An 'Interactive' Analysis of Christie's & Sanders's Social Security Plans

Earlier this week, CRFB analyzed a new plan from New Jersey Governor Chris Christie that, among other things, would close about 60 percent of the program's funding shortfall.

What we failed to mention is that our readers could analyze this and other plans themselves through CRFB's interactive Social Security Reformer tool. The Social Security Reformer allows users to simulate an existing plan or create their own. Although the Social Security Reformer does not have every permutation of every Social Security policy out there, it has enough capability to understand the broad financial impact of most Social Security plans, as well as the impact in each year.

Below, we take the Social Security Reformer for a test drive, showing how it can be used to analyze Governor Christie's plan as well as a plan from Senator Bernie Sanders (I-VT).

The Christie Plan

The major components of the Christie Social Security plan are all available in the Reformer. By clicking through a variety of selections, users can raise the retirement age to 69, means-test benefits for higher earners, tighten eligibility for the SSDI program, measure COLAs using chained CPI, and increase benefits for the oldest beneficiaries.

Of course, the Christie plan does include changes not in the Reformer, including more aggressive means-testing, a tax break for working seniors, an increase in the early retirement age, and a variety of SSDI reforms -- but these changes are relatively small and because they move in opposite directions they will likely have very little impact overall.

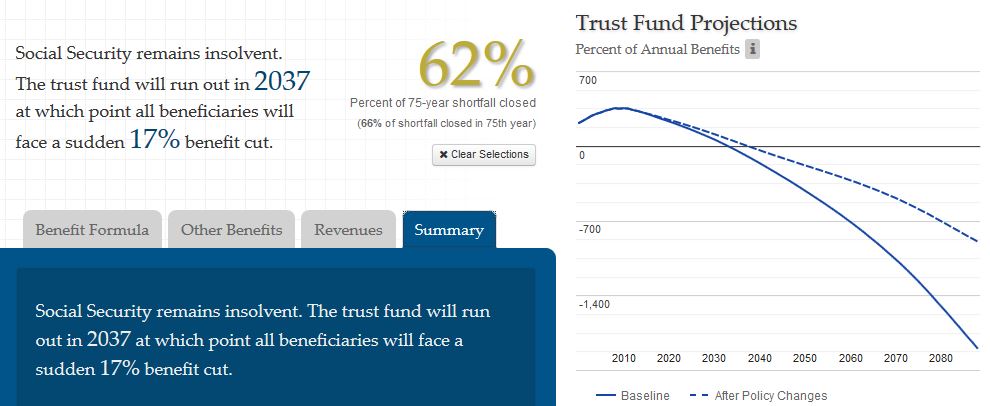

So what results do we get when we punch in the Christie plan? First of all, the plan would reduce 62 percent of the 75-year shortfall and about two-thirds of the shortfall in the 75th year. Because savings phase in very slowly, absent other changes it would extend the program's insolvency date only four years to 2037.

Interactive Simulation of Christie Plan's Effect on the Trust Fund and Shortfall

Over the long term, though, it would also put spending and revenue on pretty similar trajectories, meaning they would grow at about the same pace. Additional changes equivalent to 1 percent of payroll over 75 years and almost 2 percent in the 75th year would bring these two metrics in line.

Interactive Simulation of Christie Plan's Effect on Spending and Revenues

The Sanders Plan

Many components of Senator Sanders' Social Security Expansion Act are available in some form in the Reformer. Users can capture most of the plan by selecting changes to eliminate the payroll tax cap, index COLAs through the more generous CPI-E, and enact a new minimum benefit. While our Reformer does not include Senator Sanders's proposal to broadly increase benefit levels, this increase happens to be similar in size to the new benefits the Reformer assumes will accompany a tax max increase -- but which are not included in the Sanders plan. Since the Reformer also does not include an option to apply the payroll tax to investments, we substitute a 0.65 percent payroll tax increase as a rough approximation of that policy.

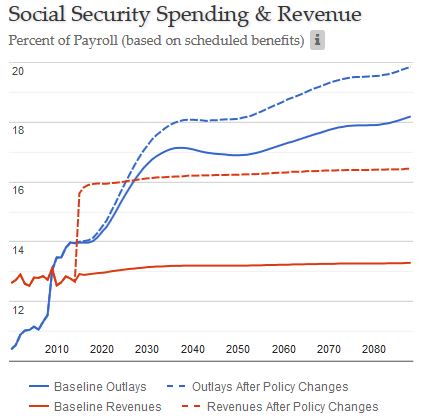

So what do we find? Senator Sanders's plan would close three-quarters of the 75-year shortfall and extend the solvency date to 2066.

Interactive Simulation of Sanders Plan's Effect on the Trust Fund and Shortfall

However, because revenue is front-loaded and the plan accelerates rather than slows the growth of benefits, the plan would close only 45 percent of the funding gap in the 75th year (our simulator says 31 percent because it doesn't account for the growing revenue base of the investment tax), ultimately requiring savings approaching 2.8 percent of payroll by the end of the 75-year window.

Interactive Simulation of Sanders Plan's Effect on Spending and Revenues

*****

As the above simulations show, the Social Security Reformer can be a powerful tool to assess the impact of Social Security reform legislation. Our hope is that as the 2016 campaign kicks into gear, we'll see more plans to begin improving the financial state of the program.

The two plans we analyzed are clearly quite far apart, and neither of them by itself would make Social Security sustainably solvent for the next 75 years and beyond. But policymakers could take the best part of both plans to come up with a package that would do just that. Versions of proposals from Christie to raise the retirement age, move to the chained CPI, and increase benefits for the oldest seniors have been featured in a number of bipartisan Social Security plans. Meanwhile, versions of proposals from Senator Sanders to increase the taxable maximum and establish a minimum benefit have also been in those plans. And as it turns out, taking those five policies together would make the program sustainably solvent for future generations.

Interactive Simulation of "Combination" Plan

Of course, that is only one of many plans that could work to fix Social Security. The Social Security Reformer provides the opportunity to create many types of Social Security plans and see how different approaches would affect Social Security solvency, spending, and revenue. You can check out this interactive tool and design your own plan at https://www.SocialSecurityReformer.org.