COVID Money Tracker Insights

Each week, we update our COVID Money Tracker tool with the latest commitments and disbursals from the federal response to the novel coronavirus pandemic and related economic downturn. By compiling all available data on actions taken by Congress, executive branch agencies, and the Federal Reserve, we aim to provide a comprehensive look at the COVID response to inform the public, policymakers, and the media about how these tax dollars are being used.

From vaccine funding to unemployment insurance payments and small business support, COVIDMoneyTracker.org provides real-time updates and allows users to filter by state, industry, and much more.

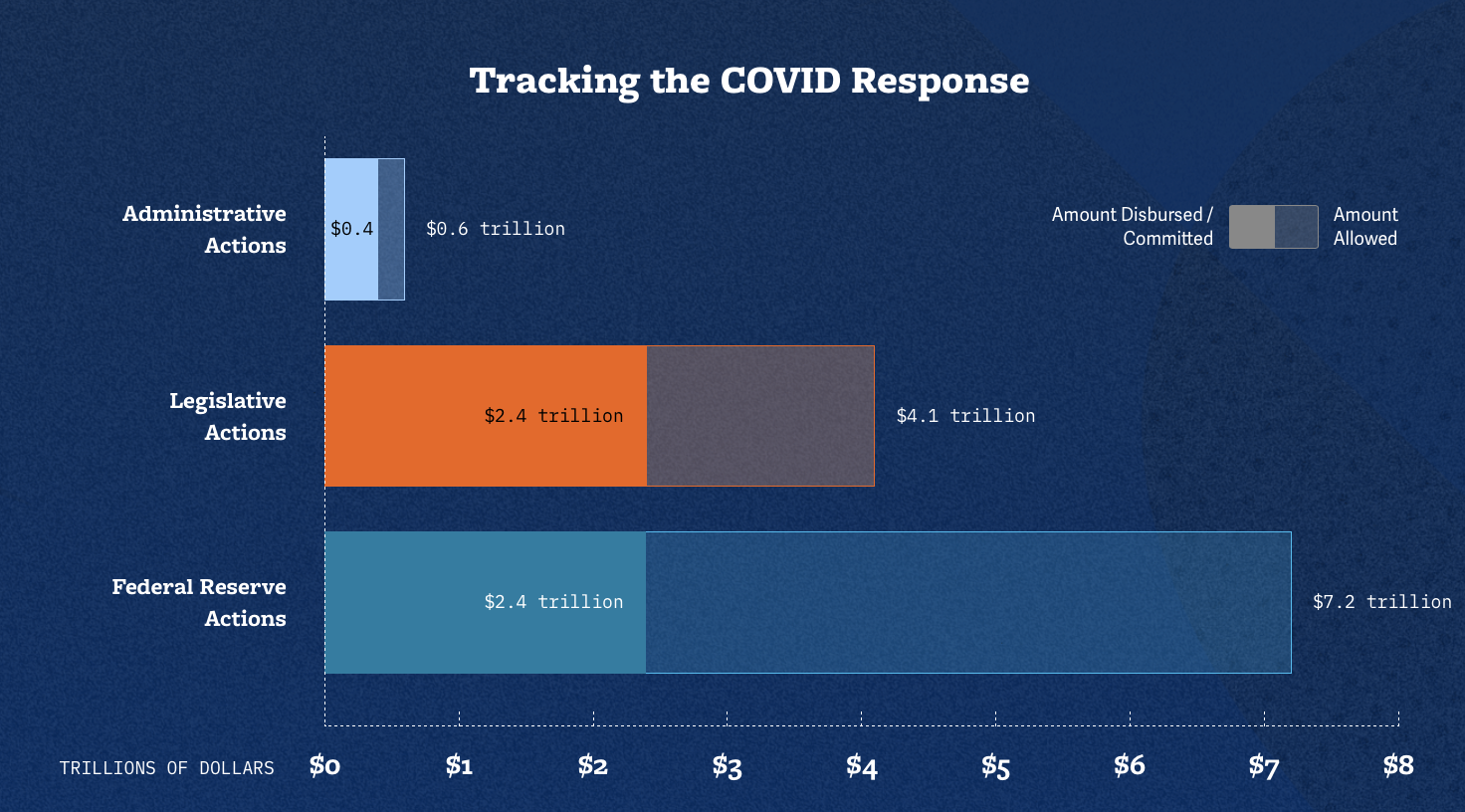

An overview of the federal COVID response thus far:

- Of the $4.1 trillion in support authorized by Congress, $2.4 trillion has been committed or disbursed. This figure represents more than 90 percent of the estimated $2.7 trillion net deficit impact and almost 60 percent of the $4.1 trillion in total support authorized by Congress.

