Additional Offsets for Senator Sanders's Health Plan

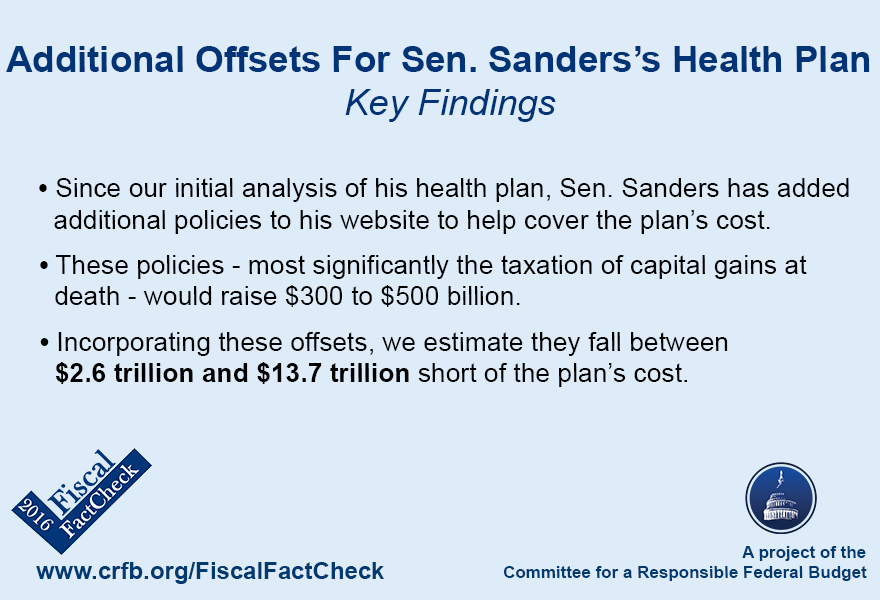

Specifically, our updated estimate finds that the plan’s offsets will fall $2.6 to $2.8 trillion short of the costs that Sanders estimates, down from $3.1 trillion in our original analysis. And if the single-payer plan costs nearly twice as much, as economist Kenneth Thorpe estimated, offsets would fall short by $13.5 to $13.7 trillion. As with our prior estimates, our analysis is based largely on existing CBO and JCT scores, but is very rough and excludes most interactions, many behavioral effects, and all economic feedback effects.

Additional Policies to Pay for Senator Sanders’s Single Payer Plan

At the time we published our initial analysis, Senator Sanders’s website listed a variety of tax increases to pay for his single-payer health plan, including a 2.2 percent individual income-based premium, a 6.2 percent income-based premium paid by employers, reforms to increase the estate tax, progressive increases in income tax rates, and the taxation of capital gains and dividends as ordinary income (at a new top rate of 52 percent, before surtaxes). Since that time, two additional offsets have been added to the campaign’s website (which campaign representatives have told us pay for their health care plan) – both related to capital gains.

First, the plan would require derivatives be taxed annually on their value, meaning that taxpayers would pay taxes on the gains (or could deduct losses) from derivatives even if the items were not sold and the gains were not yet received. This policy was included in Chairman Camp’s tax reform plan and President Obama’s budget. We’ve explained it here.

Much more significantly, the plan would largely eliminate the exclusion for capital gains at death. Under current law, individuals generally pay taxes on capital gains in the year assets are sold. If assets are not sold but instead passed as an inheritance, the tax on those gains is essentially forgiven.

Under Senator Sanders’s plan, those gains would be taxed as if sold when the owner dies; and a similar capital gains tax would be applied to gifted assets. Structurally, this plan would be similar – though not identical – to one proposed by President Obama.

According to information provided to us by the campaign, this tax would exempt the first $250,000 per person of real estate gains. It would also include an exemption equal to $250,000 minus the deceased individual’s earned income in that year (for example, if the individual earned $50,000 then $200,000 would be exempt from taxation of death). The proposal would not exempt charitable bequests from capital gains taxation.

This policy would generate revenue in two ways. First, it would directly tax assets that currently escape taxation at death. Secondly, it would reduce the “lock-in effect” of current capital gains taxation that encourages people to hold rather than sell assets – an effect amplified in part because investors can currently avoid the capital gains tax altogether by holding assets until death. By reducing this lock-in effect, taxing capital gains at death will increase the amount of assets sold and the revenue raised from ordinary capital gains rates.

