Deficit Totaled $1.7 Trillion Over the Past Year

The federal budget deficit totaled $1.7 trillion over the past 12 months, down $32 billion from the 12-month rolling deficit ending in March and down $68 billion from the full year FY2023 deficit. The federal government ran a surplus of $208 billion as Americans filed their annual tax returns, about $32 billion more than surplus in April 2023. Receipts in April were $777 billion and spending was $468 billion, about $100 billion more than last April. The following is an updated analysis of the rolling deficit, incorporating the latest data from the Congressional Budget Office (CBO).

Removing the effects of student debt cancellation, which was ruled illegal, the deficit was $2.0 trillion over the past year. As a share of the economy, the deficit was roughly 5.8 percent of Gross Domestic Product (GDP), or 7.0 percent excluding student debt effects.

Compared to the 12-month period ending April 2023, nominal spending is down 3.0 percent to $6.3 trillion and revenue is up 2.6 percent to $4.7 trillion. The drop in spending is due the Supreme Court ruling student debt cancellation illegal, mostly offset by growth in net interest, Social Security, and health care benefits. Revenue went down form individual income taxes and up from corporate tax refunds.

As a share of GDP, revenue was roughly 16.9 percent of GDP over the past year and spending was roughly 22.7 percent of GDP.

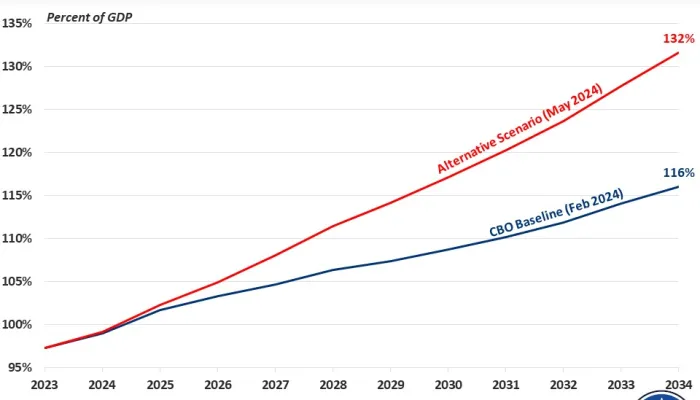

Deficits are projected to be $1.5 trillion at the end of the fiscal year (5.3 percent of GDP) and grow to $2.6 trillion (6.2 percent of GDP) by 2034. Policymakers should work together to get the economy and our fiscal health back on track and can start by closing the gap between spending and revenue.