The Tax Break-Down: Section 199, the Domestic Production Activities Deduction

This is the fifth post in our blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Last week, we wrote about preferential rates on capital gains and the child tax credit.

The domestic production activities deduction is the second largest domestic corporate tax break, providing an incentive to domestic manufacturing. A business with “qualified production activities” can take a deduction equal to 9 percent of related income, as per Section 199 of the Internal Revenue Code. Effectively, the deduction gives a 3.15 percent lower rate for qualifying business income (9 percent deduction times 35 percent statutory rate = 3.15 percent).

The eligible activities center around manufacturing, but many other businesses qualify. In addition to manufacturing, qualified activities include producing electricity and films, selling items manufactured in the United States, engineering, and software development. The deduction is adequately broad that assembling gift baskets, making hamburgers, or roasting coffee qualifies for the deduction. Roughly one-third of corporate activities qualify for the deduction. As former U.S. tax official John Harrington explained, "If you are in the Dow Jones industrial (average), and you are not taking this deduction, there must be something wrong. It has always applied to a motley crew of activities."

Previously, the tax code allowed for companies to organize foreign subsidiaries, called Foreign Sales Corporations, to exclude income they earned overseas. When the European Union successfully challenged the provision as an export subsidy not allowed under World Trade Organization standards, Congress adopted a new law in 2000 to repeal the Foreign Sales Corporation law and allow companies to exclude income from overseas sales, the “extraterritorial income exclusion” (ETI). The EU challenged this program again as the same subsidy under a different name, and it was again found to contradict the WTO.

In 2004, Congress replaced the ETI with Section 199, giving domestic manufacturers a subsidy without running afoul of the WTO. Section 199 was designed to phase-in as the ETI phased out: the deduction started in 2005, allowing a business to take a deduction of 3 percent of income. It was increased to 6 percent in 2007, and 9 percent in 2010.

Below, we answer other questions about the domestic production activities deduction.

How Much Does It Cost?

The Section 199 deduction cost $14 billion of foregone revenue in 2013, or nearly $200 billion over the next ten years according to the Joint Committee on Taxation (JCT). Approximately 70 percent of the deduction’s value is used by C-Corporations; the remainder by pass-through companies which are subject to the individual income tax. OMB estimates a similar value, $13 billion in 2013.

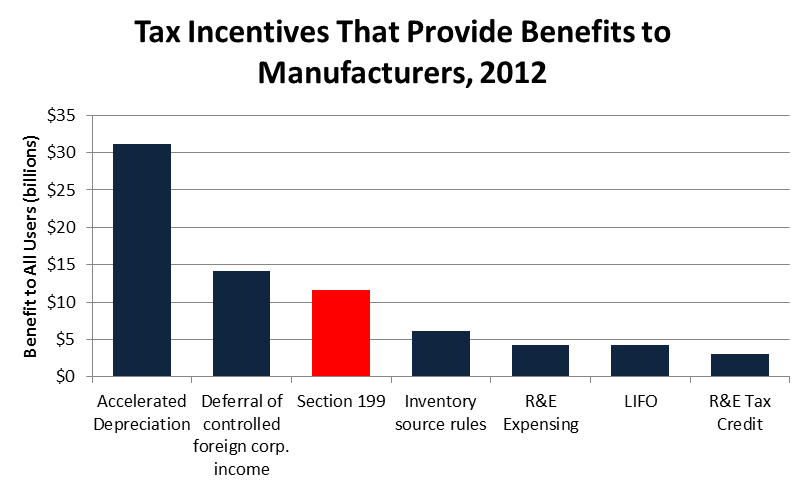

Source: Congressional Research Service

According to our Corporate Tax Reform Calculator, if the deduction were repealed, the revenue from C-corporations could finance a corporate rate cut of 1.2 percentage points. If the deduction were also repealed for pass-throughs, the rate could decrease 1.5 percentage points.

Who Does It Affect?

Two-thirds of the value of the domestic production activities deduction is captured by the manufacturing industry, meaning the other third goes to non-manufacturers. Specifically, large portions of the deduction flow to information technology companies and mining operations.

Although manufacturers benefit the most from the deduction on a nominal basis, the deduction is relatively is more valuable to several other industries. For instance, Section 199 represents 2.9 percent of the tax base for agriculture and hunting, 2.5 percent for construction, and 2.4 percent for information; compared to 2.2 percent for manufacturing. 65 percent of income from information technology and construction firms qualifies for the deduction, compared to about 40 percent for manufacturing.

| Industry Grouping |

Share of Deduction Claimed | Estimate of Qualifying Income as a Share of Taxable Income |

