest rates across the yield curve average about 75 basis points above baseline projections. If rates remain 75 basis points above CBO’s projections, it could add $2.3 trillion (6 percent of Gross Domestic Product) to the debt over the next ten years and $350 billion (0.9 percent of debt-to-GDP) to the deficit in 2033. Under that scenario, interest costs would exceed combined spending on Medicaid, SSI, and SNAP as well as spending on defense by next year. By 2026, the cost of interest would reach a record high 3.3 percent of the economy.

With yields across the curve ranging from 4.2 to 5.6 percent, interest rates on newly issued debt are now likely above the expected long-term growth rate of nominal GDP, which is 3.8 percent according to the Federal Reserve or 3.7 percent according to CBO.

Although rates may come down, if interest rates remain above the growth rate (r>g), it puts the United States at risk of a debt spiral, where debt-to-GDP grows even if deficits, excluding interest, are brought under control. We’ll write more about this possible debt spiral in a future piece.

Even if interest rates quickly fall back to CBO’s projections, debt is on track to reach a record share of the economy by 2029 and interest will cost $10 trillion over the next decade. Rising Treasury interest rates will put even more pressure on our high and rising debt. The best way to mitigate these costs is through thoughtful and responsible fiscal reforms that limit additional borrowing, reduce inflationary pressures, push down interest rates, and support stronger economic growth.