CBO Releases New Economic Projections

Today, the Congressional Budget Office (CBO) released updated economic projections, incorporating the economic damage from the COVID-19 pandemic. These estimates are an update to CBO's May projections; they incorporate data through June 26 - not including the latest jobs report - as well as the estimated effects of fiscal support enacted so far. CBO projects rapid economic growth beginning in the third quarter of this year and a return to the pre-crisis economic trajectory by 2028. Using the CBO's latest forecasts, we have updated our ten-year budget projections, which now show that debt will eclipse the size of the economy this year and reach 121 percent of GDP by 2030.

Importantly, CBO's projects represent the middle of a wide range of likely outcomes. The agency's economic projections and our fiscal projections both come with a wide range of uncertainty.

CBO's July Economic Projections

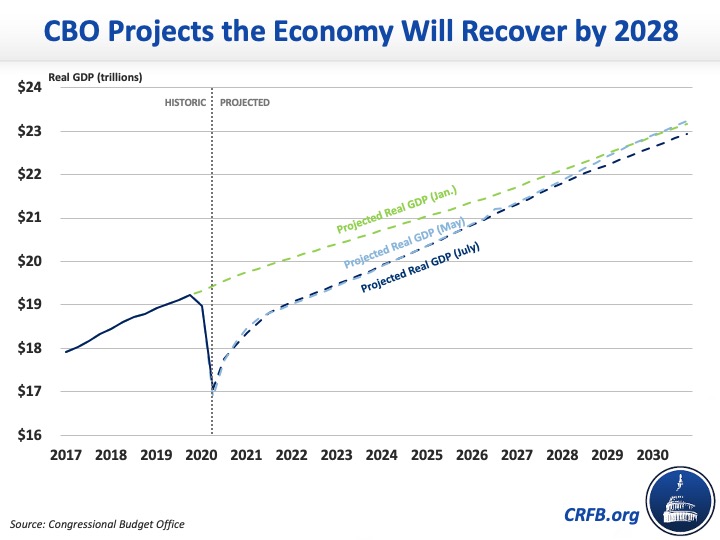

CBO's latest projections show real Gross Domestic Product (GDP) falling by 11.2 percent between the fourth quarter of 2019 and second quarter of 2020 and then recovering about half of those gains by the end of the year. This is similar to CBO's May projections, which projected real GDP would fall 12.2 percent between the end of 2019 and the second quarter of 2020 and recover roughly half of those gains by year's end. CBO projects output will reach pre-pandemic levels by the middle of 2022, but the economy won't return to its previous trajectory until 2028.

On an annual basis, CBO projects the economy will shrink by 5.8 percent between 2019 and 2020, grow by 4.0 percent in 2021, and then grow an average of 2.2 percent per year beginning in 2022. Potential GDP will grow by roughly 2 percent per year - and real GDP will begin to grow at that rate starting in 2028 once the economy has recovered under CBO's projections. The agency's growth estimates are slightly more pessimistic than its May estimates, under which the economy grew by 4.4 percent in 2021 and an average of 2.4 percent every year thereafter. The difference may be explained by somewhat lower population growth estimates in CBO's latest forecasts.

From 2020 through 2030, real GDP will be roughly $7.5 trillion lower (in 2012 dollars) than projected in the pre-pandemic baseline.

In addition to lower economic output, CBO also projects slower inflation, at least based on traditional measures. Specifically, CBO projects the Personal Consumption Expenditures (PCE) index to grow by only 0.8 percent in 2020, compared to 1.9 percent growth in the agency's pre-pandemic baseline. From 2021 through 2030, CBO expects inflation to normalize and average 1.8 per year, close to target inflation of about 2 percent.

Due to lower inflation in 2020, overall price levels will remain lower than previously projected, and estimates of nominal GDP will fall by more than real GDP projections. CBO estimates nominal GDP will be $17.5 trillion (6.2 percent) lower than pre-pandemic projections through 2030, including $1.3 trillion (4.1 percent) lower in 2030.

In terms of interest rates, CBO estimates the rate on three-month Treasury Bills, which fell from 1.6 percent the end of last year to about 0.1 percent today, will hold steady between 0.15 and 0.2 percent through mid 2025 before rising gradually to 2.3 percent by the end of 2030. Similarly, CBO estimates the rate on ten-year Treasury notes - which fell from 1.8 percent before the crisis to about 0.7 percent today - will rise steadily to 1 percent by the end of 2021, 1.5 percent by the end of 2023, and 3.2 percent by the end of 2030.

