How Much Will the Revised Health Bill Cost?

House Republicans are reportedly nearing a deal to vote on passage of the American Health Care Act (AHCA) to repeal and replace the Affordable Care Act (ACA or "Obamacare"). The deal comes with the addition of an amendment sponsored by Representatives Tom MacArthur (R-NJ) and Mark Meadows (R-NC), leaders of the Tuesday Group and Freedom Caucus, respectively. We are not able to estimate the cost of this amendment at this time, and unfortunately, Members do not appear poised to wait for an official score from the Congressional Budget Office (CBO). To the extent that the amendment is successful in expanding insurance coverage, however, it could prove costly and could wipe out some or all of the savings from previous versions of the AHCA.

The MacArthur amendment would make a few notable changes to the prior version of the AHCA by allowing states to change a number of the AHCA and ACA's insurance regulation through a presumptive waiver process, which would automatically grant states waivers unless the federal government denied them within 60 days of submission. Specifically, states could waive:

- The AHCA's 5:1 age-rating limit (beginning in 2018).

- The ACA's "community rating" rules – including those related to health status, which require insurance companies to charge the same price regardless of pre-existing conditions – conditional upon the establishment of a "high-risk pool" or other means of risk-sharing to cover those who may have especially high medical costs (beginning in 2019). However, insurance companies would still be barred from charging different prices based on gender.

- The ACA's Essential Health Benefits (EHB) requirements (beginning in 2020).

States that adopt these changes will likely be able to offer cheaper premiums for healthy individuals and thus increase the number of people with some type of insurance package. On the other hand, premiums would likely rise substantially for less-healthy individuals – to the point that requirements for coverage of pre-existing conditions are effectively rendered meaningless. The extent to which these individuals will be able to afford coverage will depend in part on the size and effectiveness of the high-risk pools.

The MacArthur amendment would be in addition to an amendment passed by the Rules Committee in the beginning of April, sponsored by Representatives Gary Palmer (R-AL) and David Schweikert (R-AZ), which would add $15 billion in additional funding for a "Federal Invisible Risk Sharing Program" to subsidize insurers with particularly expensive claimants. In addition to the Palmer amendment, the most recent version of the AHCA includes an extra $15 billion for maternity and newborn care funding in the Patient and State Stability Fund, as well as a delay of the repeal of the 0.9 percent Medicare Hospital Insurance (HI) surtax until 2023.

In late March, when Congress made its changes to the AHCA regarding EHBs and maternity care, we evaluated how those changes could affect the cost of the bill given different levels of additional coverage impact. That analysis is included below and updated for the addition of the MacArthur and Palmer amendments. Press reports have indicated that Representative Fred Upton (R-MI) is currently working on another amendment to further increase funding to risk pools; because it is not an official part of the bill yet, we have not included it in this analysis.

Based on our previous analysis, we believe changes to the bill could save as much as $5 billion or cost as much as $265 billion – likely reducing and perhaps even reversing the $150 billion in savings from the previous version of the bill.

How Much Will Amendments to the AHCA Cost?

The Palmer amendment passed in the beginning of April added $15 billion to the cost of the updated AHCA (though possibly less if CBO estimates it would reduce premiums), and the manager's amendment passed right before the scheduled vote added $15 billion for maternity and newborn care while delaying repeal of the Medicare HI surtax. The MacArthur amendment would allow states to apply for waivers of the ACA's community-rating provisions (if they have high-risk pools), the AHCA's 5-to-1 age-rating provision, and the “Essential Health Benefit” (EHB) rules that dictate what insurance plans must cover.

It is impossible to predict how many states will take advantage of this waiver process or the degree to which they will do so. However, as we explain above, changes to community rating or the EHB package will likely result in lower premiums for many beneficiaries – with those lower premiums in many cases accompanied by less generous benefits. Because the AHCA's tax credit is fixed, in many states insurance companies could be able to offer some type of insurance product that is cheap or completely free to the consumer. Lower premiums, even for less generous (but heavily subsidized) insurance, would tend to encourage more people to enroll in some type of health insurance package.

Importantly, the total effect of these changes on coverage is unknown at this point, and indeed this change may lead some people to purchase insurance packages that CBO does not view as sufficient to be considered “coverage.”

