Does 3% Growth Mean We Can Go Much Higher?

Yesterday, President Trump gave a speech in which he mentioned that the U.S. economy grew 3.0 percent in the second quarter. While this is a solid quarter of growth, it is important to remember 3 percent growth in one quarter is much different than the Administration's stated goal of 3 percent growth sustained for a decade. One strong quarter is not a harbinger of sustained growth because the economy naturally fluctuates in the short term.

During a speech on tax reform, President Trump said:

"We just announced that we hit 3 percent in GDP... I happen to be one who thinks we can go much higher than 3%. There is no reason why we should not."

There are major differences between the economic implications of quarterly and sustained growth. Achieving 3 percent for one quarter means very little for Gross Domestic Product (GDP) over the next decade.

3 Percent Quarterly Growth Is Not Unheard Of

The President is correct that the revised estimate of second quarter real GDP growth showed that the economy grew 3 percent on a seasonally-adjusted annual basis. Our economy has not had 3 percent growth over a ten-year period since the decade ending in 2006, but 3 percent quarterly growth is not out of the ordinary in the current business cycle.

Since the Great Recession officially ended in June 2009, quarterly growth rates have varied significantly, ranging from a low of -1.5 percent to a high of 5.2 percent. Although the 3.0 percent growth rate for the second quarter of this year is faster than the 2.2 percent average quarterly growth rate for the current business cycle, it is not atypical.

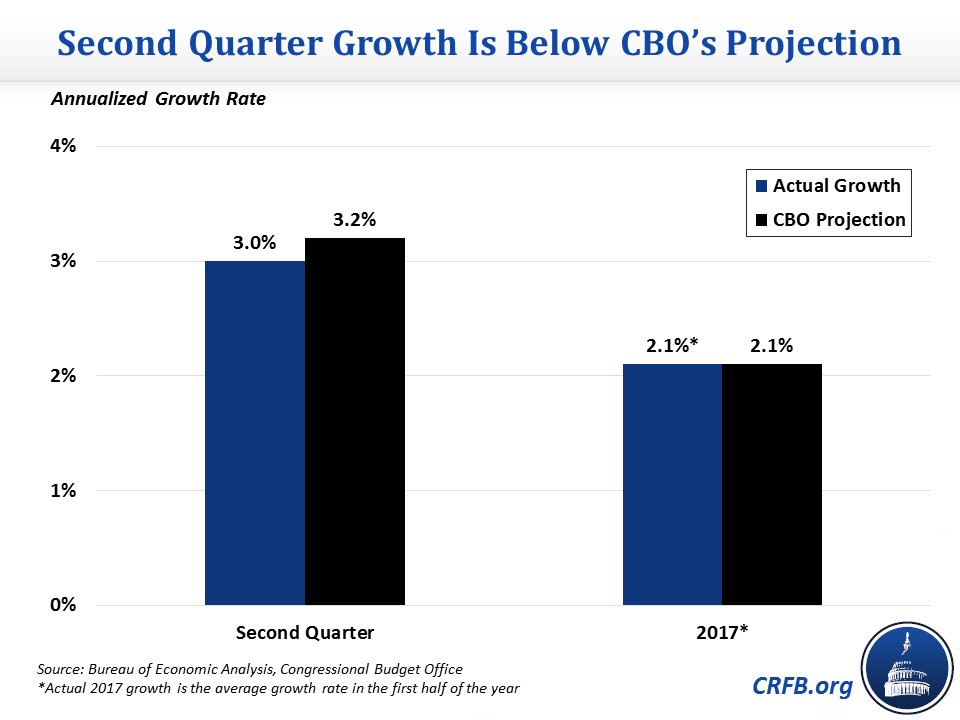

3 Percent Quarterly Growth Is Below CBO's Projection

While CBO expects 2.1 percent growth this calendar year, its expectation for this quarter was actually higher than the actual amount at 3.2 percent. So far, growth this year is in line with CBO's projection for the whole year.

Sustaining High Levels of Growth

It is quite possible for the economy to achieve 3 percent growth for a temporary period, but much more difficult to sustain that level of growth. Growth can accelerate in the short term if there is an output gap and actual GDP is catching up to potential GDP, or if actual GDP temporarily pulls ahead of potential GDP.

However, these short-term developments should not be confused with the potential GDP growth that drives long-term economic prosperity. Accelerated GDP growth will eventually close an output gap, and if actual GDP goes far enough above potential, it would cause inflationary pressure and result in monetary tightening from the Federal Reserve to bring GDP back in line. In other words, GDP growth will ultimately fall in line with potential growth.

Since CBO estimates a relatively small output gap that is already expected to close next year, lawmakers would need to increase potential growth to achieve the 3 percent goal. As we have noted before, there is little historical precedent for the rates of labor force, capital, or productivity growth that would be necessary to get to 3 percent sustained economic growth, and there is little reason to think that the President's policies would boost growth enough to reach 3 percent (even though the President's budget assumes 3 percent sustained growth). Our paper How Fast Can America Grow? also shows there is no plausible path to sustained 4 percent growth.

While the President may hope for future growth rates higher than 3 percent, they are likely to only occur on a temporary basis. No other economic forecaster outside the Administration expects long-term growth rates remotely close to 3 percent.

The key reason why most forecasters predict future economic growth will be well below its historical average is the aging of the population. The gradual retirement of the baby boom generation will limit labor force growth, which is projected to contribute only about one-quarter of what it has historically to real GDP growth. Demographics are also likely to contribute to lower savings and investment, as the baby boomers will start drawing down their retirement savings and growing Social Security and Medicare costs will lead to higher public debt. In addition, the recent productivity slowdown is widely expected to continue to some extent, in part because many older, more productive workers will soon be leaving the labor force.

So what does the 3 percent second quarter growth rate mean for the Trump Administration's goal of 3 percent sustained growth and the President's assertion that we could see even higher growth? Very little. Quarterly and sustained growth are distinct economic measures with vastly different economic implications. While 3 percent quarterly growth is a positive sign, it is not the same as 3 percent sustained growth. Such a high rate of sustained growth is unlikely to occur without strong pro-growth policies, including fiscally responsible tax reform, and a good deal of luck.

The President's statement on the growth rate this past quarter and the potential for high growth in the future lacks context. Three percent growth in one quarter means very little about the next decade.