Budget Deal Takes 20 Years to Offset Its Cost

The recently-enacted budget deal does not offset its ten-year cost like advocates have claimed, but what about the longer-term impact?

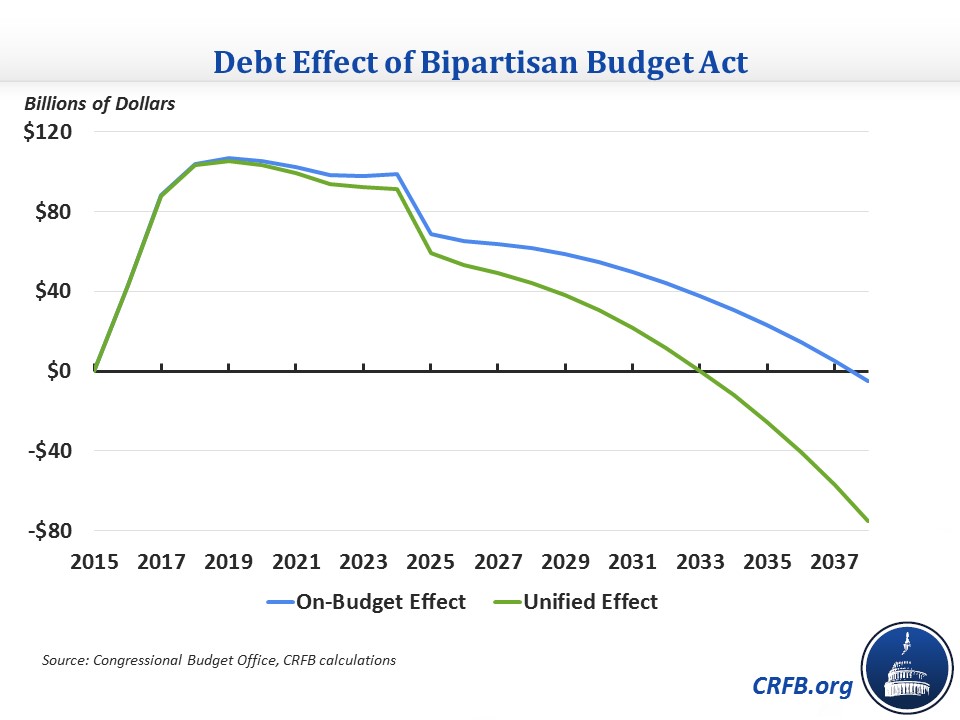

The deal clearly falls short of fiscal responsibility in the shorter term and relies in part on timing gimmicks, but the costs are temporary and some of the savings do grow over the long term. As a result, by our rough estimate, the bill will eventually pay for itself, but only after 20 years.

Given our country's fiscal situation, this is quite a long time to wait for a bill's costs to get paid back, which is why legislative scoring rules normally require costs to be offset within 10 years.

Moreover, the bill takes even a few years longer to pay for itself if you don't count the Social Security savings that are being used to close 1.5 percent of Social Security's total shortfall. It's with good reason the pay-as-you-go rules do not allow off-budget savings (e.g., from Social Security) to pay for on-budget costs. The same money cannot be used twice. If one accepts trust fund accounting for Social Security, money from the trust fund cannot be used to pay for general costs unless funds are explicitly transferred out of the trust fund.

(See the link for more on the unified budget and on-budget vs. off-budget effects.)

Over the first ten years, the deal increases on-budget deficits by about $70 billion (even including budget gimmicks) while decreasing off-budget deficits by $10 billion. In the second decade, we roughly estimate that the deal reduces on-budget deficits by $45 billion and off-budget deficits by $40 billion. Thus, over the first 20 years, while the deal reduces overall deficits $25 billion, it is the result of on-budget deficit increases of $25 billion and $50 billion of savings within the Social Security system. Note that these numbers do not include any potential future costs from additional sequester relief or continued use of the war spending gimmick.

| Longer-Term Budgetary Effect of the Bipartisan Budget Act | |||

| Policy | First Decade | Second Decade | 20-Year |

| Defense Sequester Relief | $40 billion | $0 billion | $40 billion |

| Non-Defense Sequester Relief | $40 billion | $0 billion | $40 billion |

| War Spending Increases | $30 billion | $0 billion | $0 billion |

| Mandatory Sequester Extension | -$15 billion | -$5 billion | -$20 billion |

| Strategic Petroleum Reserve Sales | -$5 billion | $0 billion | -$5 billion |

| PBGC Premium Increases | -$10 billion | -$5 billion | -$15 billion |

| Pension Smoothing Expansion | -$5 billion | $5 billion | $0 billion |

| Insurance Auto-Enrollment Repeal | -$5 billion | -$10 billion | -$15 billion |

| Medicaid Rebates and Medicare Payment Equalization | -$10 billion | -$25 billion | -$35 billion |

| Partnership Audit Changes | -$10 billion | -$20 billion | -$30 billion |

| Other Savings | -$10 billion | -$5 billion | -$15 billion |

| Interest | $25 billion | $5 billion | $30 billion |

| Subtotal, On-Budget Effect | $70 billion | -$45 billion | $25 billion |

| Off-Budget Spending | -$5 billion | -$15 billion | -$20 billion |

| Off-Budget Revenue | -$5 billion | -$15 billion | -$20 billion |

| Interest | -$1 billion | -$10 billion | -$10 billion |

| Subtotal, Off-Budget Effect | -$10 billion | -$40 billion | -$50 billion |

| Total, Unified Budget Effect | $60 billion | -$85 billion | -$25 billion |

Source: CBO, rough CRFB calculations

Positive numbers denote costs and vice versa.

Numbers are generally rounded to the nearest $5 billion.

Overall, the deal does get to deficit-neutrality within roughly 20-25 years, but that is a very low standard for a law whose costs all come within the first few years. In reality, the deal should have at least offset its costs over ten years and even better made a noticeable improvement in the long-term debt situation, as our Sequester Offset Solutions plan did and as Rep. Scott Rigell (R-VA) proposed; those plans saved $1.8 trillion and $2.5 trillion over 20 years, respectively. Policymakers should be held to a stricter standard for fiscal responsibility than offsetting temporary costs over multiple decades.