IRA Saves Almost $2 Trillion Over Two Decades

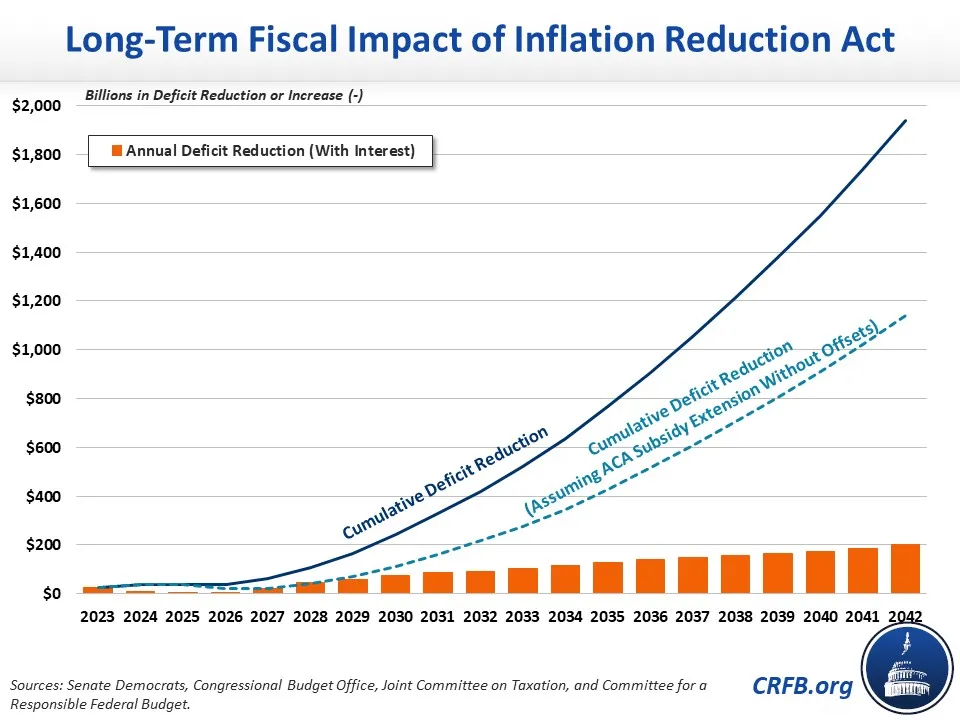

The Inflation Reduction Act (IRA) would reduce budget deficits by over $300 billion in its first nine years, but much of the savings would take time to materialize. We estimate the IRA would reduce deficits by $1.9 trillion over two decades, including interest savings. Assuming a permanent extension of the expanded Affordable Care Act (ACA) subsidies, the bill would reduce deficits by $1.1 trillion with interest.

| Policy | 2023-2031 Effect | 2023-2042 Effect | ||

|---|---|---|---|---|

| Energy and climate spending and tax credits | -$385 billion | -$750 billion | ||

| ACA subsidies (3 years) and drug spending | -$100 billion | -$150 billion | ||

| 15% minimum tax, carried interest, and other revenue | $350 billion | $850 billion | ||

| Prescription drug pricing reforms | $320 billion | $1.3 trillion | ||

| IRS funding for tax enforcement | $125 billion | $250 billion | ||

| Total Primary Deficit Reduction | $305 billion | $1.5 trillion | ||

| Interest Savings | $25 billion | $400 billion | ||

| Total Deficit Reduction, With Interest | $330 billion | $1.9 trillion | ||

| Memo: Deficit Reduction with Permanent ACA Subsidies | $160 billion | $1.1 trillion | ||

Sources: Senate Democrats, Congressional Budget Office, Joint Committee on Taxation, and Committee for a Responsible Federal Budget. First-decade estimates are rounded to the nearest $5 billion, two-decade estimates to the nearest $50 billion. Numbers may not sum due to rounding.

Over two decades, we estimate the Inflation Reduction Act includes roughly $900 billion of spending and tax cuts, $2.4 trillion of offsets, and roughly $400 billion of net interest savings. About $1.3 trillion of those offsets comes from prescription drug spending - including drug negotiations, an inflation price cap, and the repeal of a costly rebate rule. The remaining $1.1 trillion comes from higher revenue, mainly from a 15 percent corporate minimum tax and from increased Internal Revenue Service (IRS) funding to improve tax compliance.

There are several reasons why net deficit reduction in the IRA is much larger over the next two decades, on a per year basis than in the first nine years alone. First, much of the prescription drug savings don't begin to materialize until 2027, when negotiated drug prices first take effect and the current law hiatus on the rebate rule ends. Second, those prescription drug savings will grow rapidly over time as Medicare is able to negotiate the price of more prescription drugs (they negotiate 20 per year). Third, much of the energy and climate spending represents a one-time investment and will be fully spent by late this decade. And fourth, interest savings accumulate and compound over time, particularly as rates are projected to rise.

Finally -- and importantly -- the IRA only extends the expansion of ACA subsidies for 3 years, after which they have no further cost. This expiration masks a potential future fiscal burden, as new offsets would be needed to continue subsidies without adding to the debt. Assuming the subsidy expansion were continued without offsets, we estimate the legislation should reduce deficits by $1.1 trillion over two decades.

On an annual basis, we estimate net deficit reduction under the Inflation Reduction Act would rise to about $100 billion per year by 2033 and to $200 billion a year by the end of the second decade. Debt as a share of GDP would be four percentage points lower by 2042. With the extension of ACA subsidies, it would be two percentage points lower.

With debt headed to 140 percent of GDP in two decades, much more would need to be done to put it on a sustainable path. But the Inflation Reduction Act would be a step in the right direction.