Event Recap – When the TCJA Expires: A Tax Policy Summit

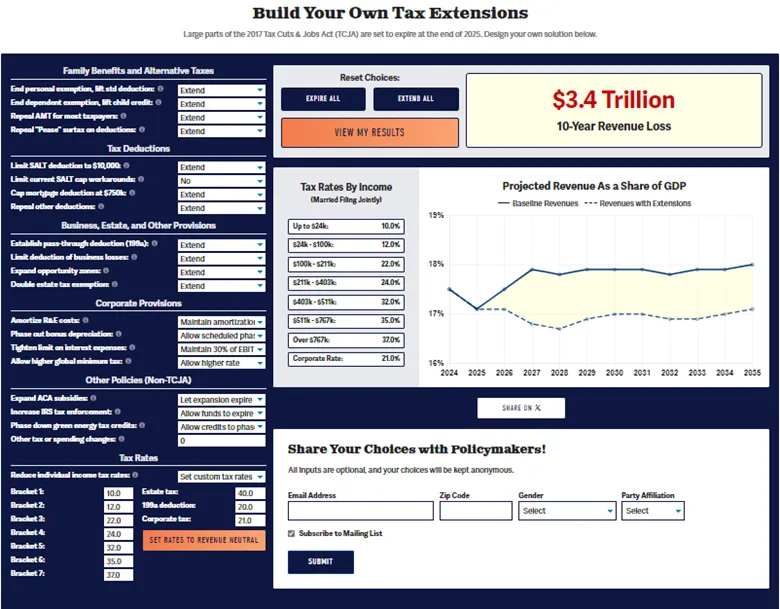

On March 28, the Committee for a Responsible Federal Budget hosted When the TCJA Expires: A Tax Policy Summit, an event focusing on the large parts of the 2017 Tax Cuts and Jobs Act (TCJA) that are set to expire at the end of 2025. The summit provided an opportunity to bring together experts and policymakers to discuss the challenges, opportunities, and potential paths forward in addressing these expirations. The Committee for a Responsible Federal Budget also unveiled Build Your Own Tax Extensions, an interactive tool that allows users to design their own plan for the upcoming TCJA expirations.

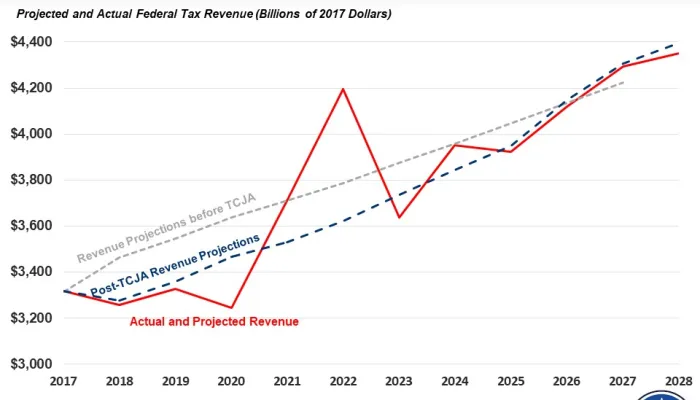

The event began with remarks from Maya MacGuineas, president of the Committee for a Responsible Federal Budget. MacGuineas discussed why 2025 is poised to be an “incredibly consequential year,” pointing mainly to the expiration of the bulk of the 2017 tax cuts. The cost of extending the TCJA’s individual provisions would be $3.4 trillion over ten years, and it could grow to become close to $5 trillion if other corporate and non-TCJA policies are extended, revived, or expanded.

The potential trillions of dollars in tax cut extensions come at a time of near-record debt levels, deficits as a share of Gross Domestic Product (GDP) being the highest that they’ve been during a time of peace, interest payments being the fastest-growing part of the federal budget, and looming insolvency of important trust funds. MacGuineas noted, however, that there were parts of the TCJA that improved efficiency of the tax code and were pro-growth, stating further that this is an opportunity for tax reform that doesn’t hurt the fiscal situation.

The first panel, “Tax Reform Redux: Four Plans to Improve the TCJA After 2025,” was moderated by Marc Goldwein of the Committee for a Responsible Federal Budget and featured Kimberly Clausing of UCLA School of Law, Kyle Pomerleau of the American Enterprise Institute, Ben Ritz of the Progressive Policy Institute, and Daniel Bunn of the Tax Foundation.

Panelists spoke on their respective plans to extend parts of the TCJA while modifying other portions. There was a great deal of overlap among their plans in terms of policy recommendations, such as in extending the repeal of personal and dependent exemptions, repealing the alternative minimum tax, extending or expanding the state and local tax deduction cap and addressing workarounds, opposing extension of the 20 percent pass-through deduction, limiting other deductions, and reviving full expensing for research and experimentation. Panelists’ plans differed on the individual tax rates, standard deduction and Child Tax Credit (CTC), mortgage deduction cap, pass-through loss deduction, opportunity zones, estate tax exemption, corporate tax rate, and other corporate provisions. However, all panelists agreed that the current fiscal situation is troubling, and each of their plans for addressing TCJA expirations raise revenue over the long term.

In addition to discussing their plans, panelists also shared their differing opinions on whether spending reform should be included in the 2025 discussions, their favorite and least favorite TCJA policies, what they think will actually happen when lawmakers address the expirations, and other tax policies they wish were being discussed, among other topics. You can find a table summarizing their plans below, as well as links to their plans.

Plans: Clausing-Sarin | Pomerleau-Schneider | Progressive Policy Institute | CRFB Budget Blueprint

You can find a summary table of the plans here.

The second panel, “Looking Over the Cliff: Challenges and Opportunities When the TCJA Expires,” was moderated by Josh Barro of Very Serious and included panelists Alex Brill of the American Enterprise Institute, George Callas of Arnold Ventures, Aruna Kalyanam of Ernst & Young, and Anna Taylor of Deloitte.

Panelists drew from years of experience working on previous tax and legislative packages to suggest what scenarios lawmakers may face when the TCJA expires. Panelists were asked specifically about what could happen after the 2024 election should Republicans take full majority control of Congress, Democrats take full majority control, or if Congress stays divided as it is now.

With President Trump in power, Brill expects that Trump’s proposed 10 percent tariff could be proposed as an offset or to justify even higher costs, and Callas agreed that a Trump cabinet would support revenue raisers like external tariffs over base broadening as they did in 2017.

Taylor noted that if Democrats were to take control, they would be able to build off recent successes and perhaps advance some substantive policies already developed and vetted during the negotiations over the Build Back Better Act and Inflation Reduction Act. Brill believes the TCJA will be the baseline for Democrats with the goal of keeping large parts of it and improving other parts like the CTC and Earned Income Tax Credit. Kalyanam said Democrats today seem more comfortable offsetting tax cuts but will be asking how to shape policy around their pledge to not raise taxes for those making under $400,000.

Panelists agreed that, in a divided government, offsets will at least be a part of the discussion. Callas pointed out the recent differences between House Republicans showing more support for offsets than Senate Republicans, and Taylor pointed to the Inflation Reduction Act as an example of Democrats seriously discussing offsets as well.

The event concluded with a lively reception during which attendees were able to design their own plan for addressing the 2025 TCJA expirations with the new Build Your Own Tax Extensions tool. The tool allows users to extend, expire, or modify different elements of the TCJA as well as customize tax rates. While a full extension of the TCJA could cost $3.4 trillion or more, we hope this tool will foster thoughtful conversations and fiscally responsible plans well in advance of the December 2025 deadline.

The Committee for a Responsible Federal Budget thanks all who attended the event.