- The Federal Reserve has provided $2.4 trillion in support out of the $7.2 trillion made available through its asset purchases, liquidity measures, and emergency lending facilities. However, use of its lending facility for smaller businesses has been sparse, and only two state or local government entities – the State of Illinois and New York City's Metropolitan Transportation Authority – have accessed the Fed’s Municipal Liquidity Facility.

- Administrative actions have committed or disbursed over $455 billion out of nearly $590 billion in potential support. $300 billion has already been recovered and all but $60 billion will eventually be recouped. These actions have included a payroll tax deferral, accelerated Medicare payments, and a delay of last tax season’s filing deadline.

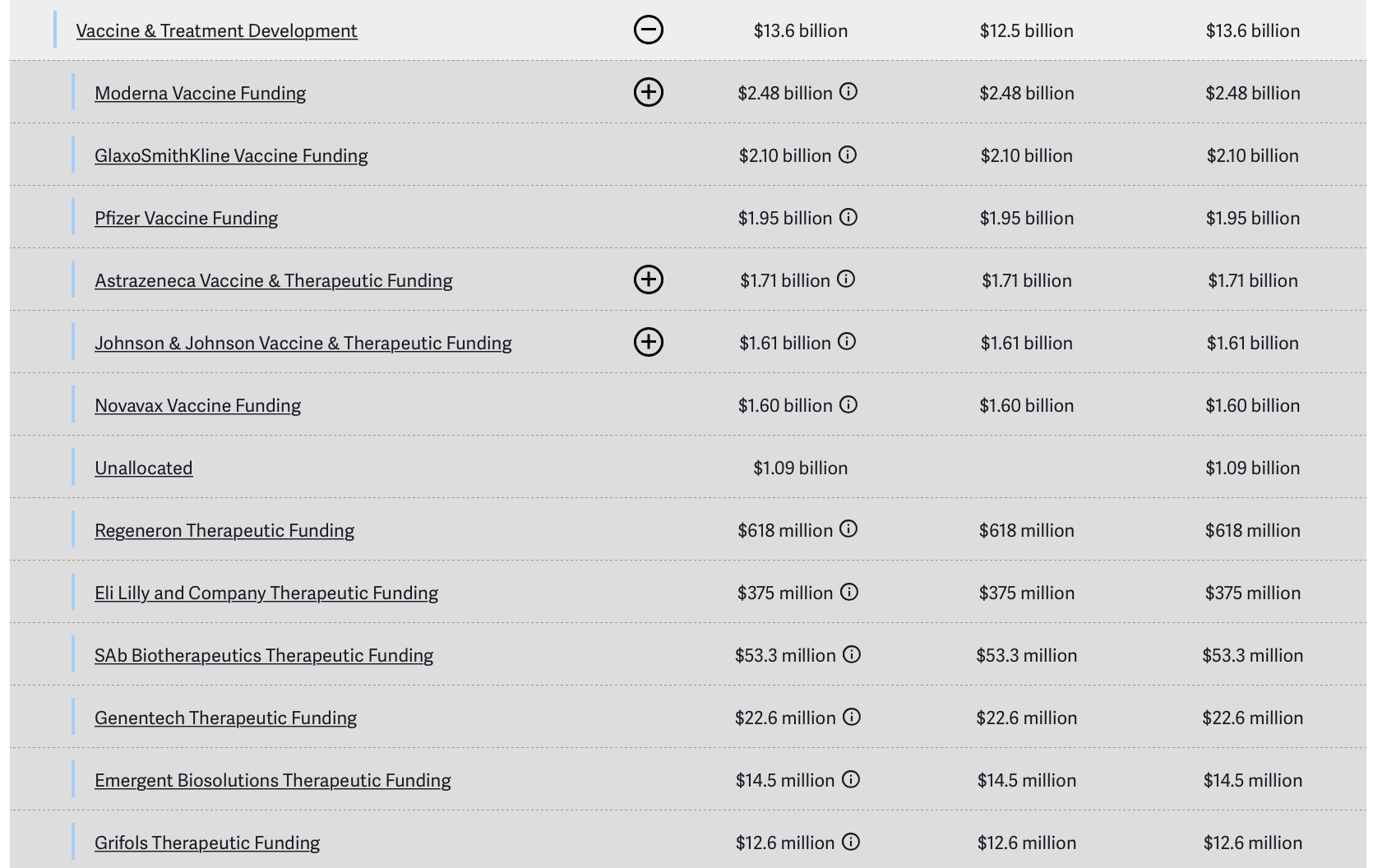

Federal investments in vaccine development

As vaccine development picks up speed, our tool shows how the federal response has supported pharmaceutical research. Pfizer and Moderna recently announced positive interim results from phase III trials of their respective mRNA vaccine candidates. Both companies have received billions of dollars in federal commitments to support development of their vaccines:

- Pfizer received a $1.95 billion guarantee from the federal government in July to produce and supply the first 100 million doses of its vaccine if it is granted Emergency Use Authorization (EUA).

- Moderna has received federal commitments to date worth $2.48 billion to support both development and production of its vaccine.

To date, the federal government has either committed or distributed approximately $12.5 billion for vaccine and therapeutic development to 12 companies.

