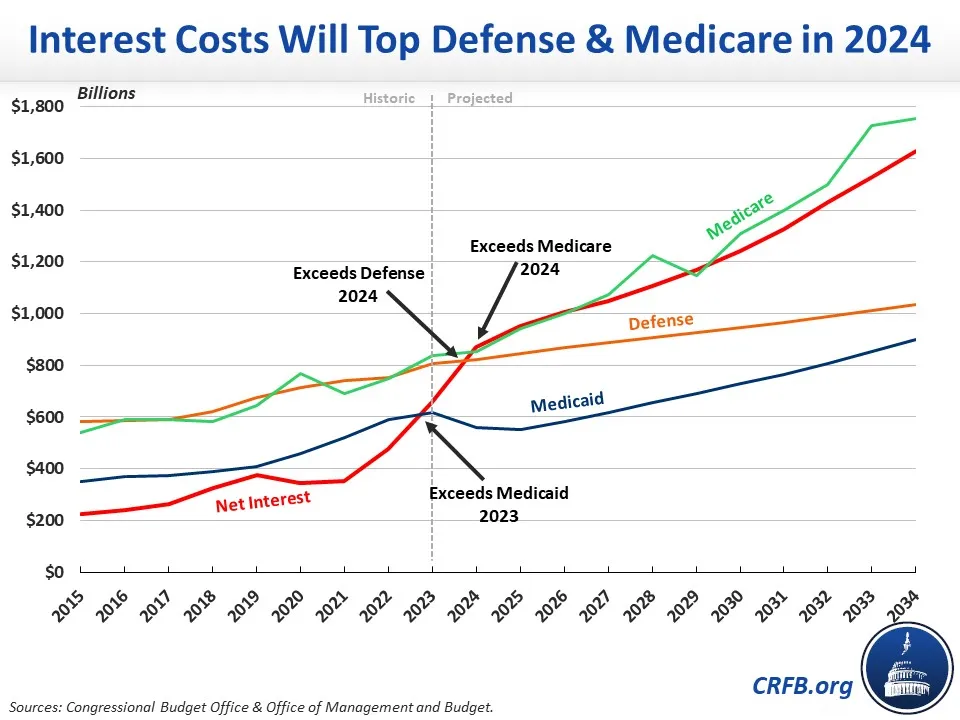

Interest Costs Will Leapfrog Medicare and Defense This Year

Interest on the debt is the fastest growing part of the budget. Net interest payments will exceed both defense and Medicare spending this year, in Fiscal Year (FY) 2024, according to new projections from the Congressional Budget Office (CBO). That will make interest the second largest government expenditure.

Net interest has been exploding over the past few years, with payments rising from $223 billion in 2015 to $352 billion in 2021 before nearly doubling to $659 billion in 2023. In 2024, CBO projects net interest will total $870 billion, a near-record 3.1 percent of Gross Domestic Product (GDP).

Spending on interest already topped the Medicaid budget and all spending on children last year. At a projected $870 billion, interest will surpass total spending on national defense ($822 billion) in 2024 and grow well beyond the defense budget over time. Interest costs will also slightly exceed net Medicare spending ($851 billion) this year and remain in line with Medicare costs in future years. That would make interest the second largest line item in the budget after Social Security.

The massive runup in net interest is due to a combination of higher interest rates and higher debt. With most Treasury yields paying between 4.0 and 5.5 percent, interest rates are the highest they have been since 2007. And by 2028, debt is projected to reach a record 106 percent of GDP, exceeding its previous record set just after World War II.

As a result of high rates on growing debt, interest payments are projected to exceed $1 trillion annually by 2026 and grow to $1.6 trillion by 2034. Over the next decade, interest will total $12.4 trillion. Interest costs would exceed $15 trillion – an additional $3 trillion – if rates are just 1 percentage point above projections.

Although Medicare will overtake interest once again in 2028, the fact that both are growing so quickly should sound the alarm in regard to rising health care costs and growing debt.

Thoughtful deficit reduction can help to reduce interest costs, both by lowering debt and putting downward pressure on interest rates. Absent such action, debt will represent a growing threat to our economy, our health care system, and our national security.