Debt Explodes Under Alternative Scenarios

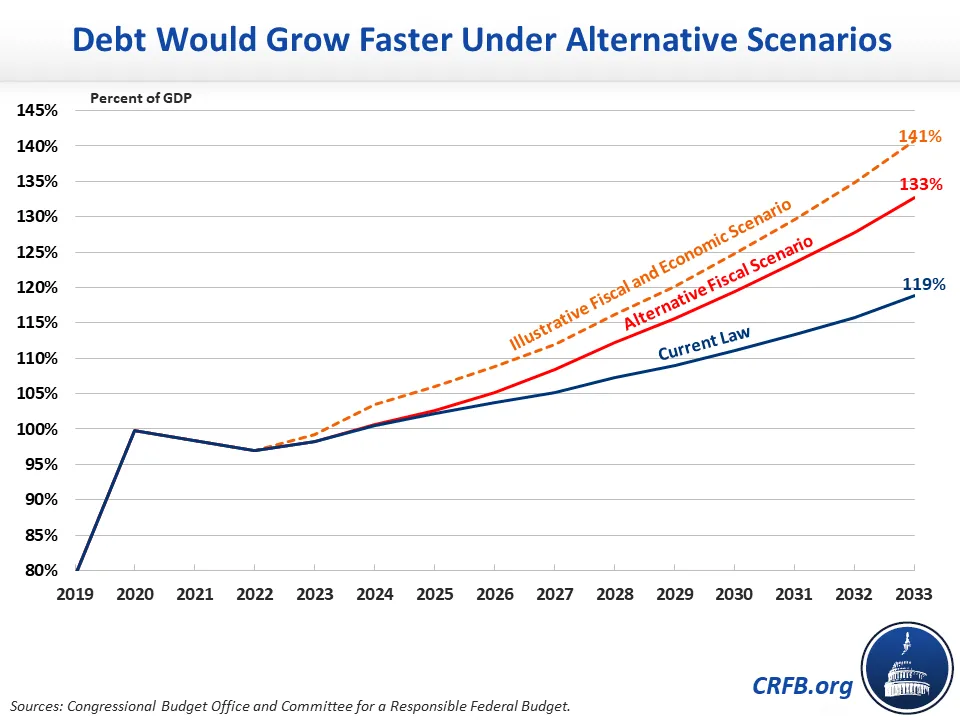

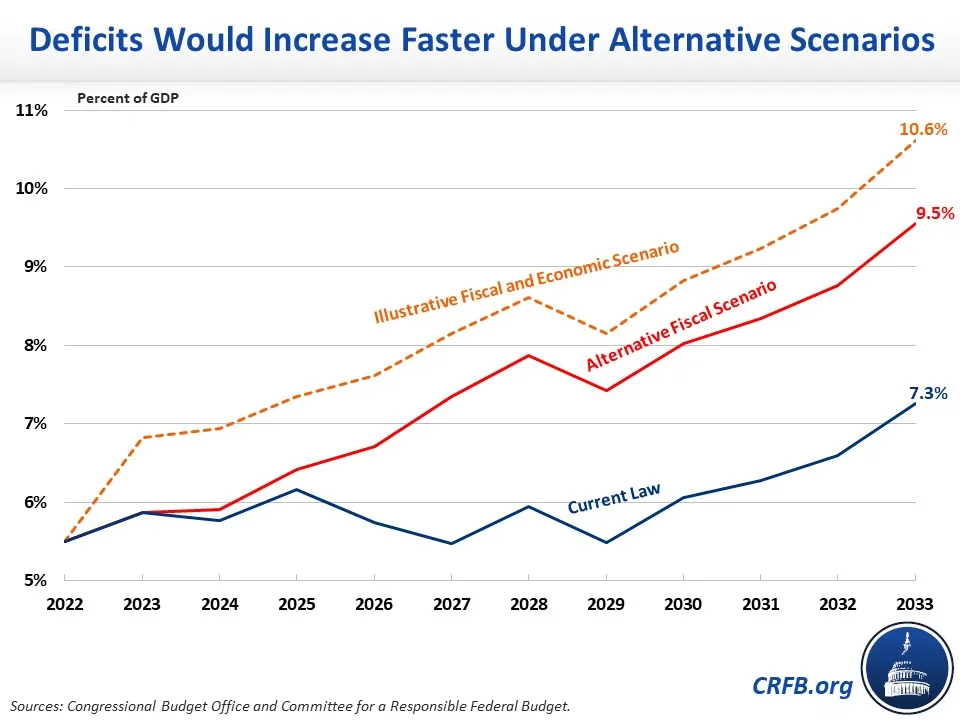

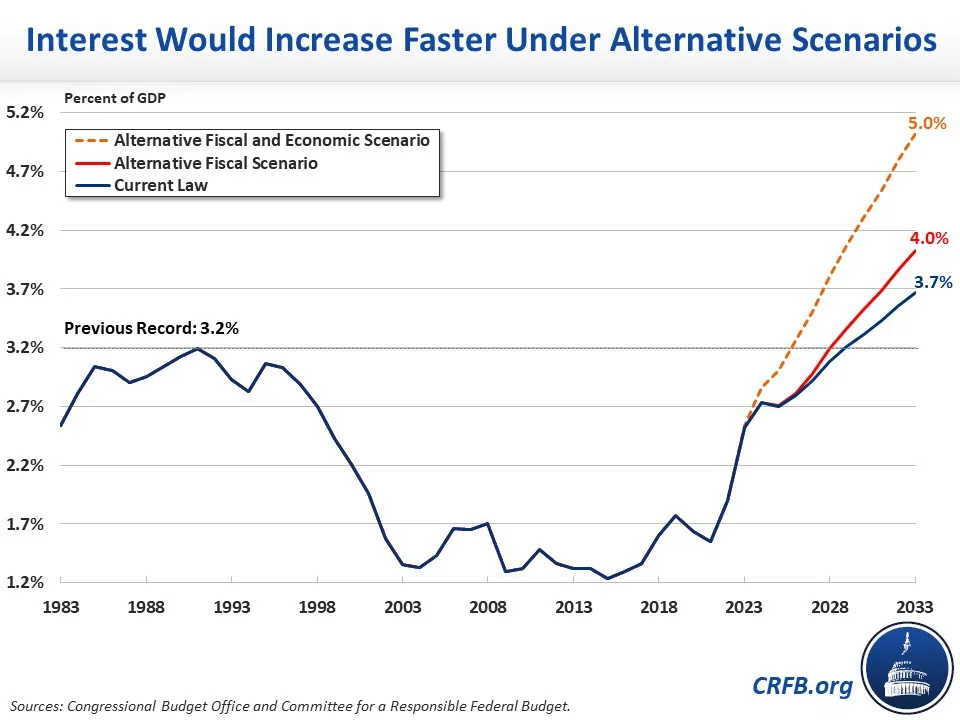

The Congressional Budget Office's (CBO) new ten-year budget projections estimate that debt will reach a record 119 percent of Gross Domestic Product (GDP) by the end of Fiscal Year (FY) 2033, and the reality could be far worse if lawmakers extend various provisions, based on new estimates from CBO. Under an Alternative Fiscal Scenario where discretionary spending grows with the economy and expiring provisions, such as those in the Tax Cuts and Jobs Act (TCJA), are extended, we estimate debt would reach 133 percent of GDP by 2033. Under a more pessimistic set of economic assumptions, debt could grow to 141 percent of GDP. In these scenarios, deficits would reach 9.5 to 10.6 percent of GDP and interest would grow to a record 4.0 to 5.0 percent of GDP.

CBO's baseline budget projections reflect current law, meaning they do not include the fiscal impact of any future legislation or administrative actions, even for temporary policies that are routinely extended. They also assume appropriations will grow at the rate of inflation – despite recent trends of higher growth and new national security challenges. Should lawmakers extend expiring provisions without offsets or grow discretionary spending faster than inflation, the fiscal outlook could be far worse.

Under our Alternative Fiscal Scenario, the federal government would borrow an additional $5.4 trillion through FY 2033, on top of the $21.9 trillion it is already projected to borrow under current law. This includes $3.1 trillion from extending various parts of the Tax Cuts and Jobs Act and $1.7 trillion from growing appropriations at about the pace of the economy, which would lift defense and/or nondefense discretionary spending by about one percentage point of GDP above the baseline. It also includes over $270 billion of costs from extending the enhanced Affordable Care Act (ACA) health insurance subsidies temporarily expanded in the Inflation Reduction Act, and nearly $550 billion of higher interest costs from these policy changes.