Revenue Impact of Senator Sanders’s Additional Policies

Changing the taxation of derivatives has been estimated several times, most recently in the Tax Reform Act of 2014 and the President’s Budget, where it was estimated to raise about $15 billion over ten years. With higher tax rates, revenue raised would be somewhat higher.

Estimating the impact of Senator Sanders’s policy to tax capital gains at death is far more difficult because official scoring agencies have not recently estimated this policy either in isolation or in concert with the substantial capital gains rate hikes proposed by Senator Sanders.

The most comparable policy which has been scored is President Obama’s proposal to tax capital gains at death while increasing the capital gains and dividends tax rates by 4.2 percentage points on incomes above $250,000. Those policies together would generate about $230 billion over ten years. A 4.2 percentage point tax rate increase by itself would raise between $50 and $100 billion, suggesting the President’s policy to tax capital gains at death alone will raise somewhere in the broad range of $150 billion over ten years.

Note that this $150 billion is inclusive of both the direct revenue raised, as well as additional capital gains revenue raised from the reduced lock-in effect.1 Senator Sanders’s proposal is likely to raise significantly more than the President’s plan, since Senator Sanders supports a capital gains rate roughly twice as high and would not exempt charitable giving from capital gains taxation.

By our very rough estimate, total revenue from these additions could be as high as $300 to $500 billion over a decade.

Adding this to our previous rough estimates yield total revenue for $11.0 to $11.2 trillion – $2.6 to $2.8 trillion short of costs as estimated by the Sanders campaign and $13.5 to $13.7 trillion short of the Thorpe estimate of the single-payer plan.

| Budgetary Effect of Senator Sanders’s Single-Payer Plan | ||

| Policy | Claimed Ten-Year Savings | CRFB Estimated Ten-Year Savings |

| 6.2% Employer Tax | $6.3 trillion | $5.3 trillion |

| 2.2% Individual Premium | $2.1 trillion | $1.6 trillion |

| Progressive Income Tax Increases | $1.1 trillion | $0.8 trillion |

| Tax Capital Gains/Dividends as Ordinary Income | $0.9 trillion | $0+ |

| Tax Capital Gains at Death | $0.3 – 0.5 trillion | |

| Reform Tax Deduction Limits for High Earners | $0.2 trillion | -$0.3 trillion |

| The Responsible Estate Tax | $0.2 trillion | $0.2 trillion |

| Savings From Health Tax Expenditures | $3.1 trillion | $3.1 trillion+ |

| Interactions | $0 | ?? |

| Total | $13.9 trillion | $11.0 – $11.2 trillion |

| Enact Single-Payer Health Insurance Plan (Sanders) | -$13.8 trillion | -$13.8 trillion |

| Enact Single-Payer Health Insurance Plan (Thorpe) | -$24.7 trillion | -$24.7 trillion |

| Total Net Effect (Sanders) | $0.1 trillion | -$2.6 to -$2.8 trillion |

| Total Net Effect (Thorpe) | -$10.8 trillion | -$13.5 to -$13.7 trillion |

Source: Sanders Campaign/Friedman, Thorpe, CRFB calculations.

Table footnotes appear at bottom of this document

Interactions and Economic Effects Not Included in Our Analysis

As we explained in our previous analysis, our estimates do not account for macroeconomic impact and generally do not account for interactions between policies.

In terms of economic feedback, as our previous estimates explained, we anticipate significant revenue loss. On a combined basis, Senator Sanders’s plans would lead to a top statutory tax rate of 85 percent – or roughly 73 percent including interactions – which is at or above what most economists believe to be the revenue-maximizing level. As the rate starts to approach that level, the revenue gain from rate increases declines and eventually reverses. As a result, scoring agencies will likely estimate lower revenue including macroeconomic impact than based on conventional scoring alone.

Relatedly, our numbers likely understate conventional behavioral effects to some degree. Outside of capital gains changes, our estimates are linearly based on estimates for small rate increases (with small behavioral effects) and do not assume increasing amounts of tax avoidance as the tax rates rise.

Whereas we likely overstate revenue raised in some areas by not accounting for economic and behavioral effects, we may be understating revenue in other areas by failing to account for interactions. For example, increased income tax rates would reduce the cost of repealing the Alternative Minimum Tax (since fewer taxpayers would be subject to it) and increase the revenue from limiting tax deductions to the 28 percent bracket. These interactions could be responsible for some or all of the $400 billion difference between our and the Sanders campaign’s estimate of Senator Sanders’s policy to replace the AMT.

