The Tax Break-Down: Accelerated Depreciation

This is the eighth post in our blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Last week, we wrote about tax-free municipal bonds and cafeteria plans that help employers offer fringe benefits.

Accelerated depreciation is the largest corporate tax break, allowing companies to deduct the costs of assets faster than their value actually declines. The preference is the largest in the corporate tax code and is broadly enjoyed by most businesses.

To understand accelerated depreciation, one must first understand that U.S. businesses are taxed on profits – that is, their revenues minus their expenses. Yet because many large expenses (for example, purchases of buildings or equipment) are used over a number of years to produce income, they must be “depreciated” over the life of the asset. Because it is impossible to know the actual life of every asset, the tax code groups types of assets into categories of “class lives” and gives each a “schedule” – a number of years over which it must be depreciated for tax purposes, as opposed to deducting the full cost when purchased. Accelerated Deprecation allows assets to be depreciated faster than their economic life.

To take advantage of accelerated depreciation, most companies rely on something called the modified accelerated cost recovery system (MACRS), which was adopted in 1986. MACRS is thought of as accelerated depreciation for two reasons: the system shortened class lives so depreciation happens more quickly, and also allows companies to deduct more of an item’s cost in the first years. By comparison, the Alternative Depreciation System – which more accurately reflects economic depreciation – uses longer class lives and relies on a straight-line method, where an item must be depreciated equally over its lifetime.

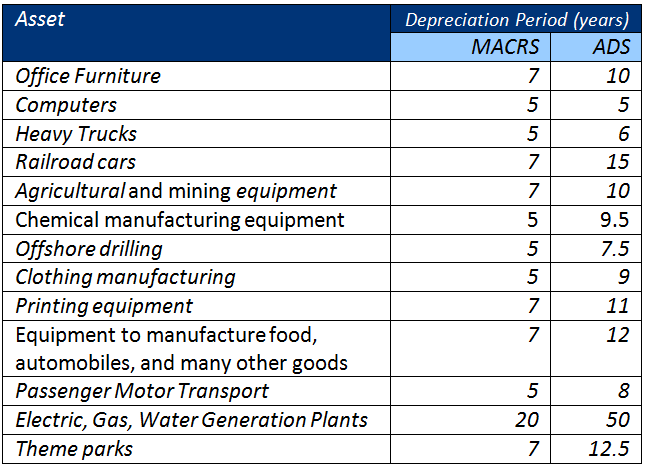

Although there are over 100 categories, the table below lists a few of the asset classes treated differently under accelerated depreciation.

Source: Internal Revenue Service

With a quicker depreciation schedule, companies can claim higher expenses and thus lower their short-term taxable income. Although over time a company theoretically pays the same amount of tax, an earlier deduction allows companies to take advantage of “the time-value of money” to reap higher interest savings or investment returns.

How Much Does It Cost?

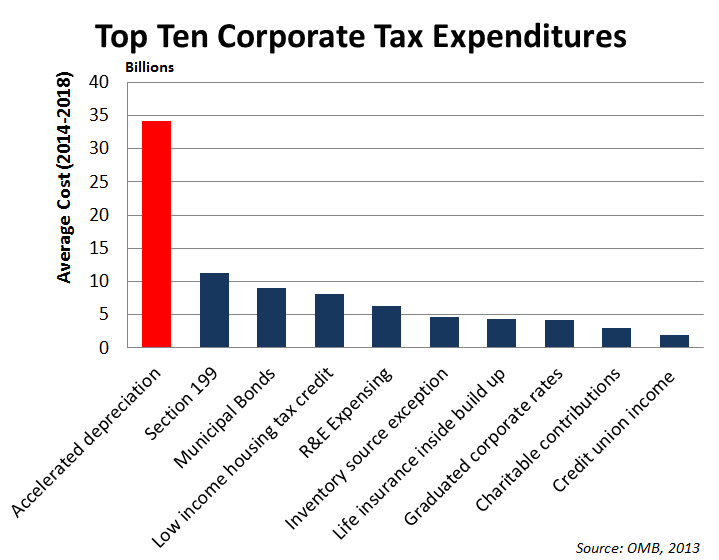

Accelerated depreciation is the largest corporate tax expenditure. The Office of Management and Budget (OMB) estimates that accelerated depreciation for machinery and equipment cost nearly $70 billion in 2012 and $274 billion over the next five years.

The Joint Committee on Taxation does not provide an isolated estimate for accelerated depreciation under MACRS; however in 2011 they estimated that a full repeal would save $724 billion between 2012 and 2021.