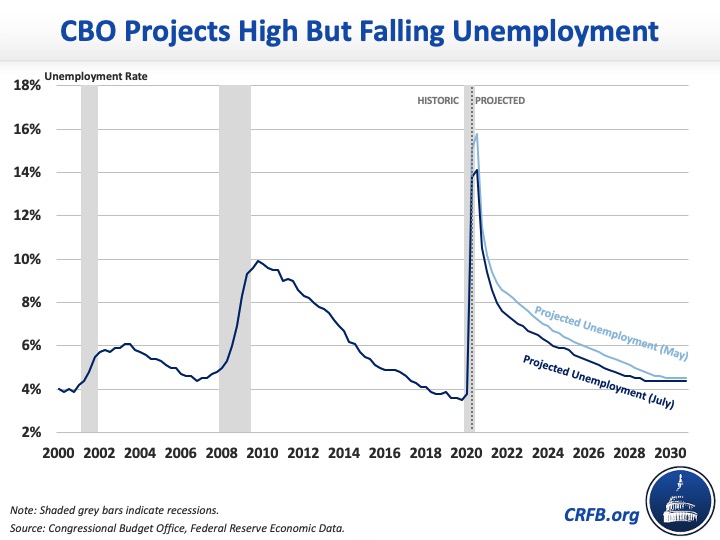

CBO also projects unemployment to remain elevated for quite some time. According to the Bureau of Labor Statistics (BLS), the official unemployment rate rose from 3.5 percent in February to a record-high of 14.7 percent in April, and has since fallen somewhat to 11.1 percent in June, still higher than during the worst part of the Great Recession. CBO projects the unemployment rate will rise somewhat to an average of 14.1 percent during the third quarter of 2020, and then decline slowly to 10.5 percent by the end of 2020, 7.6 percent by the end of 2021, 6.0 percent by the end of 2024, and stabilize around 4.5 percent beginning in 2028. This is somewhat more optimistic than CBO's May projections.

Importantly, these unemployment figures in many ways understate joblessness since they exclude a large number of people who are technically 'out of the labor force' as a result of the pandemic and recession. Whereas CBO estimates about 16 million more unemployed workers today than the end of last year, they estimate 22 million fewer are working. CBO does not project employment will reach pre-pandemic levels until 2025, at which point the adult population will be 4 percent larger. In part due to the aging of the population, CBO estimates the employed share of the adult population will never return to its pre-pandemic levels.

CBO's economic estimates incorporate the effects of $4 trillion of fiscal support enacted or administrated so far, which would likely boost output in 2020 but might slightly reducing average output after 2020 as fiscal support is withdrawn and reversed, and the economic effects of higher debt take hold. Further economic relief would likely boost output further in 2020 and 2021, though the longer term effects will depend on design details and net cost.

Updating Our Budget Projections

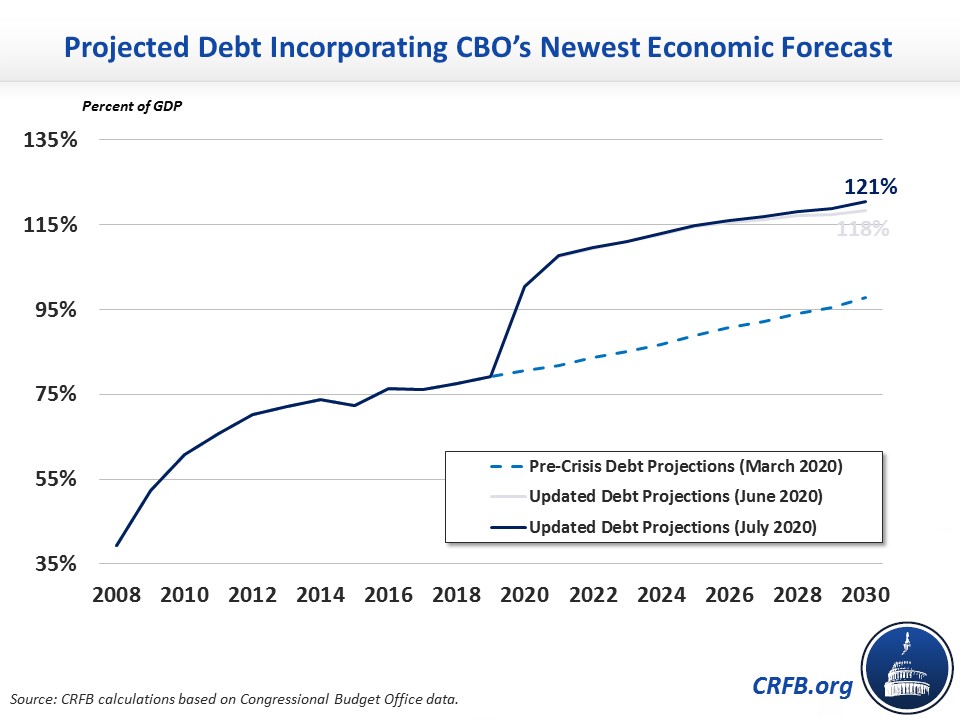

Last week, we released ten-year budget projections based on CBO's May economic forecasts. Under those projections, the deficit would total $3.7 trillion in 2020, $2.1 trillion in 2021, and total $19.9 trillion between 2020 and 2030. We also projected debt would exceed the size of the economy this year, total 108 percent of GDP by the end of 2021, and reach 118 percent of GDP by 2030.

CBO's latest economic forecasts have led to small revisions in our budget estimates. Deficits and debt remain largely unchanged in 2020 and 2021. However, deficits between 2020 and 2030 will total $20.6 trillion under our new forecasts, roughly $700 billion higher than our prior estimates and $6.4 trillion higher than CBO's pre-pandemic estimates.

Meanwhile, we project the federal debt will rise from about 80 percent of GDP prior to the pandemic to 121 percent by 2030. 2030 debt is 3 percentage points higher than in our prior estimate, 23 percentage points higher than in CBO's previous forecast, and 15 percent of GDP higher than the previous record set in World War II.

Importantly, CBO's and our projections assume current laws remain in place and no additional emergency legislation is enacted. Debt would rise to roughly 133 percent of GDP by 2030 if policymakers enacted an additional $1 trillion of fiscal support, grow appropriations with the economy, and continued various expiring tax breaks. Over the long term, debt will rise significantly further.

(7/8/20): This blog has been updated to correct an error with the budget projections. 2020-2030 deficits are $200 billion higher than originally stated, and debt in 2030 is 121 percent of GDP instead of 120 percent.