As another example, we do not account for the positive interaction between raising tax rates and effectively ending employer-provided health care. Under Senator Sanders’s health plan, employers would likely increase wages in place of offering health insurance, which in turn would increase the tax revenue raised from any tax rate hikes. Note that we do account for the effect of these higher wages on revenue raised from existing tax rates.

Yet while some interactions may be leading us to understate revenue, others move in the opposite direction. For example, the 12.6 percent of new employer taxes for higher earners (6.2 for Social Security, 6.2 for single-payer, 0.2 for paid family leave) proposed by Senator Sanders would cause employers to reduce wages, and therefore reduce the revenue raised from various tax rate increases on individual wages.

Unfortunately, we are not able to analyze the magnitude – or even direction – of the interactions between policies. However, the Tax Foundation has estimated the impact of Senator Sanders’s tax proposals using their tax model. Although their estimates exclude behavioral impacts, they do include interactions. Once adjusted to reflect only Senator Sanders’s health plan and to account for the potential behavior impact of Senator Sanders’s capital gains policies, their estimates are quite similar to our prior estimates (before accounting for changes to taxation of capital gains at death, etc).

| Tax Foundation Static Estimate of Senator Sanders’s Tax Plans | $13.6 trillion |

| Remove of policies not related to Senator Sanders’s single-payer plan | -$1.2 trillion |

| Adjustment of gains estimates to account for behavior* | -$1.2 trillion |

| Lost revenue from “mandate” and insurance taxes† | -$0.4 trillion |

| Total adjusted Tax Foundation estimate | $10.8 trillion |

| Original CRFB estimate of plan (excludes step-up basis) | $10.7 trillion |

*Adjusts Tax Foundation’s static estimate of capital gains revenue to match CRFB assumption of $0 revenue after behavioral effects

† The Sanders single payer-plan would end employer-provided coverage, eliminate the need for health insurance companies, and offer all individuals health coverage. As a result, the government would no longer generate revenue from the individual health mandate, the employer health mandate, or taxes on health insurance companies. CRFB relied on the Sanders campaign estimates of “tax expenditures” revenue, which incorporated these effects. However, these effects appear not to be incorporated in the Tax Foundation analysis.

In the coming weeks and months, we hope more organizations will estimate and analyze Senator Sanders’s health and tax proposals, providing additional insights on the many possible interactions, behavioral effects, and economic impacts of his plan.

Read our original analysis of Senator Sanders’s offsets here.

1Taxing capital gains at death is likely to increase the revenue-maximizing capital gains rate, which official scoring agencies believe to be about 30 percent. However, since realizing gains remains discretionary and the benefit of tax deferral is not repealed, higher capital gains rates are still likely to significantly reduce realization even assuming the taxation of capital gains at death. Available estimates from CBO and JCT suggest the impact of taxing capital gains at death on capital gains realization is likely small. For example, in 2012 JCT estimated only a small effect on capital gains from significantly reducing the estate tax (which functions similarly to taxing capital gains at death in terms of realization). Specifically, they estimated a policy which would cut estate tax revenue roughly in half by reducing the top rate by 10 points and the exemption by $1.5 million among other changes would only reduce capital gains realization by 0.65% and only reduce capital gains revenue by $1 billion per year. As a more direct example, JCT estimated the President’s policy to eliminate step-up basis and raising the top capital gains and dividends rates by 4.2 points would raise only $230 billion combined. CBO currently projects about $7 trillion of qualified dividends and realized long-term capital gains between 2016 and 2025 from families with income above $250,000. Assuming eliminating step-up basis simply offset the reduced realization from a 4.2 percent gains increases, one would expect about $300 billion in revenue on top of what is directly raised from taxing capital gains at death. The fact that JCT scores only $230 billion inclusive of the direct impact suggests a much more modest realization effect.

+CRFB did not estimate the impact of the proposed capital gains and dividends increase or tax expenditures savings. With regards to the tax expenditure savings, CRFB assumed the savings provided by the Sanders campaign. With regards to the capital gains and dividends increase, it is our assessment that when stacked after previously proposed increases, the rise in the capital gains rates – based on common scoring conventions – would result in significant revenue losses, likely in excess of gains from higher dividend rates. This assessment is based on the assumption that capital gains and dividends would be taxed as ordinary income under the new rate schedule. Rather than estimating a loss, we scored the impact as zero. The effect of the new policy to repeal step-up basis is shown as a separate line, which represents both the direct effect of removing step-up basis and the interaction effect with increased capital gains rates. This interaction is the only one measured.