CBO Says IRS Cuts Would Be Costly

Rescinding $20 billion of Internal Revenue Service (IRS) funding would ultimately add over $30 billion to the deficit, including $24 billion through Fiscal Year (FY) 2034, according to new estimates from the Congressional Budget Office (CBO). If the spending reductions were reallocated to appropriations, this rescission could ultimately add over $50 billion to the deficit. CBO also estimates that a $5 billion rescission would ultimately add $1.5 billion to the deficit, while a $35 billion recession would add about $70 billion to the deficit.

The Inflation Reduction Act (IRA) of 2022 appropriated $80 billion of mandatory funding for the IRS to improve customer service, invest in information technology, and improve tax compliance in order to reduce the “tax gap," or the difference between taxes owed and taxes collected. At the time, CBO estimated this funding would generate about $180 billion in additional revenue through FY 2031, leading to roughly $100 billion of deficit reduction over that period.

In light of an apparent agreement to cut some of this IRS funding as part of the FY 2024 appropriations process, CBO recently published a new report estimating the revenue impact of cutting $5 billion, $20 billion, or $35 billion of the IRS funding included in the IRA. Its estimates assume the IRS would respond to such a cut by ending additional spending sooner than planned as opposed to spending less in the near term. The report also incorporates updated estimates of the expected return on federal investment from enforcement funding – especially to account for the deterrence effect of additional audits.

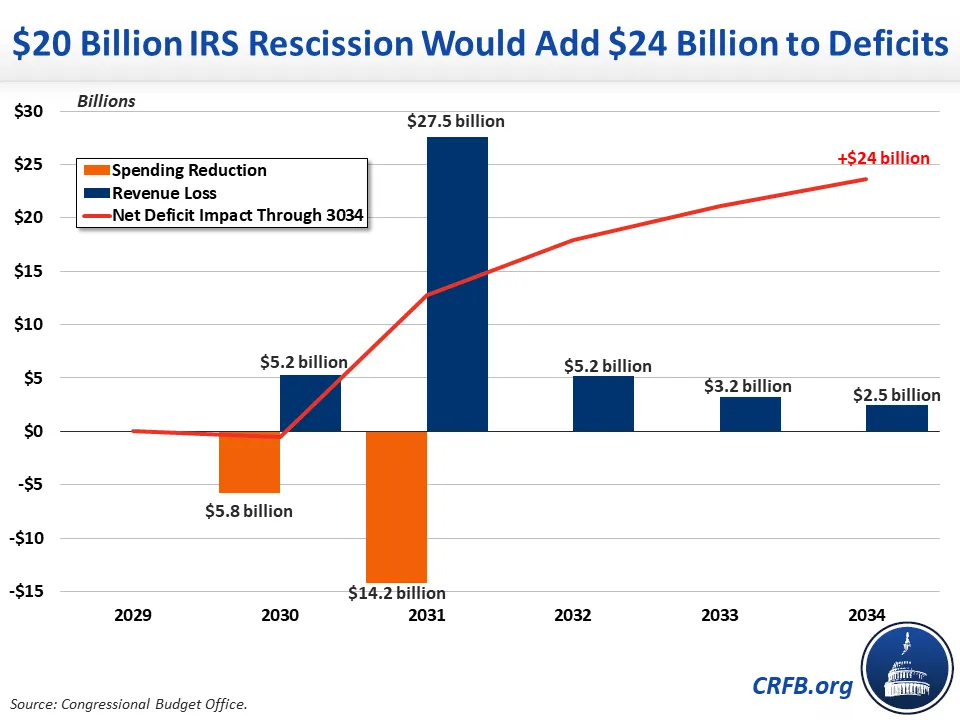

CBO estimates a $20 billion rescission will eventually lose over $50 billion in revenue ($44 billion through FY 2034), boosting the deficit by over $30 billion ($24 billion through 2034). In other words, the government would lose $2.50 of revenue for every $1 of rescinded IRS funding. While the rescission would save the government money in 2030, it would add to the deficit in all subsequent years.

CBO also looked at a $5 billion rescission, estimating that roughly $6.5 billion of revenue ($5.2 billion through FY 2034) would be lost, translating to a $1.5 billion increase in the deficit ($0.2 billion through 2034). This suggests the marginal return of the last dollar the IRS plans to spend will result in little if any net savings, and further increases to the IRS budget alone would likely not reduce deficits in CBO’s base case.

Finally, CBO estimated a $35 billion rescission, which would reduce revenue by roughly $105 billion ($89 billion through FY 2034). The deficit would increase by $70 billion as a result ($54 billion through 2034). In this case, the government would lose about $3 of revenue for every $1 of rescinded funding.

Estimated Revenue Losses for Rescinding Some of the IRS’s Mandatory Spending

| Amount Rescinded | Lost Revenue (2024-2034) | Net Deficit Increase (2024-2034) | Net Deficit Increase (Total) |

|---|---|---|---|

| $5 billion Rescission | $5.2 billion | $0.2 billion | $1.5 billion |

| $20 billion Rescission | $43.6 billion | $23.6 billion | $31 billion |

| $35 billion Rescission | $89.2 billion | $54.2 billion | $70 billion |

Sources: Congressional Budget Office, CRFB calculations.

Although CBO’s latest estimates suggest little fiscal benefit from further increases in the IRS budget, they suggest substantial costs from significant cuts. Even very small cuts, if reallocated to new spending, would meaningfully worsen the budget deficit.

Reducing the tax gap and funding the IRS has a long history of bipartisan support and has been proposed by every President from Reagan to Biden. This policy provides a rare opportunity to raise revenue without raising taxes while also improving the integrity of the tax code. Cutting the IRS budget would be a costly mistake, and using those funds for new spending doubly so.