How Clinton and Trump Could Affect Economic Growth

Recently, the Tax Policy Center (TPC) estimated the economic impact of Hillary Clinton's and Donald Trump's tax plans, finding that both plans would slightly reduce economic growth over the next decade and that Trump's would more significantly slow growth in the following decade. We built off of their estimates with the candidates' direct spending plans contained in their full policy platforms.

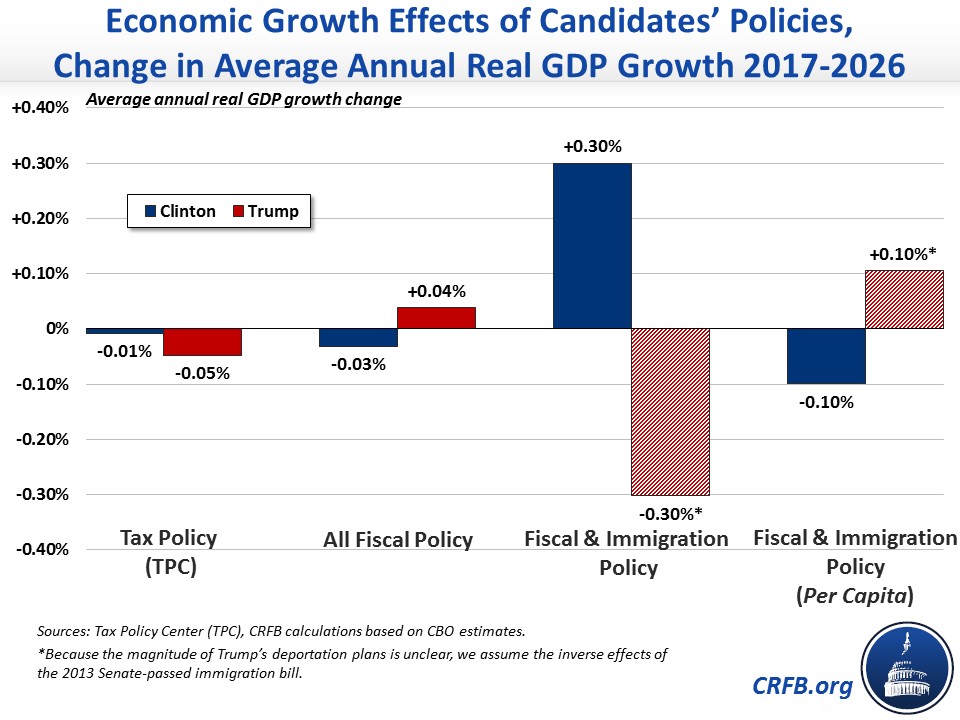

By our very rough estimates, when all fiscal policies are incorporated, Clinton's plan would have a slightly larger (but still extremely small) negative impact on growth, while Trump's plan would slightly increase economic growth over the decade. However, when immigration reform is accounted for, we expect Clinton's plan to increase average real Gross Domestic Product (GDP) growth from about 2.0 percent per year to 2.3 percent, while Trump's plan could reduce it to as low as 1.7 percent.

Importantly, these estimates do not account for the candidates' trade, regulatory, or energy plans, all of which could further impact economic growth. Even in the best case scenario, however, the candidates' policies are only likely to improve economic growth rates by decimal points, not percentage points.

What Would the Candidates' Tax Policies Mean for Growth?

Using their own Keynesian model along with the Penn Wharton Budget Model, TPC estimated the effect of Clinton's and Trump's tax plans on GDP, incorporating demand-side effects, incentive effects, and deficit impact.

TPC found that Clinton's ten-year $1.4 trillion tax increase would reduce cash available for consumption while also reducing the incentive for individuals and businesses to work, save, and invest. On the other hand, they also estimate that the tax plan would reduce debt levels and therefore increase savings and investment in the economy. On net, TPC finds Clinton's plan would reduce the size of the economy by 0.4 percent in 2017 and 0.1 percent in 2026. Because it would reduce debt levels, however, they find her tax plan would increase the size of the economy by 0.5 percent after two decades.

| 2017 GDP* | 2026 GDP | 2036 GDP | |

|---|---|---|---|

| Clinton | -0.4% | -0.1% | +0.5% |

| Trump | +1.7% | -0.5% | -4.0% |

Source: Tax Policy Center. *For 2017, the GDP effect is from the TPC Keynesian model.

