The Tax Break-Down: Charitable Deduction

This is the fifteenth post in our blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Previously, we wrote about the Low-Income Housing Tax Credit, which provides credits to state-run housing agencies, which are then distributed to developers and investors to build low-income rental housing.

The charitable deduction allows taxpayers to deduct donations they make to non-profit organizations. A donation can be made from pre-tax income, effectively reducing the "cost" to the donor.

It was first enacted in 1917, four years after the modern income tax. At the same time, the top income tax rate was increased dramatically from 15 percent to 67 percent in order to generate revenue for World War I. Policymakers were concerned that raising the top income tax rate significantly would deprive well-off people of the surplus income from which they had been making charitable contributions.

Taxpayers who make a charitable donation can deduct the donation from their income but cannot reduce their income by more than half. So a taxpayer in the 25 percent bracket giving a $100 donation would receive a tax benefit of $25, and the donation would only “cost” the donor $75. Since it is an itemized deduction, taxpayers who take the standard deduction get no benefit from making charitable donations.

Not all donations to tax-exempt organizations qualify for the deduction. Traditional 501(c)(3) non-profits and churches (even if they are not registered as a non-profit) qualify, but donations to many other types of tax-exempt organizations, such as political committees, labor unions, and chambers of commerce are not deductible.

In 2011, there was nearly $300 billion given to 1.1 million charities, but only $175 billion was deducted as a charitable contribution. The rest was either donated by non-itemizers (who cannot claim the deduction) or simply not reported.

The deduction - along with all other itemized deductions - is reduced for high-income taxpayers due to a provision enacted in the fiscal cliff deal called the Pease provision. The total amount of itemized deductions that a person can claim is reduced if a taxpayer's income is above $250,000 for single couples or $300,000 for married couples. However, studies show that this limitation has little effect on charitable giving, since the reduction is determined by the total amount of income, not on the amount of charitable donations.

How Much Does It Cost?

According to the Joint Committee on Taxation (JCT), the charitable deduction will cost $42 billion in 2013 and approximately $570 billion over the next ten years. JCT's tax expenditure list details three separate categories of the deduction: for health, for education, and for everything else. Deductions for donations to health organizations comprise approximately 10 percent of the deduction's cost, while deductions to educational institutions make up 12 percent. OMB estimates a larger figure for the whole deduction, $49 billion in 2013.

If the deduction were eliminated, the Tax Foundation estimates that the revenue could finance a tax cut of 3.7 percent (the 39.6 percent rate would become 38.3 percent).

Who Does It Affect?

Only taxpayers who itemize their deductions can claim the charitable deduction. In 2011, 32 percent of taxpayers itemized their deductions, and 81 percent of those claimed the charitable deduction.

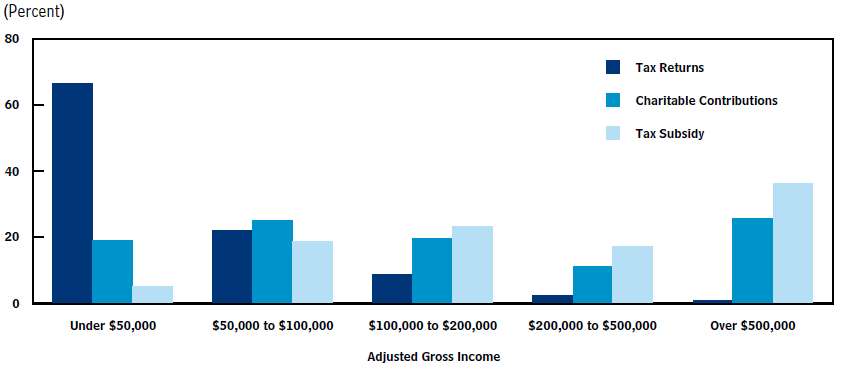

Data from CBO suggests that each income group gives a similar percentage of their income to charity: every group making below $500,000 gives between 2 and 2.5 percent of their income to charity, while those over that threshold give over 3 percent on average. However, the value of the deduction accrues primarily to wealthy individuals, because they give more in dollar terms, are more likely to itemize, and face higher marginal tax rates so the value of their deduction is worth more. Households under $50,000 give one-fifth of all the donations in the United States, but only receive 5 percent of the tax subsidy.

Different Income Groups’ Shares of Total Contributions and the Total Tax Subsidy, 2006

