Fiscal FactCheck: The First Democratic Debate

This blog is part of the “Fiscal FactCheck” series designed to examine the accuracy of budget-related statements made during the 2016 presidential campaign.

Last night marked the first Democratic Presidential debate, held in Las Vegas, and the candidates debated a number of different issues. While they did not mention any of our 16 Budget Myths to Watch Out For in the 2016 Presidential Campaign, there were other claims that related to the federal budget. Below is our analysis of these claims, and be sure to check our other fact checks of the first and second Republican debates.

Eliminating the Payroll Tax Cap Could Extend Solvency to 2061 and Allow for Expanded Benefits

Sen. Bernie Sanders (I-VT) discussed his plans to increase Social Security benefits and extend the program's solvency by saying "And the way you expand it is by lifting the cap on taxable incomes so that you do away with the absurdity of a millionaire paying the same amount into the system as somebody making $118,000. You do that, Social Security is solvent until 2061 and you can expand benefits." He is presumably referring to his plan that the Social Security Administration (SSA) evaluated in 2013, a plan that taxed all income over $250,000 and allowed the current payroll tax cap to eventually catch up so that all income was taxed. This plan did extend solvency to 2061 -- leaving a deficit of 1.5 percent of payroll in 2062, growing to 2 percent by 2090 -- but did not also increase benefits. If it had increased benefits, the insolvency date would be sooner.

SSA currently estimates that eliminating the payroll tax cap immediately would extend solvency to 2066, or 2080 if additional benefits were not credited based on the new taxes, so there would be some room to expand benefits and still extend solvency to 2061. Sen. Sanders's most recent plan would expand benefits by changing the benefit formula and by calculating cost-of-living adjustments using the faster-growing CPI-E, and the plan would extend solvency until 2065 – but it relies on a 6.2 percent investment income tax on high earners in addition to eliminating the cap. We estimate that the insolvency date would be in the early 2050s if the investment tax was not included.

The Top 0.6 Percent of Americans Generate 30% of the Revenue

Gov. Lincoln Chafee (D-RI) said “So let's go back to the tax code. And 0.6 percent of Americans are at the top echelon, over 464,000, 0.6 Americans. That's less than 1 percent. But they generate 30 percent of the revenue.” Those numbers line up with the most recent data. In 2013, almost 900,000 tax returns, or 0.6 percent of the tax returns filed, included some income that was taxed at the highest rate of 39.6 percent, which in 2015 applies to incomes over about $413,000 for single people and $465,000 for couples. Those returns paid almost $370 billion, or 30 percent of that year’s total income tax revenue, while earning 14 percent of all adjusted gross income.

The percentage that pays at the top rate is slightly smaller than 0.6 percent if you include all Americans, since IRS data only shows that 0.6 percent of tax returns paid at the top rate. More than 27 million people did not file a tax return at all in 2013 according to the Tax Policy Center. When counting these Americans, the number is slightly lower at 0.5 percent.

Also, this analysis looks at only income tax revenue. The share of total revenue contributed by this group would likely be smaller since they pay a much smaller share of payroll and excise taxes than they do income taxes.

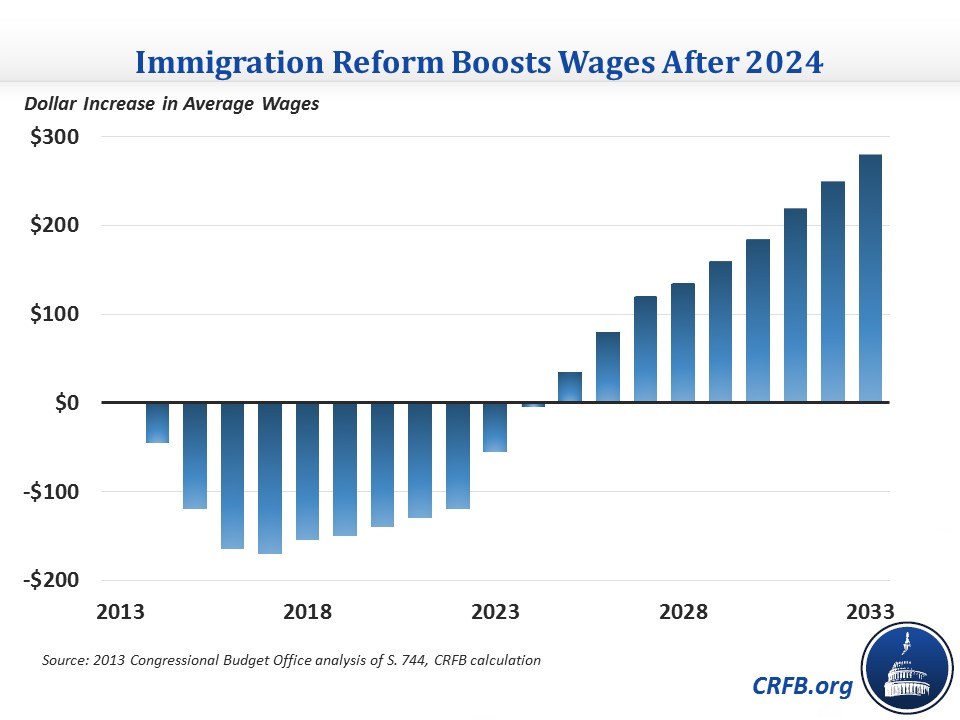

Immigration Reform Will Increase Annual Wages by $250

One claim made by former Gov. Martin O' Malley (D-MD) during last night’s debate is that immigration reform will "make wages go up in America $250 for every year."

This number comes from a calculation done by the White House regarding the 2013 Senate immigration reform bill (S. 744). When the Congressional Budget Office (CBO) did an economic analysis of this legislation, they estimated that the average real wage of the entire labor force would be 0.5 percent higher in 2033, 20 years in the future at the time of the analysis. The White House then calculated what this would be in dollar terms.

However, the effect on immigration reform on average wages is not uniform in every year. Immigration reform increases the labor supply in the United States. In the short and medium term, it would decrease average wages, as the ratio of capital to labor would decrease slightly, depressing wages by as much as 0.3 percent in 2017 and about 0.1 percent in 2023. Increased productivity would then result in wages being higher than they otherwise would be in 2025 and beyond. The analysis implies that wage increases would be higher than the 2033 effect in future years, which would mean the wage increase would be larger than $250 beyond 2033.

CBO does specify in their report on the legislation that the short-term reduction in wages does not necessarily mean lower wages for current residents:

The estimated reductions in average wages and per capita GNP for much of the next two decades do not necessarily imply that current U.S. residents would be worse off, on average, under the legislation than they would be under current law. Both of those figures represent differences between the averages for all U.S. residents under the legislation—including both the people who would be residents under current law and the additional people who would come to the country under the legislation.

*****

As the election season continues, we’ll continue fact checking fiscal statements by the candidates on our Fiscal FactCheck page. If you feel we left a particular claim out that should be addressed, contact us and we will do our best to run the claim through our Fiscal FactCheck.