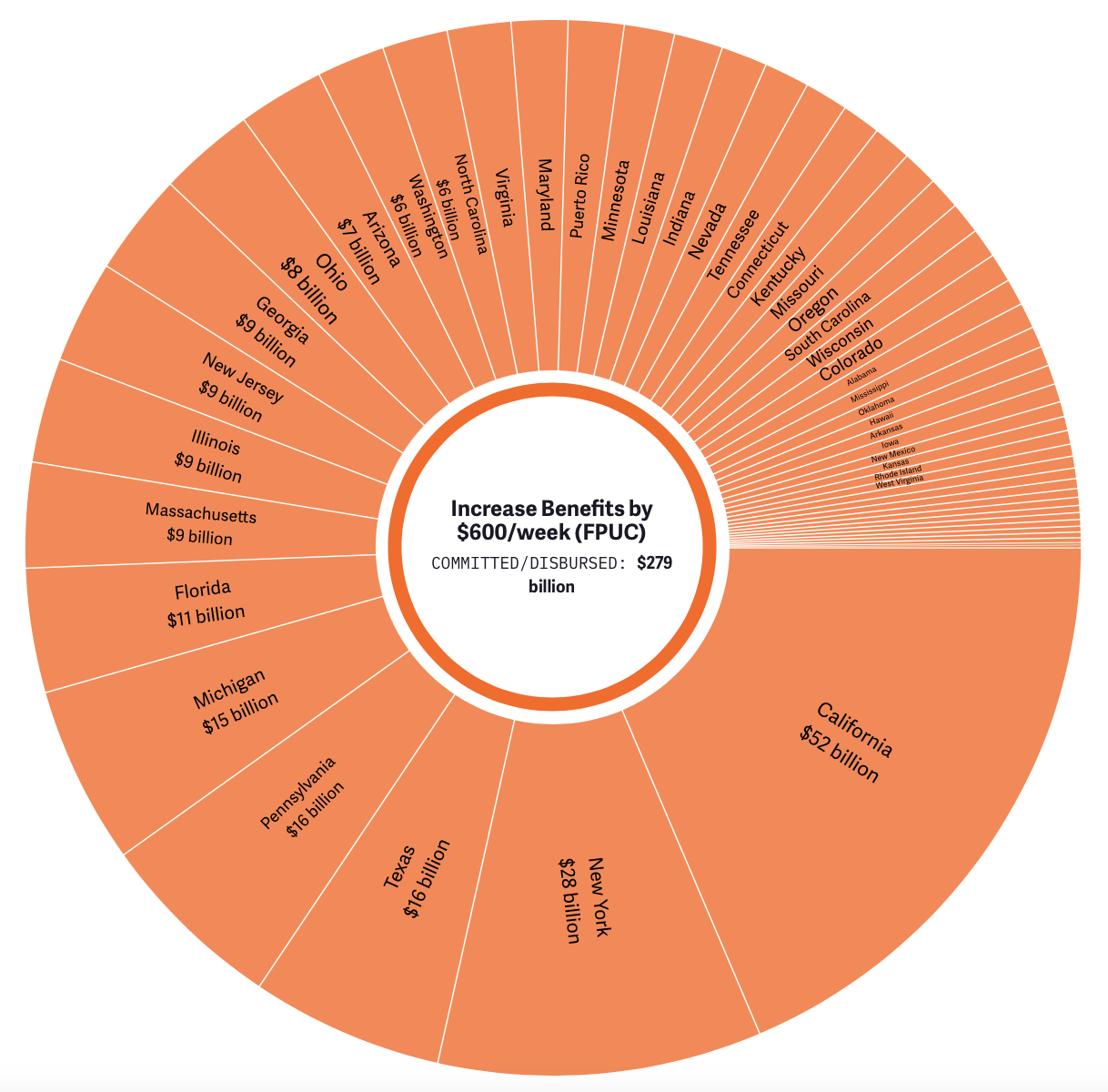

Unemployment spending by state

COVID Money Tracker has the latest state-level disbursements for six emergency unemployment programs signed into law in response to the crisis. These six programs have disbursed $368 billion through November 7, including:

- Federal Pandemic Unemployment Compensation ($279 billion): $600 weekly UI benefit boost from April through July

- Pandemic Unemployment Assistance ($65 billion): temporary unemployment payments to gig workers and the self-employed through the end of the year

- Pandemic Emergency Unemployment Compensation ($16 billion): provides unemployed workers with an additional 13 weeks of benefits through the end of the year

Federal Reserve loan facility holdings

Each month, the Federal Reserve updates its latest holdings under its temporary liquidity and loan facilities, backstopped with $195 billion in Treasury support authorized under the CARES Act. We have all the latest details, including the $23.8 billion in loans issued and bonds purchased through the CARES Act-funded facilities:

| Facility | Treasury Backstop | Current Holdings | Facility Size Limit |

|---|---|---|---|

| Term Asset-Backed Securities Loan Facility | $10 billion | $3.8 billion | $100 billion |

| Secondary Market Corporate Credit Facility | $75 billion | $13.4 billion | $750 billion* |

| Main Street Lending Program | $75 billion | $4.9 billion | $600 billion |

| Municipal Liquidity Facility | $35 billion | $1.7 billion | $500 billion |

| $195 billion | $23.8 billion | $1.95 trillion |

*Combined size limit with Primary Market Corporate Credit Facility, which has not been used to date.

All of the facilities are using much less than their overall size limit, but the Main Street Lending Program (MSLP) and the Municipal Liquidity Facility (MLF) are notably underutilized. To date, 420 companies have received $4.2 billion in loans1, less than one percent of the MSLP capacity. Only two state-level entities have utilized the MLF for a total of $1.7 billion in short-term notes purchased out of $500 billion allowed, or less than 0.5 percent of the facility’s total capacity. You can see all the latest transaction-level data for these facilities in our tool.

Oversight of small business grants and loans