Meanwhile, TPC's findings on Trump's $6 trillion tax cut are almost the opposite. They find that his plan would increase cash available for consumption and increase incentives to work, save, and invest. But because Trump's plan would add significantly to the debt, these positive effects would ultimately be wiped out by the negative impact of higher debt. As a result, TPC estimates Trump's plan would increase the size of the economy by 1.7 percent in 2017 but reduce it by 0.5 percent after a decade and by 4 percent after two decades.

What Would the Candidates' Tax and Spending Policies Mean for Growth?

TPC's estimates provide important information on the impact of the candidates' tax policies, but their spending policies would also have effects. By looking at the tax-side only, the analysis essentially assumes Clinton would reduce deficits by $1.5 trillion over a decade when in reality she would increase them by $200 billion after her spending policies are considered. TPC's numbers also don't look at Trump's various spending increases and cuts, though on net they have a much smaller effect on his overall debt impact compared to his tax plan.

We adjusted TPC's numbers to account for these effects. Using a combination of our overall estimates of the candidates' plans, TPC's economic findings, and various macroeconomic estimates from the Congressional Budget Office (CBO), we were able to generate very rough estimates of how the candidates' policies would affect economic growth.

For Clinton, higher net spending would more than wipe out the deficit reduction from her tax plan. And although we estimate about half of this new spending would be on federal investments that could help boost growth (aside from the deficit impact), we still find that Clinton's fiscal policies would reduce average annual projected growth by roughly 0.03 percent per year (compared to 0.01 percent from her tax plan alone).

For Trump, lower net spending would offset a small portion of the deficit impact from his tax plan. More importantly, Trump's plan to repeal the Affordable Care Act ("Obamacare") would likely increase the size of the economy over the next decade by increasing the incentive to work. According to CBO, "Repeal of the ACA would raise economic output, mainly by boosting the supply of labor; the resulting increase in GDP is projected to average about 0.7 percent over the 2021–2025 period." With Trump's fiscal policies fully accounted for, we estimate average annual projected growth under his plan would be about 0.04 percent higher over the next decade.

While the economic impact of fiscal policy would be extremely small over the next decade for either candidate, the effect of immigration reform could be more significant. Clinton's immigration plan, which would increase the number of documented immigrants, appears to be quite similar to the 2013 Senate-passed immigration bill; if incorporated, this would lead her plan to increase average GDP growth by 0.3 percent per year – from 2.0 to 2.3 percent over the next decade. On the other hand, this plan would reduce per capita GDP growth by about 0.1 percent.

Trump's immigration plan, designed to stem immigration and particularly illegal immigration, would have an opposite effect. Although we aren't able to estimate his precise plan, if it were the inverse1 of Clinton's the result would be a 0.3 percent reduction in annual average growth – from 2.0 percent per year to 1.7 percent. At the same time, per capita growth would be about 0.1 percent per year faster than projected.

What Would the Candidates' Plans Mean for Long-Term Growth?

Incorporating fiscal policy and immigration, we expect Clinton's plans to accelerate total economic growth and slow per capita growth over the next decade, while we expect Trump's plans to do the reverse. But over the long term, we expect different results.

For Clinton, the negative effects of tax policy and the positive effects of new federal investment plus potential modest deficit reduction are likely to mean her fiscal policies will have only a minor impact on long-term growth. However, immigration reform would continue to boost GDP growth over the second decade and would also likely boost per capita growth. Over two decades, CBO estimates immigration reform would increase average growth by about 0.25 percent per year and average per capita growth by about 0.01 percent (despite reducing per capita growth in the first decade).

On the other hand, Trump's immigration plan – along with extremely large increases in the national debt – is likely to significantly slow economic growth over the long run. In total, average GDP growth could be 0.3 to 0.5 percent slower per year over two decades, and per capita growth could be up to 0.2 percent slower.

Importantly, none of these estimates take into account trade, energy, or regulatory policy, though many independent experts have argued the candidates' trade policies would slow economic growth.2

*****

Promoting faster economic growth, which will increase national wealth and household income, should be an important part of any candidate's agenda.

An important part of growing the economy will be enacting a plan to put the debt on a downward path as a share of GDP, and this is an area where both candidates could improve their plans.

1 Trump's current immigration policy does not specify how many or at what rate he plans on deporting unauthorized immigrants. For the sake of our comparison, we assume he would do so at a rate that is the inverse of the 2013 Senate-passed immigration bill – removing about 11 million unauthorized immigrants over a decade. In reality, Trump's plan could be larger or smaller than this.

2 The Trump campaign disputes this premise, as argued by campaign economic advisor Peter Navarro.