Senate Budget Committee Releases FY 2018 Budget

Senate Budget Committee Chairman Mike Enzi (R-WY) released the Fiscal Year (FY) 2018 Senate budget resolution today. The budget proposes $3.3 trillion in net policy savings over ten years, the result of $4.9 trillion of largely unspecified spending cuts and $1.6 trillion of tax cuts, in addition to $1.4 trillion of claimed savings due to increased economic growth.

The budget also includes deficit-increasing reconciliation instructions that would increase deficits by $1.5 trillion, a notable departure from its claim to reduce deficits.

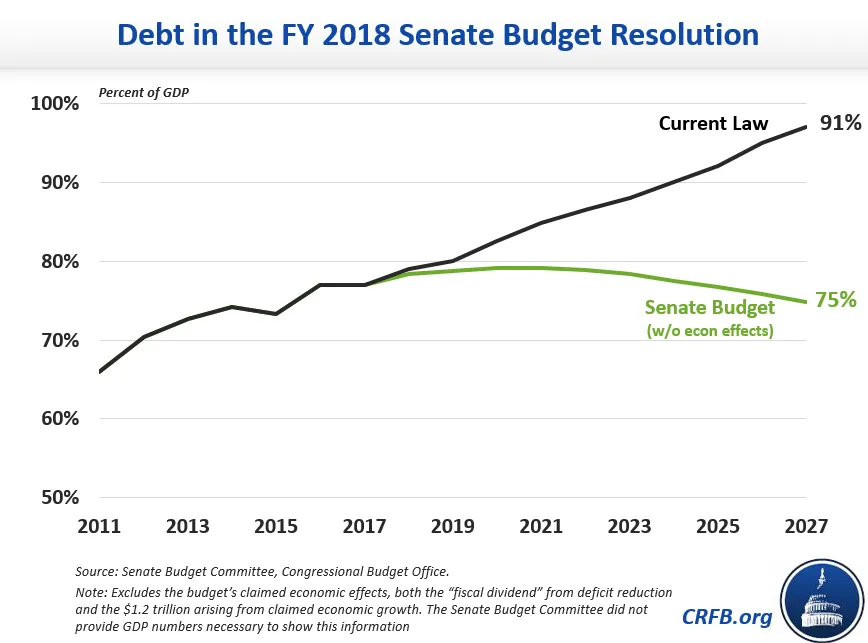

The budget's savings, without the economic effects it claims, would stabilize the debt and put it on a slightly downward path, falling from 77 percent of Gross Domestic Product (GDP) in 2017 to 75 percent by 2027. The budget's claimed economic growth could push debt down further, but it does not provide enough information to know how much growth it actually expects. Either way, the path is an improvement over the Congressional Budget Office's (CBO) June projection for current law, which has debt reaching 91 percent of GDP by 2027.