According to our Corporate Tax Reform Calculator, if the deduction were repealed, the revenue from C-corporations could finance a corporate rate cut of 4.3 percentage points over ten years. If the deduction were also repealed for pass-throughs, the rate could decrease 6.2 percentage points. If the pass-through revenue were instead used to reduce individual tax rates, the Tax Foundation estimates it could pay for a 0.7 percent cut (the 39.6 percent rate would fall to 39.3 percent).

Importantly, much of the revenue from depreciation comes from a timing shift that increases tax payments now but reduces them later. As a result, legislation that eliminated accelerated depreciation and lowered tax rates could run the risk of paying for a permanent rate cut in part with temporary revenue. Thus a proposal which was revenue-neutral over the first ten years could lose revenue in subsequent years. A paper by Treasury officials James Mackie and John Kitchen estimates that eliminating accelerated depreciation would raise aboout four-fifths of the revenue in the second decade as it did in the first, and only two-thirds of the first-decade revenue over the long-term. Other studies suggest even lower revenue levels over the long run; Congressional Research Service economist Jane Gravelle found that the long term revenue gained from repealing accelerated depreciation is only 54 percent of the revenue gained in the first ten years.

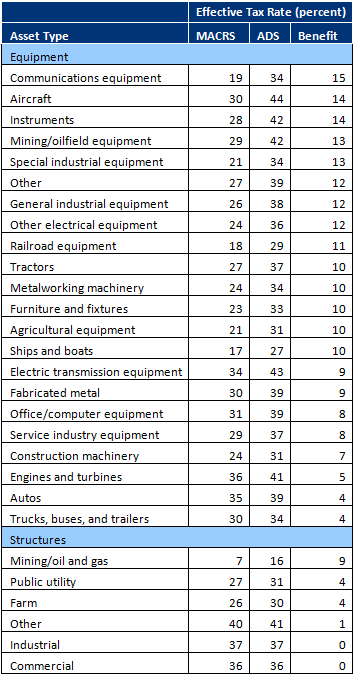

Accelerated depreciation is used by most businesses, but because it sets out different schedules for different types of assets, the effective tax rates on investment varies widely. A 2011 study by CRS economist Jane Gravelle found that effective tax rates due to accelerated depreciation vary widely on different types of assets, as shown in the table below. Accelerated depreciation provides much more tax benefit to investments in equipment, which benefit from effective tax rates between 4 and 15 percent lower. The effective tax rate on buildings, on the other hand, generally drops by 4 percent or less.

Source: Jane Gravelle, 2011

What are the Arguments For and Against Accelerated Depreciation?

Proponents of accelerated depreciation argue that it is an important incentive to spur business investment and keep effective marginal tax rates on capital investment low. For instance, the Institute for Research on the Economics of Taxation estimated in 2010 that repealing accelerated depreciation would reduce GDP by 3.2 percent. Proponents argue that trading accelerated deprecation for lower rates would still mean higher rates on new investment — at the expense of lower rates on old investments and on non-investment business activity. Many defenders of accelerated depreciation would prefer to go further toward “full expensing," which accounts for the actual expenses businesses face each year.

Opponents of accelerated depreciation argue that it is a clear preference — allowing companies to deduct expenses faster than assets actually wear out — and that it not only distorts businesses decisions of when and how much to invest but also what to invest in. Opponents also cite a study by JCT economists that found any negative macroeconomic effects from repealing accelerated depreciation would be more or less wiped out by the benefits of rate reduction, and the allocative microeconomic benefits could be substantial. Finally, opponents argue the current system is needlessly complex and tremendously outdated.

Corporate tax reformers have another reason for targeting accelerated depreciation, independent of its merits. Without accelerated depreciation, it is virtually impossible to reduce the corporate tax rate below 30 percent in a revenue neutral way through eliminating corporate tax expenditures alone. On the other hand, many worry that using accelerated depreciation to reduce the corporate tax rate would present the opportunity for a timing gimmick because the provision raises much less in the long-term than in the first decade.

What are the Options for Reform and What Have Other Plans Done?

Most corporate tax reform proposals would address accelerated depreciation in some way. Both the Simpson-Bowles plan and the Wyden-Gregg proposal would repeal accelerated depreciation entirely in favor of the Alternative Deprecation Schedule. President Bush's 2005 Tax Reform Panel recommended two plans, one that would overhaul the depreciation system and replace it with a simple system with four asset categories, and one that would repeal all depreciation in favor of full expensing, which would accelerate depreciation to top speed and allow all expenses to be deducted in the first year. In either case, small businesses would be able to fully expense items. The Heritage Foundation and the American Enterprise Institute also move to full expensing, the latter through a consumption tax.