Source: CBO

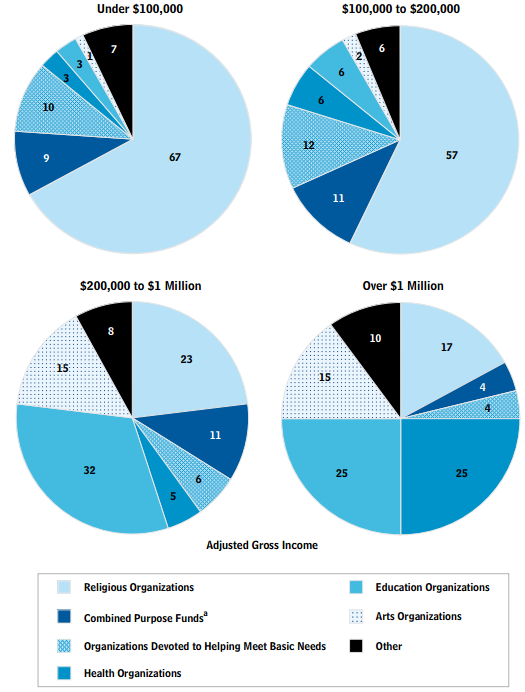

The fact that the charitable deduction mostly benefits the wealthy has important implications for charities: not every charity benefits equally. Donors with an income over $1 million are much more likely to give to health organizations, museums, and schools and give less than one-fifth of their income to churches. By contrast, donors with income less than $100,000 give two-thirds of their donations to churches. However, only 18 percent of these taxpayers claimed the deduction in 2011.

How Donors Allocate Their Charitable Contributions, by Income Group and Type of Recipient, 2005

What Are the Arguments For and Against the Charitable Deduction?

Supporters argue that the deduction is a critical form of support for non-profits. Many donors, particularly wealthy donors with multimillion dollar donations, are sensitive to losing the tax benefit. If the deduction were limited at 28 percent, estimates show that between $3 and $5.6 billion less would be given every year. Supporters also argue that charities provide public goods, and often meet needs that the government would otherwise need to provide. They argue that the deduction increases fairness between taxpayers: a taxpayer who donates would have less money available to pay taxes and should not be penalized for charity.

Further, supporters argue that the behavior encouraged by the charitable deduction benefits society as a whole, not the taxpayer, so it should not be treated like other deductions. Any reduction in giving hurts charities, not the taxpayer. Finally, they point out that charitable giving is optional, unlike other sources of deductions like mortgages or medical expenses, and any proposal to limit tax deductions across-the-board to a specific dollar amount will hit charitable contributions the hardest (in economic terms, charitable giving is more elastic).

Opponents point out that the charitable deduction funnels money to projects that may not be a government priority or traditionally thought of as charity – only one-third of contributions were targeted at helping the poor in 2011. Further, they argue donations are not completely selfless – donors also benefit, either from the "warm glow" of giving to others, or through the recognition of having buildings constructed with their names. If donors receive private benefits from a donation, opponents argue, the donation should be treated like consumption and taxed. Further, an organization does not have to serve the needy to claim tax-exempt status, and some tax-exempt organizations appear to serve private interests in the same way as for-profit corporations.

Opponents also criticize the structure of the charitable deduction, even if they agree with its purpose. The current deduction does not accrue to everyone who gives, nor does it accrue to its beneficiaries equally. It only benefits those who itemize and especially those in the higher income tax brackets. Critics say the deduction is not well-targeted: most of the deduction is a tax windfall for donations that would have occurred anyway. They propose reform options, discussed below, which could encourage more giving at a lower cost or at least minimize the negative effect on giving.

What Are the Options for Reform?

The deduction could be repealed entirely, which would raise somewhat less than the deduction’s 10-year cost of $570 billion, since some taxpayers would change their giving patterns. The deduction could be repealed only for donations to nonprofit hospitals, who in some ways act similarly to for-profit hospitals, or for donations to universities.

The provision could be made more cost-effective by adding a floor which would maintain the marginal incentive to give, but limit the windfall subsidy for donations that would have been made anyway. The tax benefit would not be available on the entire donation, but only on giving above the floor. The table below lists two potential floors: the first limits the tax benefits to donations above $500 ($1,000 for couples), and the second only gives credit for donations above 2 percent of income (which is approximately the “normal” amount of giving).

Short of repeal, the charitable deduction could be dramatically restructured. Converting it to a credit would give the same amount of tax benefit to taxpayers at all income levels. The deduction could also be moved “above-the-line” on tax forms, so all taxpayers could benefit regardless of whether they itemized their other donations.

Using floors, it is possible to design a reform that would both reduce the cost of the deduction and increase total charitable giving. For instance, adding a $500 floor along with making the deduction available to all taxpayers or converting it to a 25 percent credit would simultaneously raise revenue and increase the number of donations. Both proposals would raise about $3 billion per year and increase charitable giving by about $1 billion per year. Other policy changes might represent a cost-effective trade-off: adding a $500 floor to the existing deduction would decrease donations by about $0.5 billion, but it would raise $6-7 billion in federal revenue per year.

