Senator Ted Cruz's Tax Reform Plan

Replace the Individual Income Tax with a Flat Tax

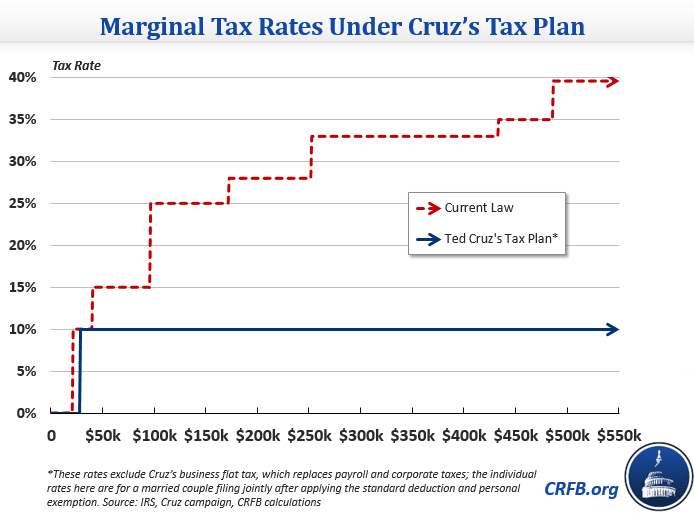

On the individual side, Sen. Cruz would replace the current seven brackets (marginal rates between 10 percent and 39.6 percent) with a single, flat 10 percent rate with exemptions for the lowest income. The plan eliminates nearly all tax preferences, but keeps the mortgage interest and charitable deductions as well as the Earned Income Tax Credit and the Child Tax Credit.

This proposal would increase the standard deduction from $6,300 to $10,000, so a family of four would not owe any tax on their first $36,000 on income. With a flat 10 percent tax, taxpayers currently in the lowest bracket of 10 percent would not see any change in marginal rates, while those in the highest bracket would see their marginal tax rate fall by almost 30 percentage points.

In addition, the plan includes several other cuts:

- Repeals the Alternative Minimum Tax

- Expands the Earned Income Tax Credit

- Reduces the capital gains and dividends rates to 10 percent

- Creates universal savings accounts for individuals to contribute up to $25,000 annually in pre-tax savings

To partially offset the cost of these cuts, this plan will:

- Eliminate all itemized deductions except for the charitable and mortgage interest deductions

- Lower the maximum mortgage eligible for a deduction from $1 million to $500,000

- Sen. Cruz also indicates he would cover the cost of his plan by making spending cuts elsewhere, which could include his campaign proposal to eliminate entire departments, agencies, and bureaus while imposing a federal hiring freeze.

Replace the Corporate Income and Payroll Taxes with a Consumption Tax

On the corporate side, this plan eliminates the 35 percent corporate income tax, 12.4 percent Social Security payroll tax on the worker’s first $118,500 of wages, and the 2.9 to 3.8 percent Medicare tax on all wages. These corporate and payroll taxes are replaced with a flat 16 percent value-added tax called the “Business Flat Tax.”

This 16 percent business tax would differ significantly from the current corporate income tax, perhaps most importantly by making capital purchases fully and immediately deductible (“full expensing”) while eliminating the deductibility of wages. It appears that the the tax would apply to all employers, including non-profits and governments, and no business tax breaks would remain in law.

Making wages non-deductible has a huge impact on revenue, since it essentially means most wage income would be taxed twice under Sen. Cruz’s plan – once at the business level and again at the individual level. This feature, in combination with full deductibility of all non-wage business expenses (capital investments), effectively makes it a consumption tax. Both the Tax Foundation and Tax Policy Center describe Cruz’s plan as a value-added tax (VAT). Although unlike European-style VATs (Sen. Cruz’s tax would not be imposed at each stage of production nor appear as a tax to consumers), it would be paid by all businesses and passed along in the form of higher prices.

By abolishing the corporate income tax, the plan would effectively move to a territorial system where future income earned overseas by a foreign subsidiary of a U.S. corporation would not be taxed. The plan would impose a one-time deemed repatriation tax of 10 percent on past profits held overseas, which are currently tax-deferred.

Other Reforms

This proposal would eliminate all Affordable Care Act taxes and repeal the estate tax. According to the campaign, taxes would be simple enough to submit on a postcard. Although Sen. Cruz claims that his reforms could “abolish the IRS,” there would still need to be some agency to handle its functions – tax collection, administration, and enforcement.

Revenue Impact

Three revenue estimates are currently available for the fiscal impact of Sen. Cruz’s tax plan. The Tax Foundation has estimated that this plan would lose $3.7 trillion in revenue without accounting for economic growth. When scored dynamically based on (generous) economic estimates that assume 13.9 percent additional GDP growth over a decade, the Tax Foundation found this plan will cost $768 billion over ten years.

As the middle estimate, the Tax Policy Center found the plan would reduce revenue by $8.6 trillion, while the Citizens for Tax Justice has a much higher estimate of revenue loss, finding that on a static basis Sen. Cruz’s plan would cost $1 trillion in the first year and $13.9 trillion over the decade.

| Economic and Revenue Analysis of Sen. Cruz’s Simple Flat Tax Plan | |||||||

| Tax Foundation | Tax Policy Center | Citizens for Tax Justice | |||||

| Revenue Impact Type |

|

||||||

| Conventional Score (no economic growth) | $3.7 trillion | $8.6 trillion | $13.9 trillion | ||||

| Dynamic Score | $768 billion | N/A | N/A | ||||

| Economic Growth from Revenue Impact Alone | |||||||

| Increase in GDP by the 10th Year | 13.9% | N/A | N/A | ||||

| Average Increase in GDP over the next 10 years | 7.0% | N/A | N/A | ||||

Sources: Tax Foundation, Tax Policy Center, Citizens for Tax Justice, CRFB Calculations

The three groups have offered partial explanations of the cost disparity, largely due to different assumptions about how the VAT should be scored. While discussing Senator Rand Paul’s proposal (which is similar), the Tax Foundation claimed that Citizens for Tax Justice underestimated the potential VAT values by about 50 percent. The difference in the VAT is also responsible for more than the entire difference in scores between the Tax Policy Center and Tax Foundation.

Conclusion

Given the country’s long-term fiscal outlook, it will be necessary to have a mixture of spending cuts, revenue increases, and entitlement reforms – not tax cuts – to bring the debt down to a sustainable level. We are encouraged that this plan makes an effort to pay for some of its cuts, and Sen. Cruz has indicated the rest of the tax plan will be paid for. He has offered a plan to cut discretionary spending by $500 billion in claimed savings and has indicated a future plan to cut entitlement spending.

Any tax reform proposal should be fully paid for, and our hope that as the campaign continues to develop policy proposals, these proposals would, in the aggregate, produce a fiscally responsible outcome.

—

Update 3/14/16: We’ve updated this piece with a revised estimate from the Citizens for Tax Justice of $13.9 trillion. They previously estimated the cost at $16.2 trillion.