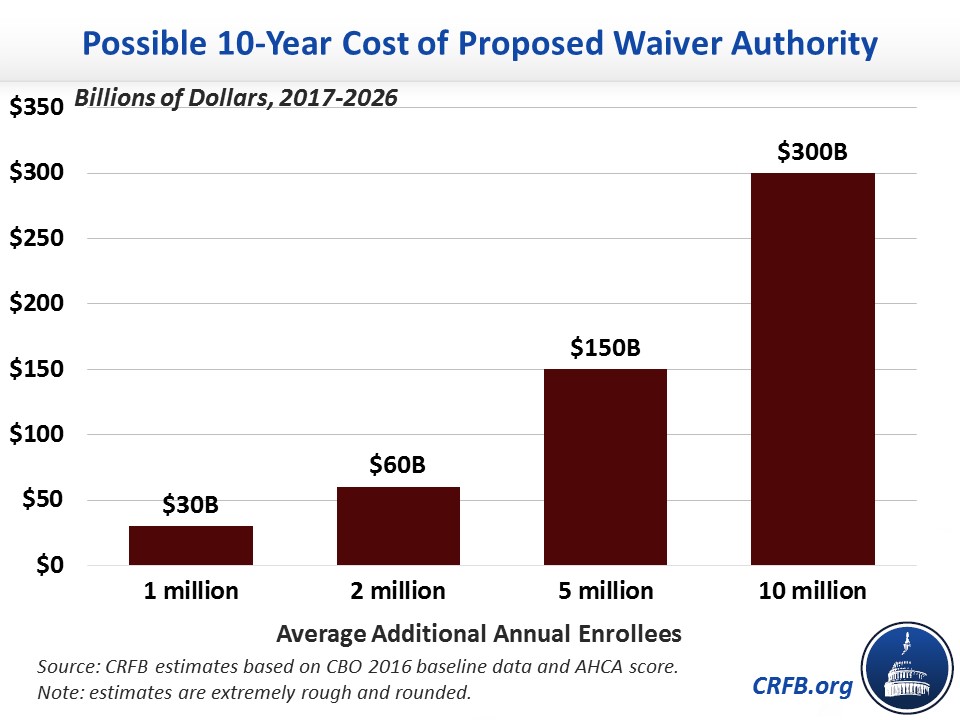

Setting aside the health policy implications of these changes, the fiscal implications could be significant. If more people purchase health insurance, more will be eligible for the AHCA’s tax credits. Assuming no change in employer coverage, we estimate an increase of one million enrollees would cost about $30 billion over a decade, two million would cost $60 billion, five million would cost $150 billion, and ten million would cost $300 billion.

Taken together, that means the amendments would save an additional $5 billion if one million more people enrolled in insurance each year than CBO's prior projection. But it would cost $25 billion if two million more people enrolled, $115 billion if five million more enrolled, and $265 billion if ten million did. With 6.5 million or more additional enrollees, the entire legislation would likely increase rather than reduce deficits.

Budgetary Effects of Palmer, Manager's, and MacArthur Amendments to American Health Care Act

| Provision | 10-Year Cost / Savings (-) Under Different Enrollment Assumptions | |||

|---|---|---|---|---|

| +1m enrolled | +2m enrolled | +5m enrolled | +10m enrolled | |

| Waiver Authority to Change Essential Health Benefits and Community Rating | $30 billion | $60 billion | $150 billion | $300 billion |

| Increase Patient and State Stability Fund for Invisible Risk Sharing | $15 billion | $15 billion | $15 billion | $15 billion |

| Increase Patient and State Stability Fund for Maternal and Newborn Care | $15 billion | $15 billion | $15 billion | $15 billion |

| Delay Medicare Tax Repeal | -$65 billion | -$65 billion | -$65 billion | -$65 billion |

| Total Cost / Savings of Amendments | -$5 billion | $25 billion | $115 billion | $265 billion |

| Total Fiscal Impact of AHCA with Amendments | -$155 billion | -$125 billion | -$35 billion | $115 billion |

Source: CRFB estimates. Note: enrollment refers to any package of health insurance eligible for tax credits and represents an average from 2018 to 2026. Estimates are rough and rounded.

Until we know the impact of the MacArthur amendment's changes, we won’t know how much of the $150 billion in deficit reduction from the second version of the AHCA – if any – will remain. Members should wait for a new CBO analysis before voting on this legislation. As CRFB president Maya MacGuineas argued in March, “Congress should not have to pass the bill to find out how much it will cost.”

Note (5/3/17): this post has been updated to clarify that waivers have presumptive approval.