Policies that raise a similar amount of money can have a very different impact on charitable giving. For example, converting the deduction to a 15 percent credit and making it above-the-line with a 2 percent floor would both raise about $175 billion, but the first option would cause donations to drop by almost 4 percent, while the latter would only decrease donations by 1 percent.

| Revenue Impact from Reforming the Charitable Deduction (Billions, 2014-2023) | |||

| Policy | No Limit | Add a $500/$1,000 floor | Add a 2% of AGI floor |

| Repeal the charitable deduction | $550 | n/a | n/a |

| Repeal the charitable deduction for nonprofit hospitals and health organizations | $50 | n/a | n/a |

| Repeal the charitable deduction for universities | $70 | n/a | n/a |

| Repeal the charitable deduction for corporate donations | $30 | n/a | n/a |

| Put a floor on the existing deduction | n/a | $75 | $210 |

| Impose a 28% limit on the value of the deduction | $75 | $135 | $250 |

| Impose a 22% cap on the value of the deduction | $150 | $210 | $330 |

| Make charitable deduction above-the-line, so it can be claimed by all taxpayers | - $70 | $30 | $175 |

| Convert the deduction into a 25% credit |

- $100 |

$30 | $160 |

| Convert the deduction into a 15% credit or matching grant to the charity | $180 | $260 | $330 |

*All scores are rough estimates and may not match official CBO scores. Scores were chiefly estimated from a 2011 CBO analysis based on 2006 data, but are consistent with more recent estimates.

In addition, policymakers could consider a host of smaller options to prevent abuse of non-cash contributions, make it easier to track donations, or simplify the way the law works. Some of the smaller changes, which either have savings below $1 billion a year or do not have available public estimates, are:

- Allow lottery winners to donate their winnings to charity without paying tax

- Impose various limits on conservation easements, which are difficult to value and sometimes abused: by converting the deduction to a capped credit, eliminating it for golf courses, or limiting it for personal residences and historic property.

- Limit deductions to $500 of clothing or household items, which are often overvalued

- Prevent deductions for donating property that is not useful to the receiving non-profit

- Prevent taxpayers from claiming the charitable deduction for donations required to buy collegiate athletic tickets, or prevent deductions for donations to college sports teams altogether

- Allow donations to count in the previous year until April 15th. If the policy’s goal is to encourage giving, the best time for donations would be when people are preparing (and trying to save on) their taxes.

- Exempt the charitable deduction from the Pease limitation, so the deduction is not reduced for high-income taxpayers

- Simplify the complicated language around the measurement of deductions

- Limit the deduction to "traditional" charities forming part of the social safety net

- Reform and simplify the rules regarding partial gifts (for example, when co-owners give a piece of art)

- Prevent abuse of charitable trusts

- Prevent taxpayers from claiming the deduction based on capital gain

- Require charities to report large gifts to the IRS (over $250 or $600, for example)

- Require fewer appraisals, raising the limit for the gifts that must be appraised from $5,000 to $10,000

- Eliminate a Cold War-era prohibition on claiming the deduction for donations to communist-controlled organizations.

What Have Other Plans Done?

Even tax reform plans that eliminate most other tax expenditures keep an incentive for charitable giving. The Fiscal Commission converted the deduction into a flat nonrefundable credit set at that plan's bottom tax rate: 12 percent. Domenici-Rivlin would also change the deduction to a credit based on that plan's bottom rate of 15 percent, although the credit would be given as a matching grant to the charity rather than to the taxpayer.

The 2005 Bush Panel on Tax Reform would add a floor of 1 percent of income to the deduction. Recognizing that most taxpayers give at least 1 percent to charity, this option restricts the tax benefit to "extra" donations. The Bush Panel would also require charities to report donations above $600 to the IRS, which would prevent fraud and help verify large donations.

Three other organizations would replace the deduction with a credit available to all taxpayers: the Economic Policy Institute proposes a 25 percent refundable credit, the Center for American Progress proposes a 15 percent credit, and the American Enterprise Institute has a 15 percent refundable credit with a $500 floor on donations.

The Heritage Foundation would retain the charitable deduction in its current form.

Where Can I Read More?

- Congressional Budget Office - Options for Changing the Tax Treatment of Charitable Giving

- Committee for a Responsible Federal Budget - Taking a Closer Look at the Charitable Deduction

- Committee for a Responsible Federal Budget - Softening the Blow on the Charitable Deduction

- Bruce Bartlett - The Future of the Charitable Deduction

- Urban Institute - Evaluating the Charitable Deduction and Proposed Reforms

- Joseph J. Cordes - Re-thinking the Deduction For Charitable Contributions: Evaluating the Effects of Deficit Reduction Proposals

- Joint Committee on Taxation - Present Law and Background Relating to The Federal Tax Treatment of Charitable Contributions

- Senate Finance Committee - Options to Change Tax-Exempt Organizations and Charitable Giving

- C. Eugene Steuerle - Testimony Before the Ways & Means Committee

- The Center for Philanthropy at Indiana University – Patterns of Household Charitable Giving By Income Group, 2005

- Elaine S. Povich - Charitable Giving Tied to State Tax Deduction Decisions

- American Enterprise Institute - The Great Recession, Tax Policy, and the Future of Charity in America

* * * * *

The charitable deduction is a long-standing and popular income tax break. However, it deserves the same scrutiny as other tax breaks to ensure that the policy is as cost-effective as it can be. There are a number of ways to make the deduction cheaper, more progressive, and more efficient -- including some that could actually increase charitable giving. If policymakers choose to keep the charitable deduction, they would be wise to consider options for improving it.

Read more posts in the Tax Break-Down here.