Bridge From Current Law to Alternative Fiscal Scenario

| Assumptions in Alternative Scenarios | 2023-2033 Cost | Percent of GDP |

|---|---|---|

| Current Law Deficits | $21,854 billion | 6.1% |

| Extend TCJA Individual Rate Cuts | $1,810 billion | +0.5% |

| Extend TCJA Other Individual Provisions | $678 billion | +0.2% |

| Extend TCJA Estate Tax Cuts | $126 billion | +0% |

| Extend TCJA Bonus Depreciation | $325 billion | +0.1% |

| Remove Other TCJA Tax Rule Tightening | $150 billion | +0% |

| Grow Discretionary Spending with GDP | $1,693 billion | +0.5% |

| Remove Certain Extrapolated One-Time Infrastructure Funding | -$228 billion | -0.1% |

| Extend Enhanced ACA Premium Tax Credits | $271 billion | +0.1% |

| Extend Other Temporary Tax Provisions ("Tax Extenders") | $56 billion | +0% |

| Extend Trade Promotion Programs | $15 billion | +0% |

| Interest | $544 billion | +0.2% |

| Increase in Deficits Under Alternative Fiscal Scenario | $5,441 billion | +1.5% |

| Deficits Under Alternative Fiscal Scenario | $27,295 billion | 7.6% |

| Deficits Under Illustrative Fiscal and Economic Scenario | $30,567 billion | 8.5% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget. Numbers may not sum due to rounding.

Actual debt could rise even faster than under this scenario if ongoing inflationary pressures and other factors result in tighter monetary policy, higher interest rates, and enhanced recession risk. In a more pessimistic Illustrative Fiscal and Economic Scenario that incorporates recent revenue losses, assumes the economy enters into a recession over the next few years, and projects higher interest rates,1 we estimate there could be an additional $8.7 trillion of borrowing over the next decade.

Under either scenario, deficits would grow much faster than current law. While deficits will reach 7.3 percent of GDP ($2.9 trillion) by FY 2033 under CBO's baseline, they will grow to 9.5 percent of GDP ($3.8 trillion) under our Alternative Fiscal Scenario. Under our Illustrative Fiscal and Economic Scenario, they will further grow to 10.6 percent of GDP ($4.2 trillion).

In addition, both scenarios would push interest payments on the national debt to record levels. Interest costs previously peaked at 3.2 percent of GDP in FY 1991 and are projected to grow significantly under current law, from 2.5 percent of GDP in 2023 to a record 3.7 percent by 2033. Under the Alternative Fiscal Scenario interest would increase further to 4.0 percent of GDP by 2033, and interest would rise to 5.0 percent of GDP by 2033 under our Illustrative Fiscal and Economic Scenario.

Since the federal debt is unsustainable even under current law, policymakers should avoid making it even worse. In particular, they should cap the growth of discretionary spending and should reject calls to extend any elements of the 2017 Tax Cuts and Jobs Act without offsets. Instead of worsening the debt, policymakers will need to enact substantial deficit reduction in order to put the debt on a more sustainable path.

Summary of Budget Projections Under Current Law and Alternative Scenarios

| Metric | 2033 Deficit | 2033 Debt | 2033 Interest |

|---|---|---|---|

| Nominal Dollars | |||

| Current Law | $2.9 trillion | $46.7 trillion | $1.4 trillion |

| Alternative Fiscal Scenario | $3.8 trillion | $52.1 trillion | $1.6 trillion |

| Illustrative Fiscal and Economic Scenario | $4.2 trillion | $55.4 trillion | $2.0 trillion |

| Percent of GDP | |||

| Current Law | 7.3% | 119% | 3.7% |

| Alternative Fiscal Scenario | 9.5% | 133% | 4.0% |

| Illustrative Fiscal and Economic Scenario | 10.6% | 141% | 5.0% |

Sources: Congressional Budget Office and Committee for a Responsible Federal Budget.

1 The Illustrative Fiscal and Economic Scenario incorporates all of the assumptions in the Alternative Fiscal Scenario. In addition, we incorporate lower revenue collections in 2023, assume an economic recession in 2024, assume the federal funds rate will gradually fall to 3.5 percent (as opposed to 2.5 percent), and assume ten-year Treasury yields will gradually rise to 4.5 percent (as opposed to 3.8 percent). In part as a result of higher debt levels, we also assume long-term growth will be about 10 basis points lower than in CBO's baseline under this scenario. These estimates are extremely rough and could differ based on the nature of an economic recession.