Average Tax Rate After Section 199, but Before Credits |

| Manufacturing | 65.1% | 38.8% | 34.31% |

| Information | 12.7% | 64.5% | 34.59% |

| Mining | 5.9% | 29.1% | 35.37% |

| Wholesale Trade | 4.4% | 19.0% | 34.18% |

| Utilities | 3.8% | 53.8% | 34.86% |

| Construction | 3.5% | 66.1% | 31.85% |

| Professional and Technical Services | 1.4% | 20.3% | 33.76% |

| Retail Trade | 1.0% | 4.2% | 34.48% |

| Finance and Insurance | 0.6% | 1.0% | 35.38% |

| Agriculture, Forestry, Fishing, and Hunting | 0.5% | 85.1% | 28.62% |

|

Management of Companies (Holding Companies) |

0.4% | 1.4% | 34.97% |

| Accommodation and Food Services | 0.3% | 8.6% | 34.37% |

| Real Estate and Rental and Leasing | 0.1% | 5.8% | 33.40% |

| Administrative, Support, and Waste Services | 0.1% | 4.4% | 34.03% |

| Other Services | 0.1% | 10.3% | 29.89% |

| Transportation and Warehousing | < 0.1% | 1.2% | 34.58% |

| Arts, Entertainment, and Recreation | < 0.1% | 6.7% | 37.85% |

| Health Care and Social Assistance | < 0.1% | 1.9% | 33.89% |

| Educational Services | < 0.1% | 6.0% | 34.36% |

Source: Shapiro, the Progressive Policy Institute, Center for Budget and Policy Priorities, Joint Committee on Taxation

What are the Arguments For and Against the Section 199 Deduction?

Proponents of Section 199 appeal to its original purpose to incentivize domestic manufacturing in a WTO-compliant way. They argue that manufacturing plays a critical role in innovation and faces intense international competition. Repealing the deduction would raise the effective tax rate on manufacturing by over 3 percentage points.

Opponents of Section 199 state that it is a “manufacturing tax break gone wild,” arguing that the definitions of qualified activities are so broad that the provision does little to achieve its intended goal and a lot to encourage creative relabeling of existing activities. By favoring some types of domestic production over others, opponents argue, the deduction also distorts domestic investment. And because qualifying activities are defined by a complex set of rules, the deduction increases the difficulty of filing business returns. Finally, opponents point out that achieving broad rate reduction will render the 199 deduction obsolete by effectively providing its intended benefit of lower effective marginal rates to all businesses.

What are the Options for Reform and What Have Other Plans Done?

As one of the largest corporate tax breaks, Section 199 has been the target of many tax reform plans which have also lowered the corporate rate. The Fiscal Commission, Domenici-Rivlin, Rep. Charlie Rangel, and Wyden-Gregg tax reform plans, for instance, all got rid of the domestic production activities deduction in favor of a lower corporate rate.

The President’s Framework for Business Tax Reform kept Section 199 and still lowered the overall corporate rate to 28 percent. The proposal expands it to a 10.7 percent deduction, bringing the effective top rate on manufacturing down further to 25 percent. For advanced manufacturing, an 18 percent deduction would bring the effective rate to 23 percent.

A variety of options exist to reform the Section 199 deduction. The policy could be completely repealed, providing $180 billion over ten years or enough revenue to finance a 1.5 percentage point cut in the corporate rate, or repealed only for C-Corps – since pass-through entities would not benefit from a corporate rate reduction. Congress could also reduce the size of the deduction by limiting it to the 2004 level of 3 percent, or the 2007 level of 6 percent.

The deduction could also be restricted by industry, either to hew closer to the deduction’s original purpose of only incentivizing manufacturing, or by prohibiting oil and gas companies from claiming the deduction. As a result of a 2008 law, oil and gas companies are already limited to a 6 percent deduction, and the President’s budget has suggested eliminating it for them. Since the deduction was originally intended to strengthen domestic businesses competing internationally, it could be repealed for businesses that would never be able to move overseas, such as agriculture, utilities, or natural resource extraction.

Finally, as in the President’s proposal, the deduction could actually be expanded or retargeted in order to further lower effective rates for some domestic activities.

| Revenue from Reforming the Section 199 Deduction |

|||||

| Policy |

Savings |

||||

| Repeal Section 199 | $190 billion | ||||

| Repeal 199 for C-Corps only | $150 billion | ||||

| Repeal 199 for oil, gas, coal, and other fossil fuel companies only | $20 billion | ||||

| Expand deduction to 10.7% with an 18% deduction for advanced manufacturing | -$40 billion | ||||

| Revert deduction to 6% (from 9%) | $55 billion | ||||

| Revert deduction to 3% | $125 billion | ||||

| Restrict the deduction to the manufacturing sector | $65 billion | ||||

| Prevent industries that cannot move overseas from claiming the deduction | $30 billion | ||||

Where Can I Read More?

- Committee for a Responsible Federal Budget – Examining the Domestic Production Activities Deduction

- Progressive Policy Institute – Anatomy of a Special Tax Break and The Case for Broad Corporate Reform

- David Cay Johnson – Manufacturing Tax Break Gone Wild

- Congressional Research Service - Federal Tax Benefits for Manufacturing: Current Law, Legislative Proposals, and Issues for the 112th Congress

- Center for Budget and Policy Priorities – States Can Opt Out of the Costly and Ineffective “Domestic Production Deduction” Corporate Tax Break

- Joint Committee on Taxation – Background and Present Law Relating to Manufacturing Activities Within the United States

- American Enterprise Institute – Big oil, targeted taxes, and the rule of law

*****

The domestic production activities deduction, or Section 199, is a widely-used tax break to reduce the tax burden of many industries within the United States, while excluding others. Many tax reform plans have suggested repealing this tax break to raise enough revenue to lower the corporate rate and to reduce distortions in domestic investment. If Congress does decide to keep some form of a manufacturing incentive, it has numerous options available to reform, trim, or simplify the deduction as part of tax reform.

Read more posts in The Tax Break-Down here.