More recently, the President's Framework for Business Tax Reform calls for "addressing depreciation schedules," but does not specify how other than by eliminating accelerated depreciation for corporate jets.

The Domenici-Rivlin plan and the Center for American Progress explicitly retain accelerated depreciation.

If accelerated depreciation were repealed, it could be repealed only for C-Corporations or for all businesses, which would raise either $550 or $775 billion over ten years. Another option would be to retain some amount of accelerated depreciation, but update the schedule of class lives. These schedules have not been updated since 1986 and are calibrated based on the assumption that 25-year interest rates would be 5 percent. Adjusting schedules to a newer estimate of inflation (like 2.5 percent projected in CBO’s recent long-term outlook), would also equalize effective tax rates between equipment and structures, ending the implicit subsidy for equipment, and raise $260 billion over ten years.

Depreciation could also be increased further by switching to full expensing, either for small businesses or for all businesses, which would cost hundreds of billions over the next ten years.

| Revenue from Reform Options on Accelerated Depreciation | |||||

| Policy | Savings (2014-2023) | ||||

| Repeal accelerated depreciation, returning to the Alternative Depreciation Schedule | $775 billion | ||||

| Repeal accelerated depreciation, for C-Corps only | $550 billion | ||||

| Reduce accelerated depreciation for C-Corps by half | $275 billion | ||||

| Retain accelerated depreciation. but lengthen class lives to equalize effective tax rates between equipment and structures and account for today's lower level of inflation | $270 billion | ||||

| Repeal accelerated depreciation for corporate jets | $4 billion | ||||

| Update class lives to adjust for changes in technologies | unknown | ||||

| Allow businesses with incomes up to $1 million to fully deduct expenses | - $40 billion | ||||

| Permanently extend increased expensing for small businesses | - $70 billion | ||||

| Allow companies to fully expense capital assets in the first year | unknown | ||||

*All estimates are CRFB calculations based on available estimates

Importantly, the revenue raised from most of these options in the first decade is substantially higher than the second decade, or over the long term. For instance, fully repealing accelerated depreciation would raise approximately $775 billion over the first decade—approximately 0.36 percent of GDP. By the second decade, it would raise more like 0.30 percent of GDP, 0.27 percent of GDP by the third decade, and 0.24 percent of GDP once new depreciation changes are fully in place. If policymakers wish to enact corporate tax reform that was revenue-neutral over the long-term, this differential must be taken under consideration. One option to reduce the differential would be to gradually phase in changes in the deprecation schedule rather than imposing the shift immediately.

Where Can I Read More?

- Committee for a Responsible Federal Budget – Yes, Actually, We Can (At The Very Least) Make Corporate Tax Reform Revenue Neutral

- Raquel Meyer Alexander - Expensing

- Department of the Treasury – Report to the Congress on Depreciation Recovery Periods and Methods

- Jane Gravelle – Reducing Depreciation Allowances To Finance a Lower Corporate Tax Rate

- Bruce Bartlett – Depreciation’s Place in Tax Policy

- American Enterprise Institute – The quickest way to wreck corporate tax reform

- Nicholas Bull, Tim Dowd, and Pamela Moomau – Corporate Tax Reform: A Macroeconomic Perspective

- Center on Budget and Policy Priorities – Timing Gimmicks Pose Threat to Fiscally Responsible Tax Reform

- Tax Foundation – The Tax Treatment of Capital Assets And Its Effect On Growth: Expensing, Depreciation, and the Concept of Cost Recovery in the Tax System

* * * * *

As the largest corporate tax break, accelerated depreciation will play a central role in any corporate tax reform plan. Although there are strong arguments that it plays a helpful role in spurring investment, it can distort business decision-making and is extremely expensive. In fact, retaining this break would make it close to impossible to bring the corporate rate below 30 percent from corporate tax expenditure reform alone without losing revenue. If policymakers are unwilling to repeal accelerated depreciation entirely, there are a number of options to reduce its costs. In all cases policymakers must remain aware of the long-term fiscal implications and how they differ from those in the first decade. Failing to address depreciation schedules at all, however, will make corporate tax reform quite difficult to achieve.

Read more posts in The Tax Break-Down here.