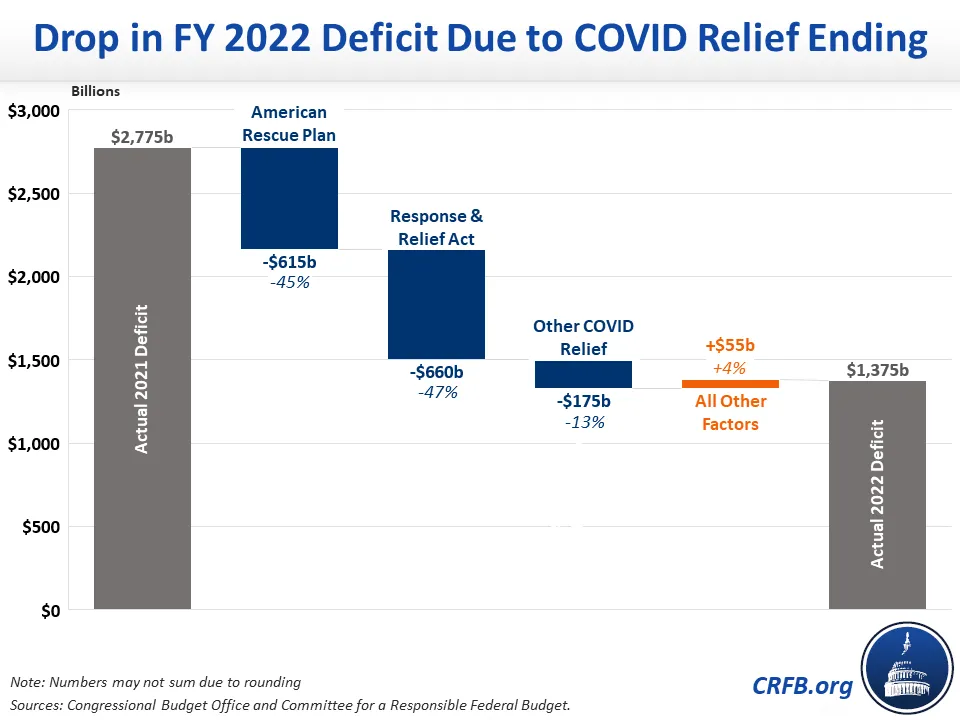

COVID Relief End Explains All of 2022 Deficit Decline

The budget deficit fell by half between Fiscal Year (FY) 2021 and FY 2022, from $2.8 trillion to $1.4 trillion. While the Biden Administration has tried to take credit for this "historic deficit reduction," we estimate that over 100 percent was the result of shrinking or expiring COVID relief. And while roughly 22 percent of the gross improvements come from changes in economic projections (more than offset by the cost of student debt cancellation), those economic changes will actually increase future deficits by over $1.5 trillion between 2023 and 2032.

Of the $1.4 trillion drop in the deficit between FY 2021 and 2022, roughly $1.45 trillion - or 104 percent - was the result of shrinking or expiring COVID relief. This includes $615 billion (44 percent) from declining stimulus from the American Rescue Plan enacted in March 2021 and another $660 billion (47 percent) of shrinking aid from the Response & Relief Act enacted in December 2020. The remaining $175 billion (13 percent) represents declining COVID relief from the CARES Act., the Families First Act, and other legislation enacted in the first half of 2020.

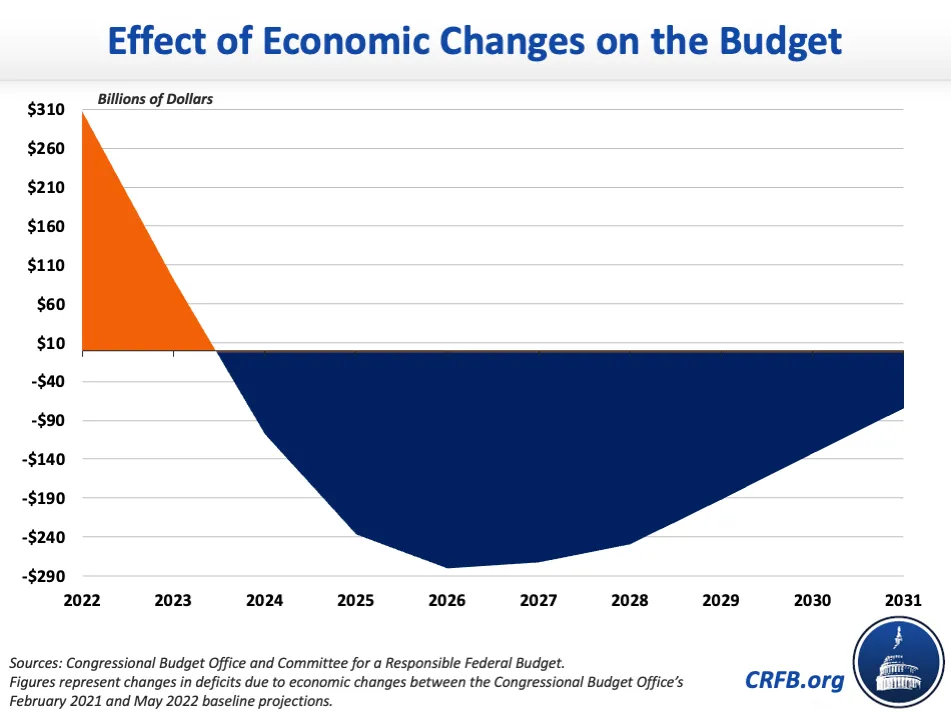

The $55 billion of other factors includes $380 billion (27 percent) of higher deficits due to the cancellation of up to $20,000 per borrower of student debt, a $310 billion (22 percent) reduction in the deficit as a result of economic changes since CBO's February 2021 baseline, along with $15 billion (1 percent) of net deficit reduction from other factors. The economically-driven fall in 2022 deficits, relative to prior projections, is due to a combination of lower unemployment, faster economic recovery, and higher inflation, partially offset by higher interest rates.

Importantly, while economic changes reduced the deficit by $310 billion in FY 2022, they will actually increase deficits by over $1.5 trillion between 2023 and 2032 under CBO's baseline. Factors such as higher inflation tend to increase revenues in the near-term but increase spending and push up interest costs over time. Economic changes are likely to boost deficits even further when including more recent economic data, since interest rates are now much higher and economic growth much weaker than CBO projected in the spring.

All said, the decline in the deficit over the past fiscal year is more than entirely the result of waning COVID relief and not of historic deficit reduction by President Biden as the White House claims. In fact, the President's actions to date have increased deficits by $4.8 trillion through 2031.

With inflation at a 40-year high and debt headed to record levels, actual deficit reduction is needed to put the country on solid fiscal ground.