The federal government has disbursed over $750 billion through the Paycheck Protection Program and Economic Injury Disaster Loans (EIDL) to support small businesses during the sharp decline in economic activity due to the pandemic. COVID Money Tracker includes state-level data for both programs and entity-level data where available.

- The Small Business Administration is currently contesting a federal judge’s order to release additional information regarding loans issued from both programs, including recipient names, addresses, and loan amounts. To date, the government has only revealed the names of businesses that recieved Paycheck Protection Program loans over $150,000, and many EIDL recipient names have been redacted due to personally identifiable information. We have the full list of the 660,000 employers that received PPP loans over $150,000. While these businesses have recieved approximately three-quarters of the funds distributed thus far, they represent only one-eighth of the more-than 5.2 million businesses that have received support through the program.

- Bloomberg recently published an exposé on the Small Business Administration's EIDL program, which has distributed over $210 billion in loans and advances during the crisis. The report presented evidence of potentially widespread fraud, particularly in the early days of the EIDL Advance program, which provided up to $10,000 in cash advances to small businesses materially affected by the nationwide lockdowns. COVID Money Tracker lists all the latest EIDL disbursements by state.

Not only are we continually updating COVID Money Tracker with the latest available data, we're also adding new features that make it even easier to track and evaluate the trillions of dollars in COVID relief distributed thus far. In addition to lawmakers and oversight officials, it’s important that the public be as informed as possible regarding how this aid is being used, as a lack of transparency could undermine support for future relief proposals.

Visit COVIDMoneyTracker.org to explore the data for yourself today.

1 This is slightly under the current holdings number of $4.9 billion because the transaction-level data represents holdings through October 30, whereas the current holdings reflects holdings as of November 11.