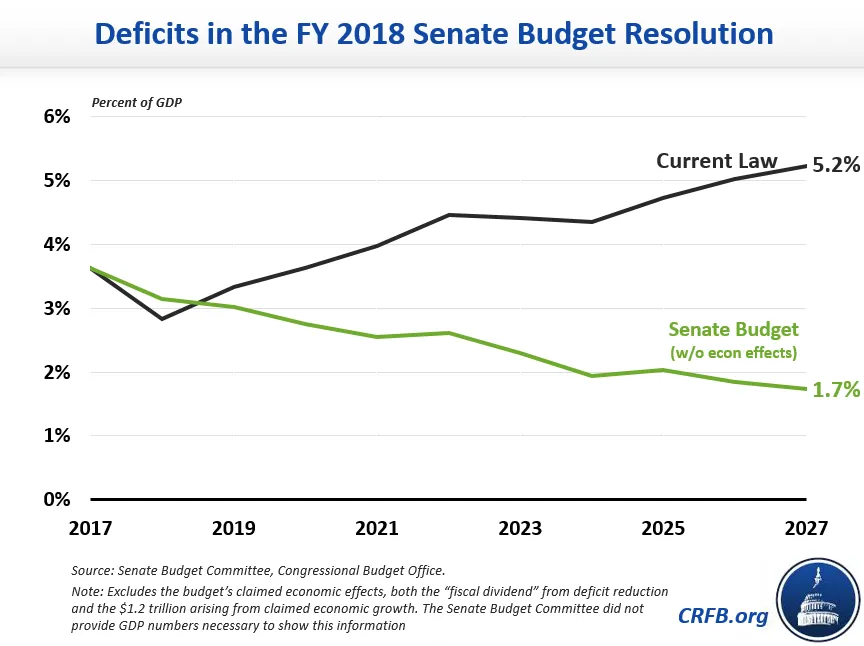

The budget would reduce deficits and achieve on-budget balance (after assumed economic effects). On-budget balance, which excludes Social Security and the Postal Service, is a less ambitious fiscal goal than the House budget's goal of balancing the unified budget. Unified deficits (which includes on- and off-budget accounts) would fall from 3.6 percent of GDP ($693 billion) in 2017 to 1.7 percent ($485 billion) in 2027, excluding economic effects. This path would represent a significant improvement over the 5.2 percent of GDP ($1.5 trillion) deficit projected for 2027 under current law.

The Senate budget gets most of its net deficit reduction from mandatory spending. It calls for $4.1 trillion in unspecified mandatory spending savings, and it makes no effort to describe where in the budget these savings would fall.

On discretionary (appropriated) spending, the budget would adhere to the current defense spending caps through 2021 and growing with the CBO baseline thereafter. At the same time, the budget would adhere to the non-defense spending cap in FY 2018 but cut non-defense budget authority below current law by $632 billion over the next decade, or 11 percent. By 2027, nondefense discretionary spending would be reduced 16 percent below current law base spending. All of the areas that would receive cuts are unspecified.

Finally, the budget allocates war spending, or Overseas Contingency Operations (OCO), at President Trump's request for FY 2018 ($77 billion). War spending would phase down until zeroing out completely in 2022 and beyond.

The budget assumes $1.4 trillion in total economic feedback. One-eighth of this total, or $178 billion, comes from the macroeconomic effects of the budget's deficit reduction, as estimated by the Congressional Budget Office. This assumption is reasonable for the effects arising from deficit reduction. However, the remaining $1.2 trillion of economic feedback is unexplained, nor does the budget explain what economic growth rates it expects to give rise to this extra $1.2 trillion. These unspecified savings are similar to the House budget's egregious $1.5 trillion in economic gains from assuming GDP growth levels much higher than projected by CBO.

Policy Changes in the Chairman's Mark of the FY 2018 Senate Budget

| Budget Category | 2018-2027 Savings |

|---|---|

| Unspecified Mandatory | $4,100 billion |

| Discretionary | $534 billion |

| Revenue | -$1,635 billion |

| Interest | $239 billion |

| Subtotal, Policy Savings | $3,258 billion |

| Economic Effect of Deficit Reduction (from the Congressional Budget Office) | $178 billion |

| Additional Claimed Economic Feedback | $1,240 billion |

| Baseline Adjustments | $1,308 billion |

| Total, Claimed Savings Compared to CBO June Baseline | $5,984 billion |

The Senate budget resolution calls for significant deficit reduction that would put debt as a share of GDP on a downward path, but the most likely part of the budget to be acted on would widen deficits even further. The budget includes reconciliation instructions for not more than $1.5 trillion of deficit-increasing legislation from the Senate Finance Committee (likely for tax reform) and savings of at least $1 billion in future legislation from the Senate Energy and Natural Resources Committee. In total, the budget assumes $1.6 trillion in revenue loss. The additional revenue loss beyond the $1.5 trillion reconciliation instruction is unspecified but may be coming from an assumed "skinny repeal" of the Affordable Care Act.

In a statement, CRFB president Maya MacGuineas called this budget "a roadmap leading us in the wrong direction." The reconciliation instructions – the part of the budget that will most likely be acted on – increases deficits by $1.5 trillion and abandons the House's attempt at including $200 billion of mandatory savings. The budget claims $4.1 trillion in mandatory savings but includes no detail where they come from. Finally, relying on large unspecified amounts of economic growth to fill the budget's hole is irresponsible.

The Senate budget could be improved by allowing for smart tax reform that does not add to the debt as well as reconciliation instructions for mandatory spending reductions. The House budget included revenue-neutral tax reform and $200 billion in mandatory savings from reconciliation; the Senate shouldn't abandon these principles.